INDIVIDUAL INCOME TAX RETURN City of Troy in 2023

What is the Individual Income Tax Return

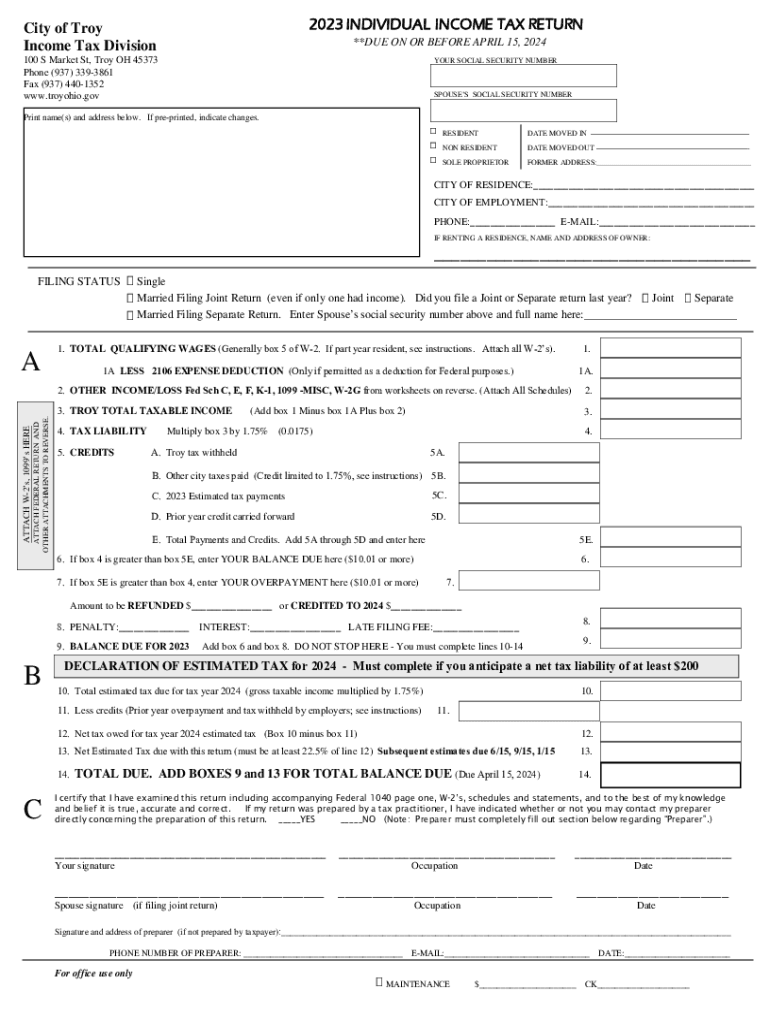

The Individual Income Tax Return is a crucial document used by residents of the City of Troy, Indiana, to report their annual income to the Internal Revenue Service (IRS). This form allows individuals to declare their earnings, calculate their tax liability, and determine if they are eligible for any tax refunds or credits. It is essential for ensuring compliance with federal tax laws and for maintaining accurate financial records.

How to Use the Individual Income Tax Return

Using the Individual Income Tax Return involves several steps. Taxpayers must gather all necessary financial documents, including W-2s, 1099s, and other income statements. Once the information is compiled, individuals can fill out the form either by hand or through tax preparation software. It is important to follow IRS guidelines to ensure that all income is reported accurately and that deductions are claimed correctly.

Steps to Complete the Individual Income Tax Return

Completing the Individual Income Tax Return requires a systematic approach. First, gather all relevant documents, such as proof of income and any deductions. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your income on the appropriate lines of the form. After calculating your total tax liability, apply any credits or payments made throughout the year. Finally, review the completed form for accuracy before submission.

Key Elements of the Individual Income Tax Return

Several key elements are essential when filling out the Individual Income Tax Return. These include personal identification information, income sources, deductions, and tax credits. Understanding these components helps taxpayers navigate the form effectively. Additionally, it is vital to be aware of any state-specific requirements that may apply to residents of Troy, Indiana.

IRS Guidelines

The IRS provides specific guidelines for completing the Individual Income Tax Return. These guidelines include instructions on how to report various types of income, claim deductions, and apply for credits. Taxpayers should familiarize themselves with these rules to avoid errors that could lead to penalties or delays in processing their returns. Staying updated with any changes in tax laws is also crucial for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Income Tax Return are critical to avoid penalties. Typically, the deadline for filing is April fifteenth of each year. However, taxpayers may request an extension if they need additional time. It is important to be aware of these dates to ensure timely submission and to avoid any potential issues with the IRS.

Required Documents

To complete the Individual Income Tax Return, several documents are required. These typically include W-2 forms from employers, 1099 forms for other income sources, and documentation for any deductions or credits claimed. Keeping these documents organized and accessible will streamline the filing process and help ensure accuracy in reporting income and expenses.

Quick guide on how to complete individual income tax returncity of troyin

Easily Get Ready INDIVIDUAL INCOME TAX RETURN City Of Troy In on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily access the correct template and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents promptly without any delays. Manage INDIVIDUAL INCOME TAX RETURN City Of Troy In on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The Easiest Way to Modify and Electronically Sign INDIVIDUAL INCOME TAX RETURN City Of Troy In Without Stress

- Find INDIVIDUAL INCOME TAX RETURN City Of Troy In and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark relevant sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and hit the Done button to save your updates.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign INDIVIDUAL INCOME TAX RETURN City Of Troy In and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax returncity of troyin

Create this form in 5 minutes!

How to create an eSignature for the individual income tax returncity of troyin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN?

An INDIVIDUAL INCOME TAX RETURN is a form used by residents of the City Of Troy, IN, to report their annual income to the IRS. This document includes information about income earned, deductions, credits, and any taxes owed or refunds due. It is essential to complete this form accurately to avoid penalties and ensure compliance with federal tax laws.

-

How can airSlate SignNow help with my INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN?

airSlate SignNow streamlines the process of preparing and submitting your INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN, by providing a secure platform for document management and eSigning. With an easy-to-use interface, you can collect signatures, send documents, and manage your tax forms all in one place. This helps save time and reduce the stress associated with tax season.

-

What are the costs associated with using airSlate SignNow for my INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN?

airSlate SignNow offers a range of pricing packages to fit different needs for handling your INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN. Plans are competitively priced and can provide signNow savings compared to traditional methods of document handling. Each plan includes essential features to help you manage your tax documents efficiently.

-

What features does airSlate SignNow provide for preparing an INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN?

airSlate SignNow provides a robust set of features designed to assist you with your INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN. These include customizable templates, secure eSigning, document sharing capabilities, and real-time tracking of document status. All these features enhance your productivity and ensure that your documents are handled with utmost security.

-

Is it safe to use airSlate SignNow for my INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling your INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN. With advanced encryption and compliance with regulations, you can trust that your sensitive information is protected. Additionally, user verification processes guarantee that only authorized personnel can access your documents.

-

Can I integrate airSlate SignNow with other software for my INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN?

Absolutely! airSlate SignNow offers various integrations with popular accounting and tax software to streamline your INDIVIDUAL INCOME TAX RETURN process in the City Of Troy, IN. This capability allows for seamless data transfer, minimizing the need for manual entry and reducing errors. Such integrations ensure a more efficient and cohesive workflow.

-

What are the benefits of using airSlate SignNow for my INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN?

Using airSlate SignNow for your INDIVIDUAL INCOME TAX RETURN in the City Of Troy, IN, offers numerous benefits, including time savings, ease of use, and enhanced security. You can eSign documents from anywhere, which allows for greater flexibility and convenience. Moreover, the platform minimizes paperwork and speeds up the completion of your tax returns.

Get more for INDIVIDUAL INCOME TAX RETURN City Of Troy In

Find out other INDIVIDUAL INCOME TAX RETURN City Of Troy In

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking