Instructions for Form 5695 Internal Revenue Service 2022

Understanding Form 5695 for Massachusetts Energy Credit

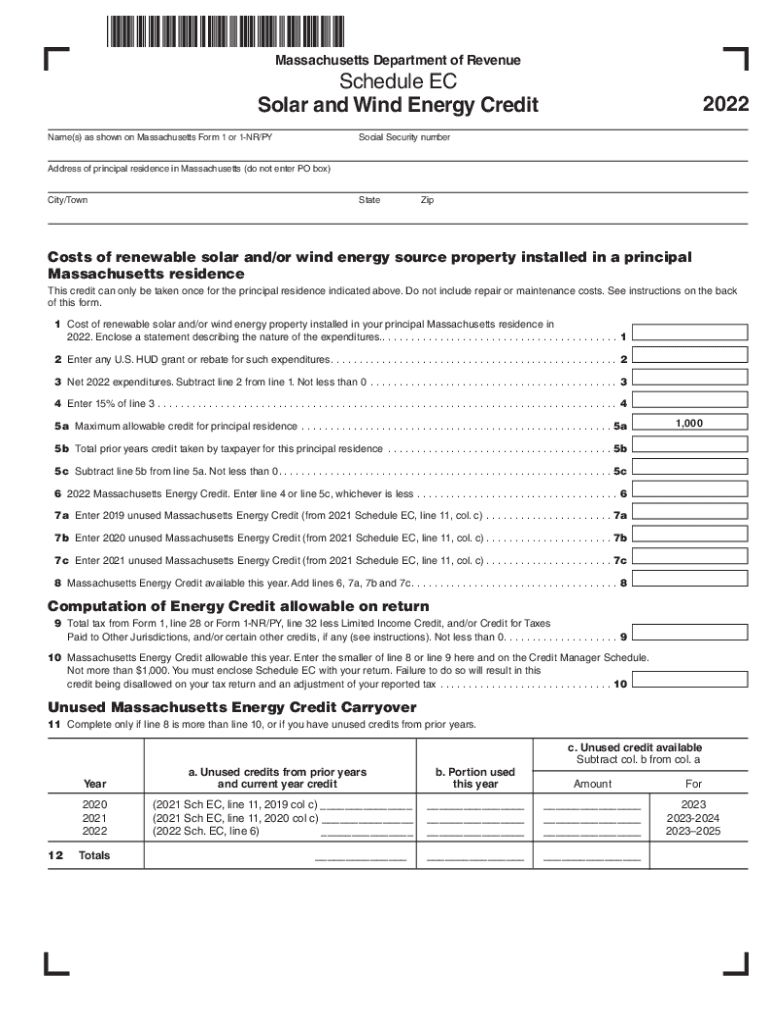

The Massachusetts energy credit is a tax benefit designed to incentivize energy-efficient home improvements. This credit is claimed using IRS Form 5695, which outlines the necessary steps and requirements for taxpayers. By completing this form, individuals can receive a credit for a portion of the costs associated with qualified energy-saving improvements made to their homes, such as solar energy systems, insulation, and energy-efficient windows.

Steps to Complete Form 5695 for Massachusetts

To successfully complete Form 5695, follow these steps:

- Gather necessary documentation, including receipts for energy-efficient improvements and any relevant tax records.

- Fill out Part I of the form to calculate the residential energy credit, detailing the costs of qualifying improvements.

- Complete Part II if you are claiming a credit for energy-efficient home improvements.

- Transfer the calculated credit amount to your tax return.

Ensure that all information is accurate to avoid delays or issues with your tax filing.

Eligibility Criteria for Massachusetts Energy Credit

To qualify for the Massachusetts energy credit, taxpayers must meet specific eligibility criteria:

- The improvements must be made to a primary residence located in Massachusetts.

- Only certain types of energy-efficient improvements are eligible, such as solar panels, solar water heaters, and geothermal heat pumps.

- Taxpayers must have incurred eligible expenses during the tax year for which they are claiming the credit.

Review the detailed guidelines on eligible improvements to ensure compliance with state regulations.

Required Documents for Filing Form 5695

When filing Form 5695, it is essential to have the following documents ready:

- Receipts or invoices for all energy-efficient improvements made.

- Any manufacturer certifications for products installed, if applicable.

- Previous tax returns, if needed for reference.

Having these documents organized will facilitate a smoother filing process and help substantiate your claims.

Filing Deadlines for Massachusetts Energy Credit

Filing deadlines for the Massachusetts energy credit align with the standard tax return deadlines. Typically, the deadline for submitting your federal tax return, including Form 5695, is April 15 of the following year. If you require additional time, you can file for an extension, but ensure that any taxes owed are paid by the original deadline to avoid penalties.

Legal Use of Form 5695 in Massachusetts

The legal use of Form 5695 hinges on compliance with both federal and state tax laws. The form must be filled out accurately and submitted as part of your federal tax return. It is crucial to adhere to IRS guidelines and Massachusetts state regulations to ensure that your claim for the energy credit is valid and recognized.

Quick guide on how to complete instructions for form 5695 2022internal revenue service

Complete Instructions For Form 5695 Internal Revenue Service effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Instructions For Form 5695 Internal Revenue Service on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign Instructions For Form 5695 Internal Revenue Service with ease

- Find Instructions For Form 5695 Internal Revenue Service and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Edit and eSign Instructions For Form 5695 Internal Revenue Service and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 5695 2022internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 5695 2022internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts energy credit program?

The Massachusetts energy credit program is designed to encourage businesses and residents to adopt renewable energy solutions. By participating in this program, you can benefit from financial incentives that help reduce the initial costs of adopting energy-efficient technologies.

-

How can airSlate SignNow help me with the Massachusetts energy credit application?

airSlate SignNow streamlines the process of signing and submitting required documents for the Massachusetts energy credit. With our eSignature solution, you can quickly and securely complete your application, ensuring that all necessary forms are properly signed and submitted on time.

-

What are the key benefits of utilizing the Massachusetts energy credit?

The Massachusetts energy credit offers several benefits, including signNow financial savings on your energy bills and enhanced property value. By leveraging these credits, you can invest in sustainable energy solutions, ultimately contributing to a greener environment.

-

Are there any eligibility requirements for the Massachusetts energy credit?

Eligibility for the Massachusetts energy credit depends on various factors, including your energy consumption and the type of renewable technology you choose. Typically, both residential and commercial properties may qualify, but it's essential to consult with a professional to determine specific requirements.

-

What types of renewable energy solutions are eligible for the Massachusetts energy credit?

Eligible renewable energy solutions for the Massachusetts energy credit include solar panels, wind turbines, and energy-efficient heating systems. Each technology may have specific guidelines, so it's crucial to itemize which improvements you plan to make and confirm their eligibility.

-

How does airSlate SignNow integrate with my existing workflow for energy credit applications?

airSlate SignNow easily integrates with various project management and document management tools, allowing you to incorporate the Massachusetts energy credit application process smoothly into your existing workflow. This integration ensures that your team can collaborate efficiently while maintaining compliance with documentation requirements.

-

What are the pricing options for using airSlate SignNow with the Massachusetts energy credit process?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes, which helps facilitate the process of applying for the Massachusetts energy credit. With our budget-friendly options, you can choose a plan that best fits your needs and start simplifying document management today.

Get more for Instructions For Form 5695 Internal Revenue Service

Find out other Instructions For Form 5695 Internal Revenue Service

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself