Massachusetts Department of Revenue Schedule EC so 2024-2026

Understanding the Massachusetts Department of Revenue Schedule EC

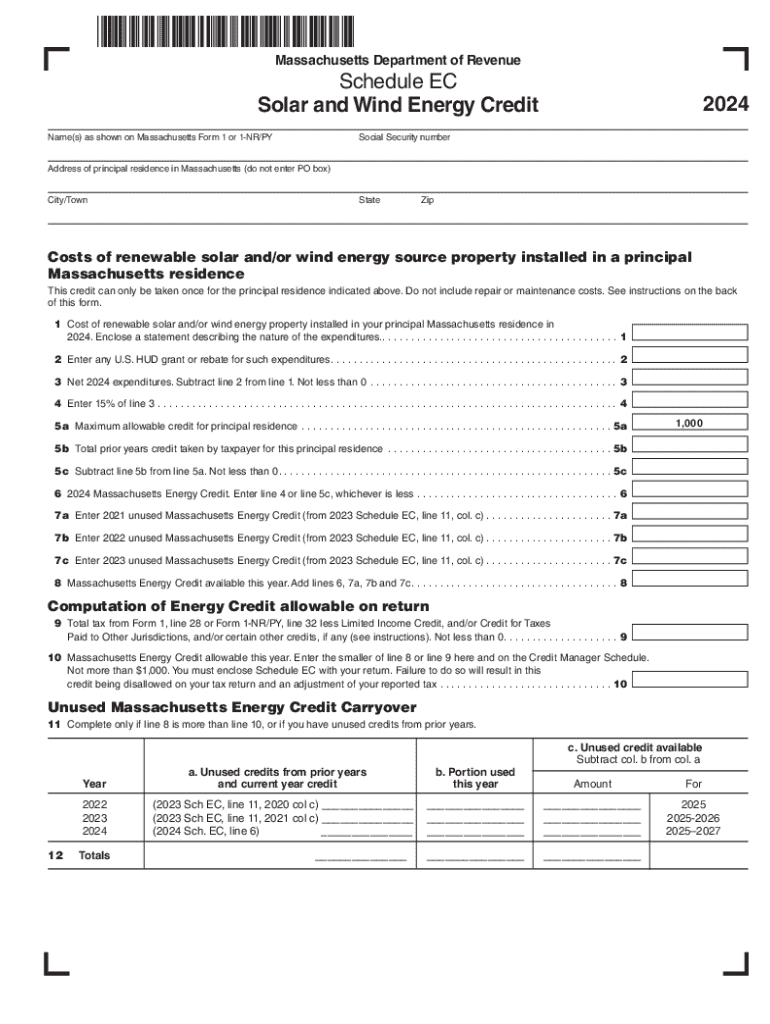

The Massachusetts Department of Revenue Schedule EC is a crucial form for taxpayers in the state, specifically designed to report certain energy credits. This form allows individuals and businesses to claim credits related to energy-efficient improvements and renewable energy installations. Understanding the purpose and details of this schedule is essential for maximizing your tax benefits while ensuring compliance with state regulations.

Steps to Complete the Massachusetts Department of Revenue Schedule EC

Completing the Massachusetts Schedule EC involves several key steps. First, gather all necessary documentation, including receipts for energy-efficient purchases and installation costs. Next, accurately fill out the form, ensuring that all information aligns with your tax return. Pay particular attention to the credit amounts, as these can vary based on the type of energy improvements made. Finally, double-check your entries for accuracy before submission to avoid delays or penalties.

Eligibility Criteria for the Massachusetts Energy Credit

To qualify for the Massachusetts energy credit, taxpayers must meet specific eligibility criteria. Generally, the credit is available for individuals and businesses that have made qualified energy-efficient improvements to their properties. This includes installations of solar panels, energy-efficient heating systems, and other renewable energy sources. It is important to review the specific requirements outlined by the Massachusetts Department of Revenue to ensure compliance and maximize your potential credits.

Required Documents for Filing Schedule EC

When filing the Massachusetts Schedule EC, certain documents are required to substantiate your claims. These typically include receipts for energy-efficient products, installation contracts, and any relevant energy audits. Keeping organized records will facilitate a smoother filing process and help in case of an audit. Ensure that all documents are accurate and reflect the expenses incurred during the tax year.

Filing Deadlines for Massachusetts Schedule EC

Filing deadlines for the Massachusetts Schedule EC align with the general tax filing deadlines. Typically, taxpayers must submit their forms by April 15 of the following year. However, it is crucial to check for any updates or changes to deadlines, especially in light of potential extensions or changes in tax law. Timely submission is essential to avoid penalties and ensure that you receive the credits you are entitled to.

Form Submission Methods for Schedule EC

Taxpayers can submit the Massachusetts Schedule EC through various methods. The form can be filed online through the Massachusetts Department of Revenue’s e-filing system, which offers a quick and efficient way to submit your information. Alternatively, you can choose to mail a paper copy of the form to the appropriate address provided by the Department of Revenue. In-person submissions may also be possible at designated tax offices, depending on local regulations.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue schedule ec so

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue schedule ec so

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Massachusetts credit and how does it work?

The 2024 Massachusetts credit is a financial incentive designed to support residents and businesses in the state. It provides tax credits that can help reduce overall tax liability. Understanding how this credit works can help you maximize your savings when filing taxes.

-

How can airSlate SignNow help with the 2024 Massachusetts credit documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to the 2024 Massachusetts credit. Our platform allows you to easily create, send, and eSign necessary forms, ensuring you meet all deadlines and requirements efficiently.

-

What are the pricing options for using airSlate SignNow for the 2024 Massachusetts credit?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, our cost-effective solutions can help you manage your documentation for the 2024 Massachusetts credit without breaking the bank.

-

What features does airSlate SignNow offer for managing the 2024 Massachusetts credit?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools streamline the process of managing documents related to the 2024 Massachusetts credit, making it easier for you to stay organized and compliant.

-

Can I integrate airSlate SignNow with other tools for the 2024 Massachusetts credit?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow for the 2024 Massachusetts credit. You can connect with popular tools like Google Drive, Salesforce, and more to ensure all your documents are easily accessible and manageable.

-

What are the benefits of using airSlate SignNow for the 2024 Massachusetts credit?

Using airSlate SignNow for the 2024 Massachusetts credit provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to focus on your business while we handle the complexities of document management.

-

Is airSlate SignNow secure for handling sensitive information related to the 2024 Massachusetts credit?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents related to the 2024 Massachusetts credit are protected. We utilize advanced encryption and security protocols to safeguard your sensitive information.

Get more for Massachusetts Department Of Revenue Schedule EC So

- Rheumatology triage form

- Abortion facility application 5418 form

- Indiana state form

- Pediatric pre pubertal form

- Physician referral form texas department of state health services

- Law enforcement medical evaluation request texas form

- Pilots for christ wyoming form

- Change of beneficiary form instructions american equity

Find out other Massachusetts Department Of Revenue Schedule EC So

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed