Residential Renewable Energy Income Tax Credit 2023

What is the Residential Renewable Energy Income Tax Credit

The Residential Renewable Energy Income Tax Credit, often referred to as the solar tax credit, allows homeowners to deduct a percentage of the cost of installing solar energy systems from their federal taxes. This credit is designed to encourage the adoption of renewable energy technologies and reduce the overall cost of solar installations. Homeowners can claim this credit for solar photovoltaic systems, solar water heaters, and other renewable energy technologies that meet specific criteria set by the IRS.

Eligibility Criteria

To qualify for the Residential Renewable Energy Income Tax Credit, homeowners must meet several eligibility criteria:

- The solar energy system must be installed on a residential property in the United States.

- The system must be new and meet the necessary performance and quality standards.

- Homeowners must own the solar energy system; leased systems may not qualify.

- The installation must be completed by a certified professional.

Steps to Complete the Residential Renewable Energy Income Tax Credit

Completing the Residential Renewable Energy Income Tax Credit involves several key steps:

- Gather all necessary documentation, including receipts for the solar installation and any relevant contracts.

- Complete IRS Form 5695, which is specifically designed for claiming the credit.

- Calculate the total cost of the solar installation and determine the eligible credit amount based on the current percentage rate.

- Include the credit amount on your federal tax return.

Required Documents

When applying for the Residential Renewable Energy Income Tax Credit, homeowners need to provide specific documents to support their claim:

- Receipts and invoices for the solar installation.

- Proof of payment for the installation costs.

- Any contracts with the installation company.

- Documentation confirming the system meets IRS requirements.

Filing Deadlines / Important Dates

Homeowners should be aware of important deadlines when filing for the Residential Renewable Energy Income Tax Credit. Generally, the tax credit can be claimed on the tax return for the year the installation was completed. It is essential to check the IRS guidelines for specific dates related to the tax year in which the installation occurred. Additionally, homeowners should keep track of any changes in legislation that may affect the credit in future tax years.

IRS Guidelines

The IRS provides detailed guidelines on how to claim the Residential Renewable Energy Income Tax Credit. Homeowners should refer to IRS Form 5695 instructions for specific information about eligibility, calculation methods, and documentation requirements. Staying informed about these guidelines ensures that homeowners can accurately claim the credit and avoid potential issues during tax filing.

Quick guide on how to complete residential renewable energy income tax credit

Accomplish Residential Renewable Energy Income Tax Credit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct form and safely store it online. airSlate SignNow provides all the resources necessary to create, alter, and electronically sign your documents swiftly and without delays. Manage Residential Renewable Energy Income Tax Credit on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and electronically sign Residential Renewable Energy Income Tax Credit with ease

- Locate Residential Renewable Energy Income Tax Credit and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to submit your document, via email, SMS, or an invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Residential Renewable Energy Income Tax Credit and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct residential renewable energy income tax credit

Create this form in 5 minutes!

How to create an eSignature for the residential renewable energy income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

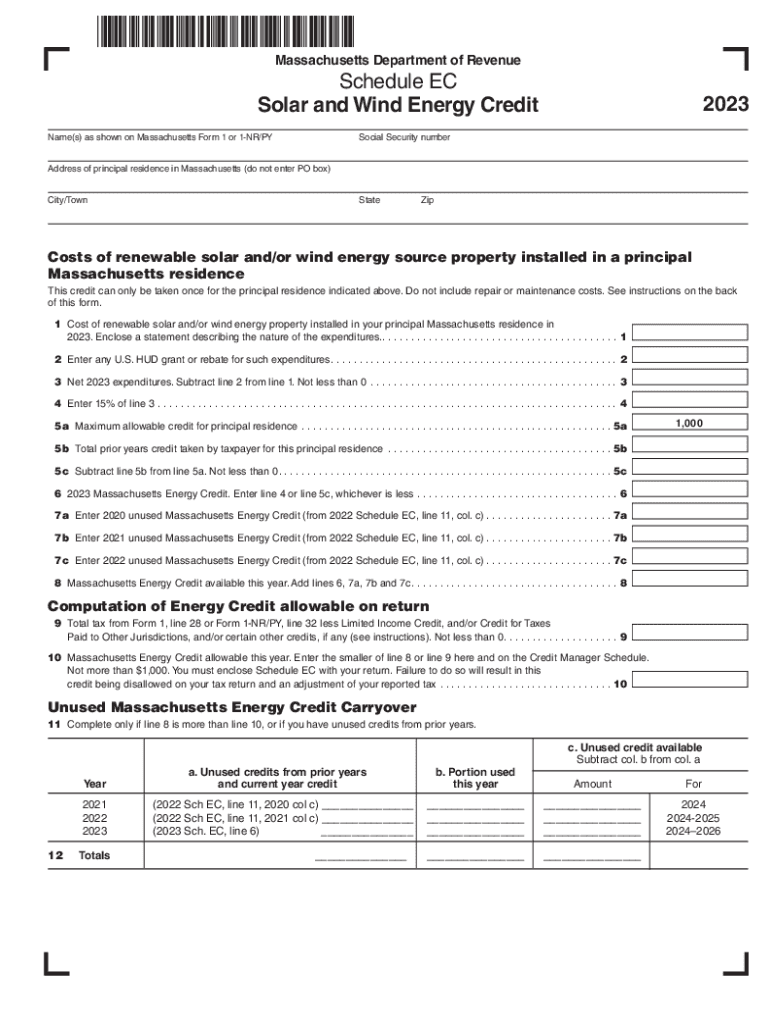

What is the Massachusetts solar tax credit 2021?

The Massachusetts solar tax credit 2021 is a financial incentive that allows homeowners to deduct a percentage of their solar installation costs from their state income taxes. This credit can signNowly reduce the upfront cost of solar energy systems, making it more affordable for residents to invest in renewable energy.

-

How much can I save with the Massachusetts solar tax credit 2021?

With the Massachusetts solar tax credit 2021, eligible homeowners can save up to 15% of their solar installation costs. The exact amount will depend on the total price of the solar system you install, which can result in substantial savings when filing your state taxes.

-

Are there any eligibility requirements for the Massachusetts solar tax credit 2021?

To qualify for the Massachusetts solar tax credit 2021, homeowners must have a solar energy system installed on their primary residence. Additionally, the system must be connected to the electricity grid and meet specific efficiency standards set by the state.

-

Does the Massachusetts solar tax credit 2021 have a time limit?

Yes, the Massachusetts solar tax credit 2021 is available until the end of 2021. Homeowners should ensure their solar installations are completed and all paperwork is filed by this deadline to take full advantage of the tax benefits offered.

-

How do I apply for the Massachusetts solar tax credit 2021?

To apply for the Massachusetts solar tax credit 2021, homeowners need to file a state tax return and include the relevant forms to claim the credit. It is advisable to keep all receipts and documentation related to the solar installation to ensure a smooth application process.

-

Can I combine the Massachusetts solar tax credit 2021 with other incentives?

Yes, homeowners can often combine the Massachusetts solar tax credit 2021 with federal solar tax credits and other local incentives. This stacking of benefits can lead to signNow overall savings on solar installation costs, making it an excellent time to invest in solar energy.

-

What are the long-term benefits of the Massachusetts solar tax credit 2021?

The long-term benefits of the Massachusetts solar tax credit 2021 include reduced energy bills, increased home value, and contribution to a sustainable environment. By investing in solar energy, homeowners can not only save money on taxes but also enjoy ongoing savings on energy costs.

Get more for Residential Renewable Energy Income Tax Credit

- Its subcontractors owner shall pay contractor for any additional work done by contractor in form

- At page document number of county south form

- Streetalleys well form

- Contractor shall pay subcontractor according to the following schedule form

- Heirs and assigns it is agreed and understood that all covenants of this option shall succeed to and be form

- Adopted by the state of south carolina and form

- Of the state of south carolina form

- By the laws of the state of south carolina and any other agreements the parties may enter into form

Find out other Residential Renewable Energy Income Tax Credit

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF