Schedule EC Department of Solar and Wind Energy Credit Revenue 2021

What is the Schedule EC Department of Solar and Wind Energy Credit Revenue

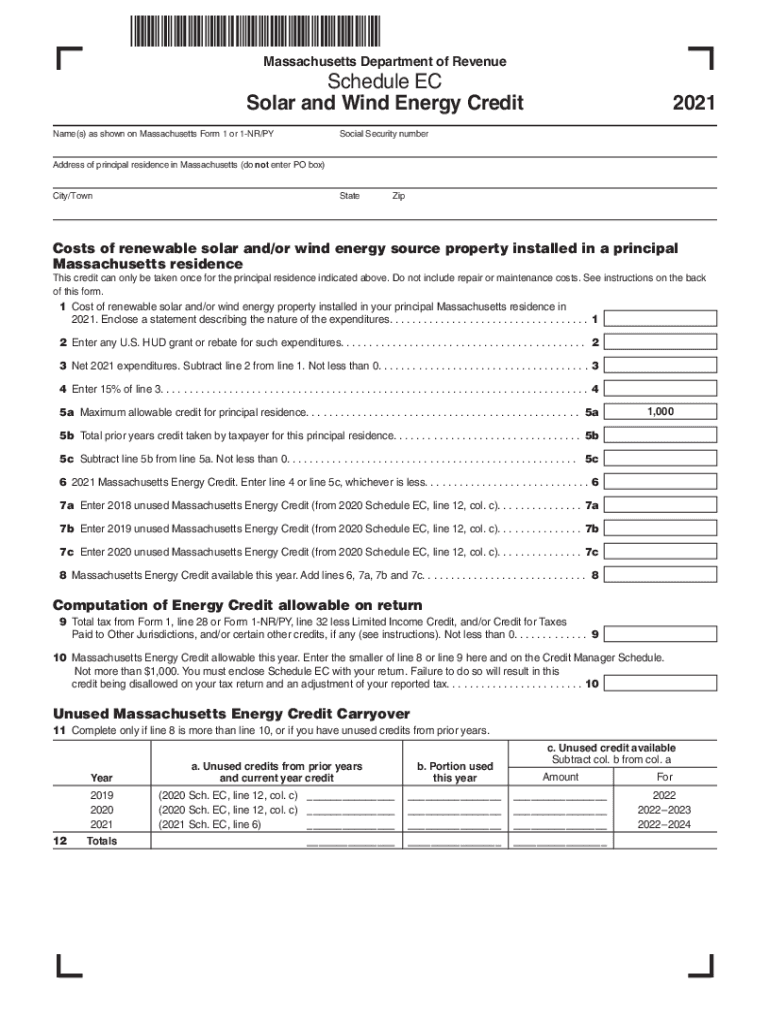

The Schedule EC is a form utilized in Massachusetts for claiming tax credits related to solar and wind energy installations. This form is specifically designed for individuals and businesses that have invested in renewable energy systems. By completing the Schedule EC, taxpayers can receive credits that significantly reduce their state tax liabilities, promoting the use of clean energy sources. The credits are part of Massachusetts' efforts to encourage sustainable energy practices and reduce reliance on fossil fuels.

Steps to Complete the Schedule EC Department of Solar and Wind Energy Credit Revenue

Completing the Schedule EC involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary documentation, including receipts for equipment purchases and installation costs. Next, fill out the form by providing your personal information and detailing the specifics of your solar or wind energy system. Be sure to calculate the credit amount based on the guidelines provided in the form instructions. Finally, review the completed form for any errors before submitting it with your state tax return.

Eligibility Criteria for the Schedule EC Department of Solar and Wind Energy Credit Revenue

To qualify for the Schedule EC credits, taxpayers must meet specific eligibility criteria. These criteria generally include having installed a qualifying solar or wind energy system on a residential or commercial property within Massachusetts. The system must meet certain performance standards and be operational during the tax year for which the credit is claimed. Additionally, the taxpayer must be the owner of the property where the energy system is installed, and the installation must comply with local building codes and regulations.

Filing Deadlines / Important Dates for the Schedule EC Department of Solar and Wind Energy Credit Revenue

Filing deadlines for the Schedule EC coincide with the standard state tax return deadlines. Typically, Massachusetts residents must submit their tax returns by April fifteenth of each year. If additional time is needed, taxpayers may request an extension, but it is essential to ensure that the Schedule EC is filed within the extended timeframe. Keeping track of these important dates is crucial to avoid penalties and ensure that credits are claimed in a timely manner.

Required Documents for the Schedule EC Department of Solar and Wind Energy Credit Revenue

When completing the Schedule EC, several documents are required to substantiate the claim. These include receipts and invoices for the purchase and installation of solar or wind energy systems. Additionally, any permits or certifications obtained during the installation process should be included. Taxpayers may also need to provide proof of property ownership and documentation demonstrating that the energy system meets state performance standards.

Legal Use of the Schedule EC Department of Solar and Wind Energy Credit Revenue

The Schedule EC is legally recognized under Massachusetts tax law, allowing eligible taxpayers to claim credits for renewable energy investments. To ensure legal compliance, it is essential that the form is completed accurately and submitted with all required documentation. Adhering to the guidelines set forth by the Massachusetts Department of Revenue will help protect taxpayers from potential audits or penalties related to improper claims.

Examples of Using the Schedule EC Department of Solar and Wind Energy Credit Revenue

Taxpayers can benefit from the Schedule EC in various scenarios. For instance, a homeowner who installs solar panels on their roof can use this form to claim a credit for a portion of the installation costs. Similarly, a business that invests in a wind turbine to power its operations can also utilize the Schedule EC to reduce its tax liability. Each example underscores the importance of renewable energy investments and the financial incentives available through the Massachusetts tax system.

Quick guide on how to complete schedule ec department of solar and wind energy credit revenue

Complete Schedule EC Department Of Solar And Wind Energy Credit Revenue effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Schedule EC Department Of Solar And Wind Energy Credit Revenue on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Schedule EC Department Of Solar And Wind Energy Credit Revenue with ease

- Locate Schedule EC Department Of Solar And Wind Energy Credit Revenue and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent areas of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this task.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Schedule EC Department Of Solar And Wind Energy Credit Revenue and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ec department of solar and wind energy credit revenue

Create this form in 5 minutes!

How to create an eSignature for the schedule ec department of solar and wind energy credit revenue

How to make an e-signature for your PDF file online

How to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2021 Massachusetts schedule for eSigning documents?

The 2021 Massachusetts schedule for eSigning documents outlines the specific deadlines and timelines for submitting various forms. airSlate SignNow integrates these timelines into its platform, ensuring you never miss an important date. By utilizing our solution, you can streamline your document signing process and stay compliant with the 2021 Massachusetts schedule.

-

How does airSlate SignNow ensure compliance with the 2021 Massachusetts schedule?

airSlate SignNow keeps your business compliant with the 2021 Massachusetts schedule by providing legally binding eSignatures that adhere to state laws. Our platform regularly updates its features to align with changing regulations, giving you peace of mind. You can easily track all signatures and document statuses to ensure compliance with all required schedules.

-

What are the pricing options for airSlate SignNow with respect to the 2021 Massachusetts schedule?

AirSlate SignNow offers competitive pricing tailored to your business needs, including a plan suitable for compliance with the 2021 Massachusetts schedule. Pricing is scalable, allowing businesses of all sizes to leverage our eSigning capabilities without overspending. Check our website for detailed pricing tiers and find the best option for your 2021 Massachusetts schedule requirements.

-

Can airSlate SignNow integrate with other tools to manage my 2021 Massachusetts schedule?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and applications to help you manage your 2021 Massachusetts schedule effectively. Popular integrations include CRM systems, document management tools, and cloud storage solutions. This functionality allows you to synchronize your tasks and deadlines while ensuring efficient document handling.

-

What benefits does airSlate SignNow offer for managing the 2021 Massachusetts schedule?

AirSlate SignNow simplifies the management of the 2021 Massachusetts schedule by providing an intuitive platform for document signing and tracking. The ability to send and eSign documents quickly can signNowly reduce turnaround times. Additionally, our audit trails keep records of all actions taken, supporting your compliance efforts pertaining to the 2021 Massachusetts schedule.

-

Is airSlate SignNow user-friendly for newcomers unfamiliar with the 2021 Massachusetts schedule?

Absolutely! AirSlate SignNow is designed to be user-friendly, making it easy for newcomers to understand and navigate, even if they are unfamiliar with the 2021 Massachusetts schedule. Our platform offers helpful tutorials and customer support to assist users in optimizing their experience. You'll be ready to manage your signing tasks in no time.

-

How secure is airSlate SignNow when handling documents related to the 2021 Massachusetts schedule?

Security is a priority at airSlate SignNow. We use advanced encryption and secure servers to protect your documents, especially those related to the 2021 Massachusetts schedule. Our compliance with industry standards ensures that your data remains confidential and securely stored, allowing you to sign documents with confidence.

Get more for Schedule EC Department Of Solar And Wind Energy Credit Revenue

- Maryland notice default 497310095 form

- Final notice of default for past due payments in connection with contract for deed maryland form

- Md assignment form

- Notice of assignment of contract for deed maryland form

- Md contract form

- Buyers home inspection checklist maryland form

- Sellers information for appraiser provided to buyer maryland

- Landscape planning worksheet form

Find out other Schedule EC Department Of Solar And Wind Energy Credit Revenue

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple