Partner's Instructions for Schedule K 1 Form 1065 IRS 2022

What is the Partner's Instructions For Schedule K-1 Form 1065 IRS

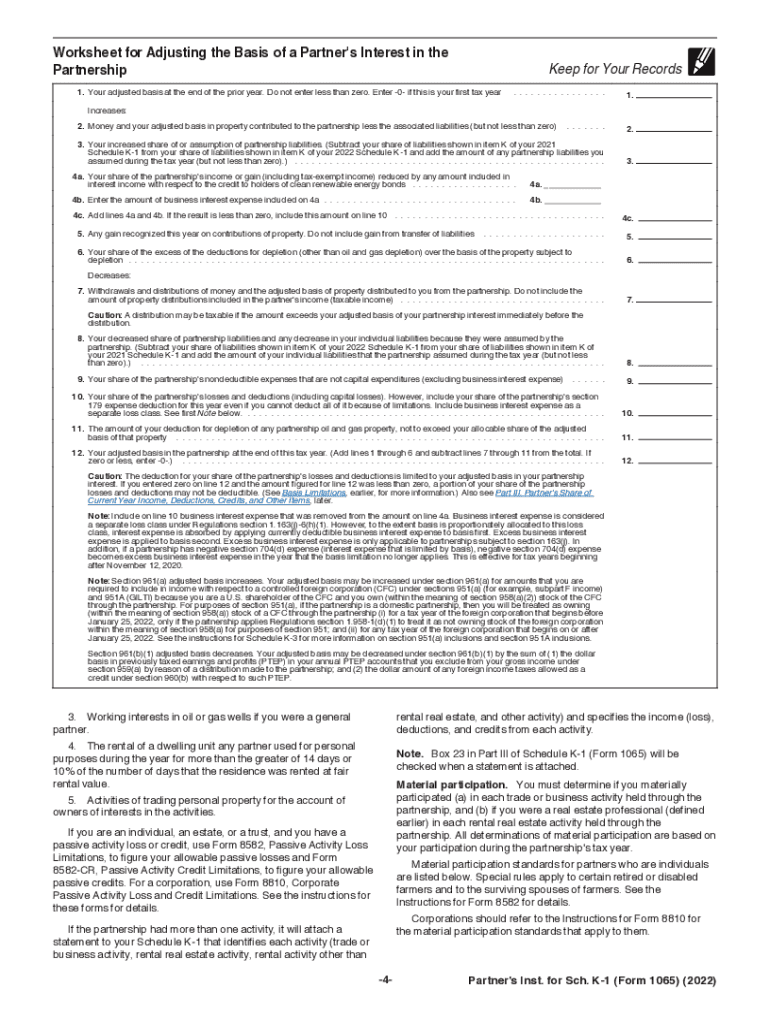

The Partner's Instructions for Schedule K-1 (Form 1065) are essential guidelines provided by the IRS for partners in a partnership. This form is used to report each partner's share of the partnership's income, deductions, credits, and other tax-related items. Understanding these instructions is crucial for accurate tax reporting and compliance. The instructions detail how to interpret the information reported on the K-1, including how to report it on individual tax returns. They also clarify the responsibilities of both the partnership and the individual partners regarding tax obligations.

Steps to Complete the Partner's Instructions For Schedule K-1 Form 1065 IRS

Completing the Partner's Instructions for Schedule K-1 involves several key steps:

- Gather necessary information, including the partnership's financial statements and prior year K-1s.

- Review the partnership agreement to understand how profits and losses are distributed among partners.

- Fill out the K-1 form by entering the appropriate amounts in the designated boxes, ensuring accuracy in reporting income, deductions, and credits.

- Provide each partner with a copy of their K-1 for their records and tax filing.

- File the completed K-1 with the partnership's Form 1065 return by the due date.

IRS Guidelines

The IRS has established specific guidelines for completing and filing Schedule K-1. These guidelines include:

- Ensuring that the K-1 is filled out accurately to avoid penalties.

- Providing clear explanations of the items reported on the K-1 for the partners' understanding.

- Submitting the K-1 along with the partnership's tax return by the established deadlines.

- Maintaining records of the K-1s issued for at least three years in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for Schedule K-1 (Form 1065) are critical for compliance. The partnership must file Form 1065 by March 15 of the year following the tax year. Partners should receive their K-1 by this date to ensure they can accurately report their income on their personal tax returns. If the partnership requires an extension, it can file for an automatic six-month extension, but the K-1s must still be provided to partners by the original deadline.

Key Elements of the Partner's Instructions For Schedule K-1 Form 1065 IRS

Key elements of the Partner's Instructions for Schedule K-1 include:

- Identification of the partnership and the partner, including names and tax identification numbers.

- Details on the partner's share of income, losses, deductions, and credits.

- Instructions on how to report these amounts on the partner's individual tax return.

- Information on any special allocations or adjustments that may apply to the partner's share.

Legal Use of the Partner's Instructions For Schedule K-1 Form 1065 IRS

The legal use of the Partner's Instructions for Schedule K-1 is essential for ensuring compliance with IRS regulations. Partners must utilize the information provided in the K-1 to accurately report their income and deductions on their tax returns. Failure to adhere to these instructions can result in penalties, including fines and interest on unpaid taxes. It is also important for partnerships to ensure that the K-1s are distributed in a timely manner to avoid complications during tax season.

Quick guide on how to complete 2020 partners instructions for schedule k 1 form 1065 irs

Prepare Partner's Instructions For Schedule K 1 Form 1065 IRS effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Partner's Instructions For Schedule K 1 Form 1065 IRS on any gadget using airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign Partner's Instructions For Schedule K 1 Form 1065 IRS with ease

- Locate Partner's Instructions For Schedule K 1 Form 1065 IRS and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which only takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Partner's Instructions For Schedule K 1 Form 1065 IRS and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 partners instructions for schedule k 1 form 1065 irs

Create this form in 5 minutes!

How to create an eSignature for the 2020 partners instructions for schedule k 1 form 1065 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 1065 K-1 instructions and why are they important?

1065 K-1 instructions are essential guidelines that help partnerships report income, deductions, and credits to their partners. Correctly following these instructions ensures compliance with IRS regulations and helps partners accurately report their share of partnership income on their tax returns.

-

How can airSlate SignNow assist with 1065 K-1 instructions?

airSlate SignNow provides an efficient platform for sending and eSigning documents related to 1065 K-1 instructions. With its user-friendly interface, businesses can streamline the process of preparing, sharing, and signing K-1 forms, making it easier to comply with tax regulations.

-

Are there any costs associated with using airSlate SignNow for 1065 K-1 instructions?

Yes, while airSlate SignNow offers various pricing plans, it provides a cost-effective solution for handling 1065 K-1 instructions. By using our platform, businesses can reduce administrative costs related to document handling and improve overall efficiency.

-

What features of airSlate SignNow support 1065 K-1 instructions?

AirSlate SignNow offers features like customizable templates, real-time tracking, and secure cloud storage that enhance the management of 1065 K-1 instructions. These tools ensure that all necessary documents are easily accessible, organized, and secure during the signing process.

-

Can I integrate airSlate SignNow with other accounting software for 1065 K-1 instructions?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage 1065 K-1 instructions efficiently. This integration allows users to import necessary data directly into their documents, streamlining the entire tax preparation process.

-

What benefits does eSigning provide for 1065 K-1 instructions?

eSigning through airSlate SignNow provides a quicker and more secure way to execute 1065 K-1 instructions. It eliminates the need for physical signatures, saves time on document exchange, and reduces the risk of lost paperwork, ensuring that important tax forms are submitted on time.

-

Is airSlate SignNow compliant with laws regarding 1065 K-1 instructions?

Absolutely! AirSlate SignNow complies with all relevant eSignature laws, ensuring that your 1065 K-1 instructions are legally binding. Our platform adheres to the highest standards of security and compliance, providing peace of mind for users handling sensitive tax documents.

Get more for Partner's Instructions For Schedule K 1 Form 1065 IRS

Find out other Partner's Instructions For Schedule K 1 Form 1065 IRS

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free