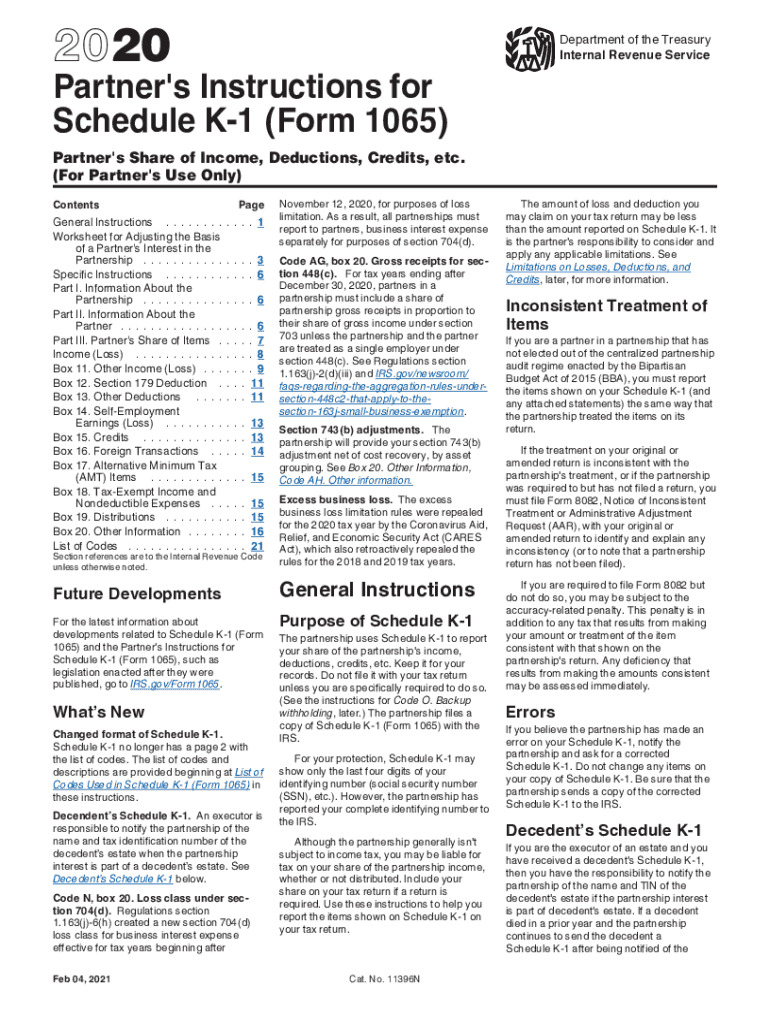

PDF Form 1065 Internal Revenue Service 2020

What is the L501 Form?

The L501 form is a tax document utilized by partnerships to report income, deductions, gains, and losses to the Internal Revenue Service (IRS). It is essential for partnerships to accurately complete this form to ensure compliance with federal tax regulations. The L501 form is often associated with the IRS Form 1065, which is the primary tax return for partnerships. Understanding the purpose and requirements of the L501 form is crucial for any partnership entity operating within the United States.

How to Obtain the L501 Form

To obtain the L501 form, individuals can visit the official IRS website or access it through authorized tax preparation software. The form is available for download in PDF format, making it easy to print and fill out. It is advisable to ensure that the most current version of the form is being used, as updates may occur annually. Keeping track of these updates can help prevent errors during the filing process.

Steps to Complete the L501 Form

Completing the L501 form involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the identifying information for the partnership, including the name, address, and Employer Identification Number (EIN).

- Report income and deductions accurately, ensuring that all figures are supported by documentation.

- Include details about each partner's share of income, deductions, and credits using the K-1 schedules.

- Review the completed form for accuracy before submission.

Legal Use of the L501 Form

The L501 form is legally binding when completed and submitted according to IRS guidelines. It is essential for partnerships to ensure that all information reported is truthful and accurate. Failure to comply with IRS regulations can lead to penalties, including fines and interest on unpaid taxes. Utilizing a reliable eSignature solution can enhance the legal standing of the completed form, ensuring that all signatures are verified and documented.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the L501 form. Typically, the form is due on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is generally due by March 15. It is important to note that extensions may be available, but they must be filed correctly to avoid penalties.

IRS Guidelines for the L501 Form

The IRS provides detailed guidelines for completing the L501 form, which include instructions on reporting income, deductions, and the distribution of K-1 schedules to partners. Following these guidelines is essential for ensuring compliance and avoiding issues during the review process. Partnerships should refer to the IRS instructions for the most accurate and up-to-date information regarding the form.

Quick guide on how to complete pdf form 1065 internal revenue service

Complete PDF Form 1065 Internal Revenue Service effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to generate, modify, and eSign your documents swiftly without delay. Handle PDF Form 1065 Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to alter and eSign PDF Form 1065 Internal Revenue Service without hassle

- Obtain PDF Form 1065 Internal Revenue Service and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your selection. Modify and eSign PDF Form 1065 Internal Revenue Service and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form 1065 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the pdf form 1065 internal revenue service

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is the l501 form download process with airSlate SignNow?

The l501 form download process with airSlate SignNow is simple and efficient. You can easily access the l501 form through our platform, fill it out, and download it in the required format. Our user-friendly interface ensures that you won't face any difficulties during the download process.

-

Are there any costs associated with downloading the l501 form?

Downloading the l501 form through airSlate SignNow is included in our subscription plans. We offer flexible pricing options, ensuring you get the best value for your needs. This means you can download the l501 form without worrying about hidden fees or additional charges.

-

Can I eSign the l501 form after downloading?

Absolutely! After you download the l501 form, you can use airSlate SignNow to electronically sign it. Our platform supports eSignatures, making it effortless to add your signature and complete the documentation process right after the l501 form download.

-

What features does airSlate SignNow offer for form management?

airSlate SignNow provides extensive features for form management, including customizable templates, tracking, and secure storage. After your l501 form download, you can easily manage and share your documents with team members or clients, enhancing collaboration and efficiency.

-

How does airSlate SignNow integrate with other applications for l501 form management?

airSlate SignNow seamlessly integrates with various applications, allowing you to manage your l501 form download alongside your existing workflows. Our platform connects with popular tools like Google Drive and Dropbox, ensuring that your documents are organized and easily accessible.

-

What are the benefits of using airSlate SignNow for the l501 form download?

Using airSlate SignNow for the l501 form download comes with numerous benefits, including fast processing, enhanced security, and easy collaboration. You can streamline your document workflow, ensuring that your forms are consistently up-to-date and efficiently managed.

-

Is there customer support available for questions about the l501 form download?

Yes! airSlate SignNow provides comprehensive customer support for any inquiries related to the l501 form download. Our dedicated support team is available to assist you with any issues or questions, ensuring a smooth experience with our platform.

Get more for PDF Form 1065 Internal Revenue Service

Find out other PDF Form 1065 Internal Revenue Service

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile