Form IRS Instruction 1065 Schedule K 1 Fill 2023-2026

Understanding Form 1065 Schedule K-1

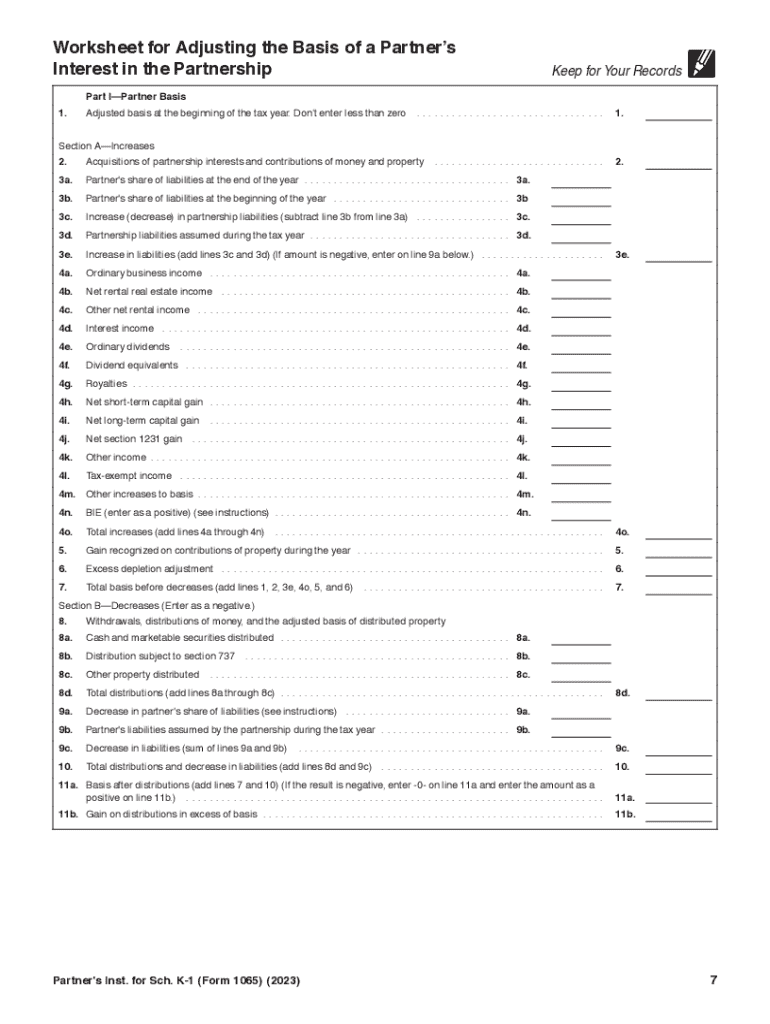

The IRS Form 1065 Schedule K-1 is a crucial document used by partnerships to report income, deductions, and credits to their partners. Each partner receives a K-1, which details their share of the partnership's income and other tax-related information. This form is essential for partners to accurately report their earnings on their personal tax returns. The K-1 includes several key elements, such as the partnership's name, the partner's share of income, and any deductions or credits applicable to the partner.

Steps to Complete Form 1065 Schedule K-1

Completing the Form 1065 Schedule K-1 involves several steps. Begin by gathering necessary information about the partnership, including its name, address, and Employer Identification Number (EIN). Next, determine each partner's share of income, deductions, and credits. This information will be reported in various sections of the K-1. Each partner's share must be calculated based on the partnership agreement. Ensure that all amounts are accurate and reflect the partnership's financial activities for the tax year.

Filing Deadlines for Form 1065 Schedule K-1

The deadline for filing Form 1065, which includes the Schedule K-1, is typically March 15 for partnerships operating on a calendar year basis. If the partnership requires an extension, it can apply for an automatic six-month extension, pushing the deadline to September 15. However, it is essential for partners to receive their K-1s in a timely manner to file their individual tax returns accurately. Partners must report the information from the K-1 on their personal returns by the due date, which is usually April 15.

Key Elements of Form 1065 Schedule K-1

Form 1065 Schedule K-1 contains several critical components. These include the partnership's name, the partner's name and address, and the partner's identifying number. Additionally, the form outlines the partner's share of the partnership's income, losses, deductions, and credits. Each section is designed to provide a clear picture of the partner's financial stake in the partnership, which is necessary for accurate tax reporting. Understanding these elements is vital for partners to ensure compliance with IRS regulations.

Obtaining Form 1065 Schedule K-1

Partnerships can obtain Form 1065 Schedule K-1 from the IRS website or through tax preparation software. It is important for partnerships to ensure they are using the most current version of the form, as tax laws and requirements may change. Additionally, partnerships should maintain accurate records of all financial transactions throughout the year to facilitate the completion of the K-1. Once completed, the form should be distributed to each partner for their records and tax filings.

Legal Use of Form 1065 Schedule K-1

Form 1065 Schedule K-1 is legally required for partnerships to report the financial activities of the partnership to the IRS and to each partner. Failure to provide accurate K-1s can result in penalties for both the partnership and the individual partners. It is essential for partnerships to comply with IRS guidelines when preparing and distributing K-1s. This ensures that all partners are accurately reporting their income and deductions, which is crucial for maintaining compliance with federal tax laws.

Create this form in 5 minutes or less

Find and fill out the correct form irs instruction 1065 schedule k 1 fill

Create this form in 5 minutes!

How to create an eSignature for the form irs instruction 1065 schedule k 1 fill

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 1065 K-1 instructions for filing taxes?

The 1065 K-1 instructions provide detailed guidance on how to report income, deductions, and credits from partnerships. These instructions are essential for partners to accurately complete their individual tax returns. Understanding these instructions can help ensure compliance and maximize tax benefits.

-

How can airSlate SignNow assist with 1065 K-1 instructions?

airSlate SignNow simplifies the process of sending and eSigning documents related to 1065 K-1 instructions. Our platform allows users to easily share tax documents with partners and ensure that all necessary signatures are obtained promptly. This streamlines the filing process and reduces the risk of errors.

-

Are there any costs associated with using airSlate SignNow for 1065 K-1 instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage your 1065 K-1 instructions without breaking the bank. You can choose a plan that fits your budget while enjoying all the essential features.

-

What features does airSlate SignNow offer for managing 1065 K-1 instructions?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure storage for managing 1065 K-1 instructions. These tools help streamline the document workflow, making it easier to prepare and send tax-related documents. Additionally, our platform ensures compliance with legal standards.

-

Can I integrate airSlate SignNow with other software for 1065 K-1 instructions?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, enhancing your ability to manage 1065 K-1 instructions seamlessly. This integration allows for automatic data transfer and reduces manual entry, saving you time and minimizing errors.

-

What are the benefits of using airSlate SignNow for 1065 K-1 instructions?

Using airSlate SignNow for 1065 K-1 instructions provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration among partners. Our platform ensures that all parties can access and sign documents from anywhere, making the tax filing process smoother and more efficient.

-

Is airSlate SignNow user-friendly for those unfamiliar with 1065 K-1 instructions?

Yes, airSlate SignNow is designed to be user-friendly, even for those who may not be familiar with 1065 K-1 instructions. Our intuitive interface guides users through the document preparation and signing process, ensuring that everyone can navigate the platform with ease. Support resources are also available for additional assistance.

Get more for Form IRS Instruction 1065 Schedule K 1 Fill

Find out other Form IRS Instruction 1065 Schedule K 1 Fill

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile