Property Tax Statement Instructions for Payable 2023-2026

Understanding the Vermont Homestead Declaration

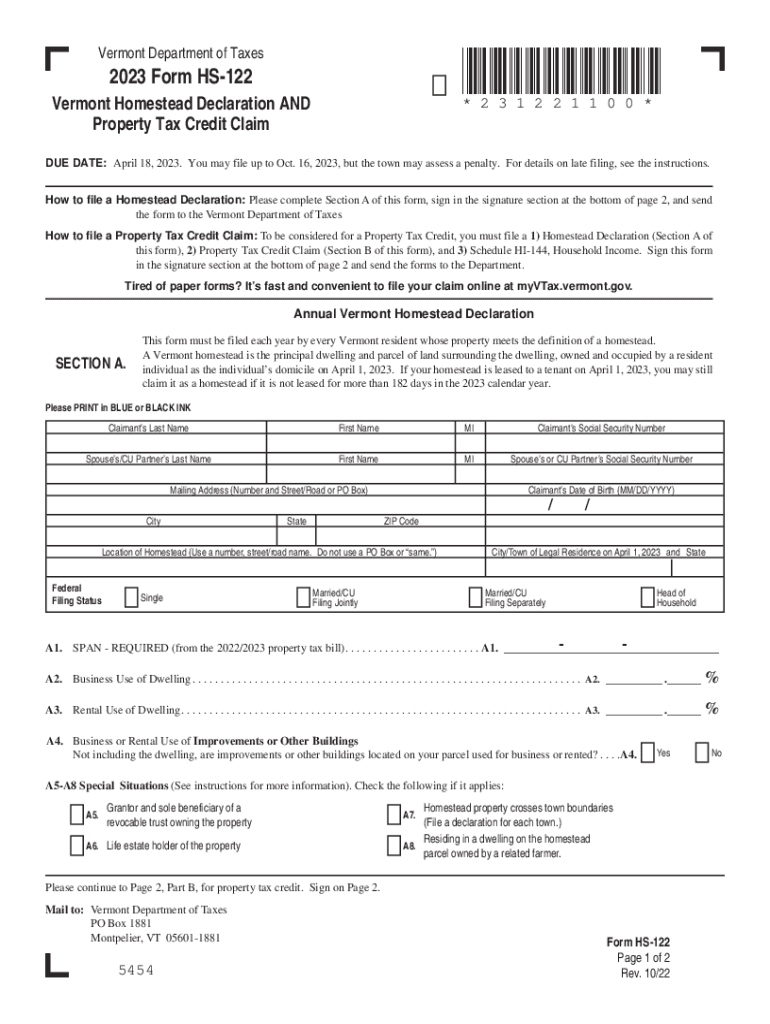

The Vermont homestead declaration is a crucial document for homeowners in Vermont, allowing them to claim their primary residence for property tax purposes. This declaration can significantly reduce property taxes by qualifying for the homestead tax rate. To benefit from this, homeowners must accurately complete the Vermont form HS-122, which serves as the official homestead declaration. The form requires details about the property, the owner, and the use of the property as a primary residence.

Steps to Complete the Vermont Homestead Declaration

Filling out the Vermont homestead declaration involves several key steps. First, gather necessary information about the property, including its address and the owner's details. Next, complete the form HS-122, ensuring that all sections are filled out accurately. Pay special attention to the sections that require information about the property’s use and any exemptions that may apply. Once the form is completed, review it for accuracy before submitting it to the Vermont Department of Taxes by the specified deadline.

Required Documents for the Vermont Homestead Declaration

When completing the Vermont homestead declaration, certain documents may be necessary to support your application. These may include proof of residency, such as a driver’s license or utility bill, and any previous tax returns that may demonstrate eligibility for the homestead tax rate. Having these documents ready will streamline the process and ensure that your declaration is processed without delays.

Filing Deadlines for the Vermont Homestead Declaration

It is essential to be aware of the filing deadlines associated with the Vermont homestead declaration. Typically, the declaration must be submitted by April 15 of the tax year to qualify for the homestead tax rate. Missing this deadline can result in the loss of potential tax savings, so homeowners should mark this date on their calendars and ensure timely submission of the form HS-122.

Legal Use of the Vermont Homestead Declaration

The Vermont homestead declaration is legally binding and must be filled out truthfully. Misrepresentation on the form can lead to penalties, including fines or loss of tax benefits. It is important for homeowners to understand the legal implications of their declaration and ensure that all information provided is accurate and reflects their true property use.

Examples of Using the Vermont Homestead Declaration

Homeowners may find various scenarios where the Vermont homestead declaration is applicable. For instance, a family residing in their primary home can file the declaration to receive a lower tax rate. Additionally, individuals who have recently purchased a home and moved in can also benefit from filing the declaration in their first year of ownership. Understanding these examples can help homeowners recognize the importance of timely and accurate submissions.

Quick guide on how to complete property tax statement instructions for payable 2023

Effortlessly Prepare Property Tax Statement Instructions For Payable on Any Device

Online document management has gained traction among businesses and individuals. It serves as a perfect eco-conscious alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without hindrances. Manage Property Tax Statement Instructions For Payable on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Method to Modify and eSign Property Tax Statement Instructions For Payable with Ease

- Obtain Property Tax Statement Instructions For Payable and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal authority as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Update and eSign Property Tax Statement Instructions For Payable while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property tax statement instructions for payable 2023

Create this form in 5 minutes!

How to create an eSignature for the property tax statement instructions for payable 2023

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Vermont homestead declaration?

A Vermont homestead declaration is a legal document that allows property owners to designate a portion of their home as a primary residence. This declaration can help in reducing property taxes and protecting a homeowner's primary residence from creditors. Understanding this process is essential for Vermont homeowners looking to maximize their benefits under state law.

-

How can airSlate SignNow assist with completing a Vermont homestead declaration?

airSlate SignNow simplifies the process of completing a Vermont homestead declaration by providing an intuitive platform for eSigning and document management. Users can easily fill out necessary forms and share them securely with their local tax authorities. With airSlate SignNow, you can save time and avoid the hassle of traditional paperwork.

-

What are the costs associated with airSlate SignNow for filing a Vermont homestead declaration?

airSlate SignNow offers a cost-effective solution for managing your Vermont homestead declaration documents. The pricing structure is flexible, catering to both individual users and businesses. Investing in airSlate SignNow means you'll have access to a suite of features designed to streamline document handling at an affordable rate.

-

Are there any key features of airSlate SignNow that aid in filing a Vermont homestead declaration?

Yes, airSlate SignNow includes features such as customizable templates and secure eSigning, which make filing a Vermont homestead declaration straightforward. The platform also offers integration with various document storage solutions, ensuring all important paperwork is kept organized. These features enhance efficiency and ease of use for all users.

-

What benefits can homeowners expect from a Vermont homestead declaration?

Filing a Vermont homestead declaration provides numerous benefits, including potential property tax reductions and legal protections. It ensures that your primary residence is recognized, which can safeguard against risks related to creditors. With the right tools like airSlate SignNow, homeowners can navigate this process more efficiently.

-

Is it easy to use airSlate SignNow for new users interested in filing a Vermont homestead declaration?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for new users looking to file a Vermont homestead declaration. The platform offers guided steps and helpful resources to assist users at every stage, ensuring a smooth experience. Whether you're tech-savvy or a beginner, you’ll find it easy to get started.

-

Can I integrate airSlate SignNow with other applications for handling Vermont homestead declaration documents?

Yes, airSlate SignNow offers seamless integration with various applications that can enhance your experience when handling Vermont homestead declaration documents. This includes popular cloud storage solutions and productivity tools, allowing for efficient document management. Such integrations help streamline workflows, making the process smoother.

Get more for Property Tax Statement Instructions For Payable

- Separate answer and defenses mississippi form

- Answer and defenses mississippi 497314682 form

- Separate answer mississippi 497314683 form

- Defendants response to request for admissions mississippi form

- Separate answer and defenses of school district mississippi 497314685 form

- Order dismissing one defendant mississippi 497314686 form

- Order of dismissal settled mississippi 497314687 form

- Mississippi application form 497314691

Find out other Property Tax Statement Instructions For Payable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors