PDF Form HS 122 Vermont Department of Taxes Vermont Gov 2020

What is the VT Homestead Property Tax Adjustment?

The VT homestead property tax adjustment is a program designed to assist eligible Vermont homeowners in reducing their property tax burden. This adjustment is calculated based on the homeowner's income and the property's value. By filing the appropriate forms, such as the Vermont HS-122, homeowners can receive a reduction in their property taxes, making homeownership more affordable. The program aims to support residents by ensuring that property taxes remain manageable, particularly for those with lower incomes or fixed incomes, such as retirees.

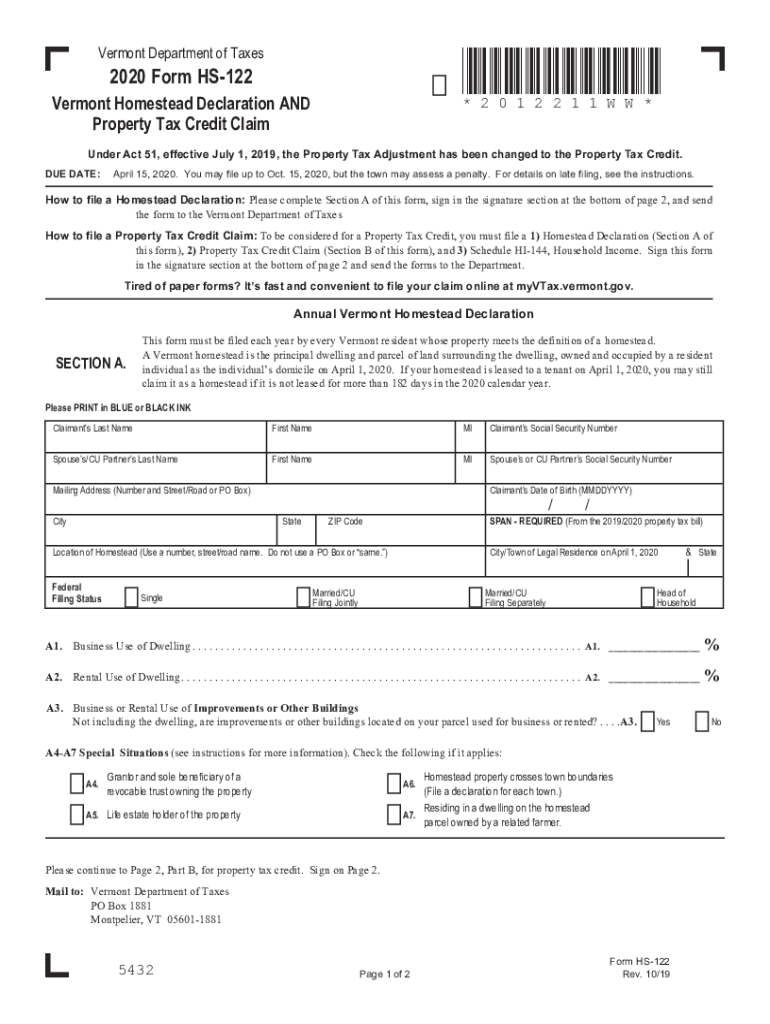

Steps to Complete the PDF Form HS-122

Completing the Vermont HS-122 form involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income and property details. Next, fill out the form with your personal information, including your name, address, and social security number. Be sure to provide accurate income information, as this will directly impact your tax adjustment eligibility. After completing the form, review it for any errors before submitting it to the Vermont Department of Taxes. Finally, keep a copy of the submitted form for your records.

Eligibility Criteria for the VT Homestead Property Tax Adjustment

To qualify for the VT homestead property tax adjustment, homeowners must meet specific eligibility criteria. Primarily, the property must be the homeowner's primary residence. Additionally, applicants must demonstrate financial need, which is typically assessed through income levels. Homeowners must also be current on their property taxes and have filed their income tax returns. Understanding these criteria is crucial for applicants to ensure they meet all requirements before submitting the HS-122 form.

Required Documents for the HS-122 Submission

When submitting the HS-122 form, certain documents are required to verify eligibility. Homeowners must provide proof of income, which can include recent pay stubs, tax returns, or Social Security statements. Additionally, documentation that confirms the property’s primary residence status is necessary. This may include utility bills or other official correspondence that lists the homeowner's name and address. Ensuring all required documents are included with the submission can help prevent delays in processing the tax adjustment.

Form Submission Methods for HS-122

The HS-122 form can be submitted through various methods to accommodate different preferences. Homeowners have the option to complete the form online through the Vermont Department of Taxes website, which allows for a streamlined submission process. Alternatively, the form can be printed and mailed to the appropriate tax office. For those who prefer in-person interactions, submitting the form at local tax offices is also an option. Each method has its benefits, and homeowners should choose the one that best fits their needs.

Legal Use of the HS-122 Form

The HS-122 form serves a legal purpose in the context of Vermont's property tax laws. It is a formal application that allows homeowners to request a property tax adjustment based on their financial situation. Proper completion and submission of this form are essential for ensuring compliance with state tax regulations. The information provided in the HS-122 is used by the Vermont Department of Taxes to assess eligibility and calculate the appropriate tax adjustment, making it a critical document for homeowners seeking financial relief.

Quick guide on how to complete pdf 2020 form hs 122 vermont department of taxes vermontgov

Execute PDF Form HS 122 Vermont Department Of Taxes Vermont gov seamlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage PDF Form HS 122 Vermont Department Of Taxes Vermont gov on any device with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign PDF Form HS 122 Vermont Department Of Taxes Vermont gov effortlessly

- Find PDF Form HS 122 Vermont Department Of Taxes Vermont gov and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign PDF Form HS 122 Vermont Department Of Taxes Vermont gov to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 2020 form hs 122 vermont department of taxes vermontgov

Create this form in 5 minutes!

How to create an eSignature for the pdf 2020 form hs 122 vermont department of taxes vermontgov

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the VT homestead property tax adjustment?

The VT homestead property tax adjustment is a program designed to reduce property tax bills for eligible homeowners in Vermont. By filing for this adjustment, homeowners can ensure that they take full advantage of available tax savings, which can signNowly lower their property tax burden.

-

How can airSlate SignNow help with the VT homestead property tax adjustment process?

AirSlate SignNow streamlines the document signing process, making it easy to complete and submit the necessary forms for the VT homestead property tax adjustment. With our user-friendly platform, you can quickly eSign documents and track their status, ensuring a smooth application process.

-

Is there a fee to use airSlate SignNow for the VT homestead property tax adjustment?

AirSlate SignNow offers a cost-effective solution with various pricing plans to fit any budget. Whether you need a basic commercial plan or a more comprehensive option, you can access tools that facilitate the VT homestead property tax adjustment without breaking the bank.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow provides several benefits, including expedited document turnaround times and enhanced security for your tax documents. Our platform ensures that your VT homestead property tax adjustment forms are handled securely, allowing you to focus on what matters most—your financial wellness.

-

Can airSlate SignNow integrate with accounting software for the VT homestead property tax adjustment?

Yes, airSlate SignNow integrates seamlessly with a variety of accounting software, enabling you to manage your financial documents more efficiently. This integration can help streamline your VT homestead property tax adjustment processes alongside your overall tax management strategy.

-

What types of documents can I eSign for the VT homestead property tax adjustment?

With airSlate SignNow, you can eSign various documents necessary for the VT homestead property tax adjustment, including application forms, supporting documents, and confirmation letters. Our platform supports a wide range of document types to ensure all your tax-related needs are met.

-

How secure is airSlate SignNow when handling sensitive tax information?

AirSlate SignNow prioritizes your security with top-notch encryption and compliance with industry standards, ensuring that your sensitive information regarding the VT homestead property tax adjustment remains protected. You can confidently manage all your tax documents with complete peace of mind.

Get more for PDF Form HS 122 Vermont Department Of Taxes Vermont gov

- Landlord tenant sublease package vermont form

- Buy sell agreement package vermont form

- Option to purchase package vermont form

- Amendment of lease package vermont form

- Annual financial checkup package vermont form

- Vt bill sale form

- Living wills and health care package vermont form

- Last will and testament package vermont form

Find out other PDF Form HS 122 Vermont Department Of Taxes Vermont gov

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT