Charles Schwab W8ben Form

What is the Charles Schwab W-8BEN?

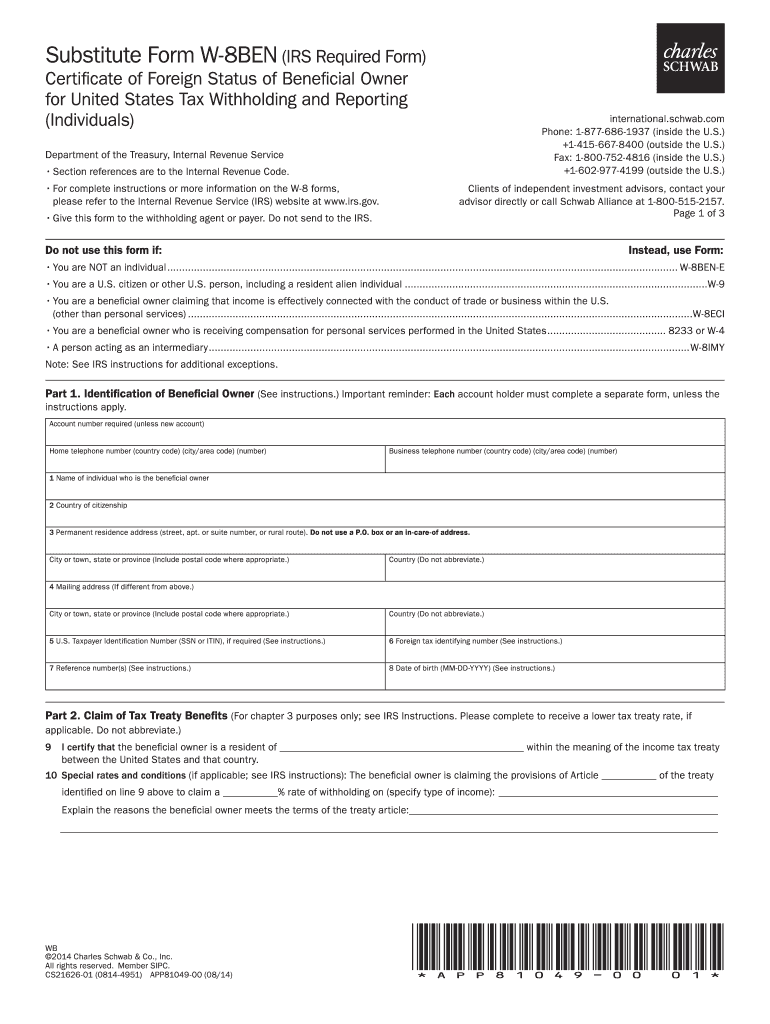

The Charles Schwab W-8BEN form is a tax document used by foreign individuals and entities to certify their foreign status for tax purposes. This form helps non-U.S. persons claim a reduced rate of withholding tax on income received from U.S. sources, such as dividends and interest. By submitting the W-8BEN, individuals can avoid higher tax rates that may apply to foreign investors. It is essential for anyone engaging in financial transactions with U.S. entities to understand the implications of this form.

Steps to Complete the Charles Schwab W-8BEN

Completing the Charles Schwab W-8BEN involves several straightforward steps. First, gather necessary information, including your name, country of citizenship, and taxpayer identification number. Next, accurately fill out the form, ensuring that all sections are completed, including the beneficial owner’s information. It is crucial to sign and date the form to validate it. After completing the form, submit it to your financial institution, such as Charles Schwab, to ensure compliance with U.S. tax regulations.

Legal Use of the Charles Schwab W-8BEN

The legal use of the Charles Schwab W-8BEN is governed by U.S. tax laws, specifically the Internal Revenue Code. This form is essential for non-resident aliens and foreign entities to establish their status and claim benefits under tax treaties. Proper completion and submission of the W-8BEN can help prevent unnecessary withholding taxes on certain types of income. It is important to keep the form updated and resubmit it every three years or whenever there is a change in circumstances.

Required Documents

When filling out the Charles Schwab W-8BEN, certain documents may be required to support your claims. These can include proof of identity, such as a passport or government-issued ID, and any relevant tax identification numbers. Additionally, if you are claiming benefits under a tax treaty, documentation proving your eligibility may be necessary. Having these documents ready can streamline the process and ensure compliance with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Charles Schwab W-8BEN are crucial for maintaining compliance with U.S. tax laws. Generally, the form should be submitted before you receive any income subject to withholding tax. It is advisable to submit the W-8BEN as soon as you open an account or begin transactions with U.S. entities. Additionally, keep in mind that the form must be updated every three years or whenever there are changes in your circumstances.

Examples of Using the Charles Schwab W-8BEN

There are various scenarios in which the Charles Schwab W-8BEN is utilized. For instance, a foreign investor receiving dividends from U.S. stocks would complete this form to ensure the correct withholding tax rate is applied. Another example is a non-U.S. resident earning interest from a U.S. bank account, where the W-8BEN helps in reducing the withholding tax burden. Understanding these examples can clarify the importance of the form in international financial transactions.

Quick guide on how to complete schwab fax for w 8ben form

Prepare Charles Schwab W8ben effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Charles Schwab W8ben on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Charles Schwab W8ben with ease

- Find Charles Schwab W8ben and then click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Charles Schwab W8ben and maintain exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Does TD Ameritrade require foreign investors to fax them the W-8BEN form?

W8ben form has to signed by you and sent by post to TDAmerirade office in Omaha. They would like to have original signed form. This is what I understood.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

Create this form in 5 minutes!

How to create an eSignature for the schwab fax for w 8ben form

How to make an electronic signature for your Schwab Fax For W 8ben Form in the online mode

How to generate an eSignature for the Schwab Fax For W 8ben Form in Chrome

How to generate an eSignature for putting it on the Schwab Fax For W 8ben Form in Gmail

How to make an electronic signature for the Schwab Fax For W 8ben Form straight from your smart phone

How to generate an electronic signature for the Schwab Fax For W 8ben Form on iOS devices

How to make an eSignature for the Schwab Fax For W 8ben Form on Android OS

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is a digital solution that empowers businesses to send and eSign documents securely. By utilizing features that enhance efficiency, users can streamline their workflow while managing documents effortlessly. For more information, you can explore 'rfzvweuhrqg site youtube com' for tutorials and demonstration videos.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to cater to different organizational sizes and needs. Plans are designed to be cost-effective while providing essential eSigning features. For detailed pricing plans, visit 'rfzvweuhrqg site youtube com' where tutorials explain the benefits of each plan.

-

What features does airSlate SignNow include?

airSlate SignNow includes features such as template creation, real-time document tracking, and advanced security options. These features are designed to enhance productivity and ensure the integrity of your documents. You can find an overview of these features on 'rfzvweuhrqg site youtube com'.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can reduce turnaround times for document signing and improve operational efficiency. The user-friendly interface helps teams collaborate seamlessly while maintaining compliance and security. For in-depth discussions on benefits, check 'rfzvweuhrqg site youtube com'.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow integrates with various applications including Google Drive, Salesforce, and Microsoft Teams. These integrations help centralize workflows and improve data accessibility. Detailed integration guides can be found on 'rfzvweuhrqg site youtube com'.

-

Is airSlate SignNow secure to use?

Absolutely, airSlate SignNow prioritizes security with features like encryption, two-factor authentication, and compliance with international standards. This ensures that all your documents remain secure throughout the signing process. More insights on security features can be learned on 'rfzvweuhrqg site youtube com'.

-

Can I try airSlate SignNow before committing?

Yes, airSlate SignNow offers a free trial that allows users to explore its features before making a financial commitment. This is a great opportunity to see how it can meet your business needs. To learn about the trial process, visit 'rfzvweuhrqg site youtube com'.

Get more for Charles Schwab W8ben

- Premarital agreements package oklahoma form

- Painting contractor package oklahoma form

- Framing contractor package oklahoma form

- Foundation contractor package oklahoma form

- Plumbing contractor package oklahoma form

- Brick mason contractor package oklahoma form

- Roofing contractor package oklahoma form

- Electrical contractor package oklahoma form

Find out other Charles Schwab W8ben

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later