Arkansas Real Property Tax Affidavit of Compliance Form

What is the Arkansas Real Property Tax Affidavit of Compliance Form

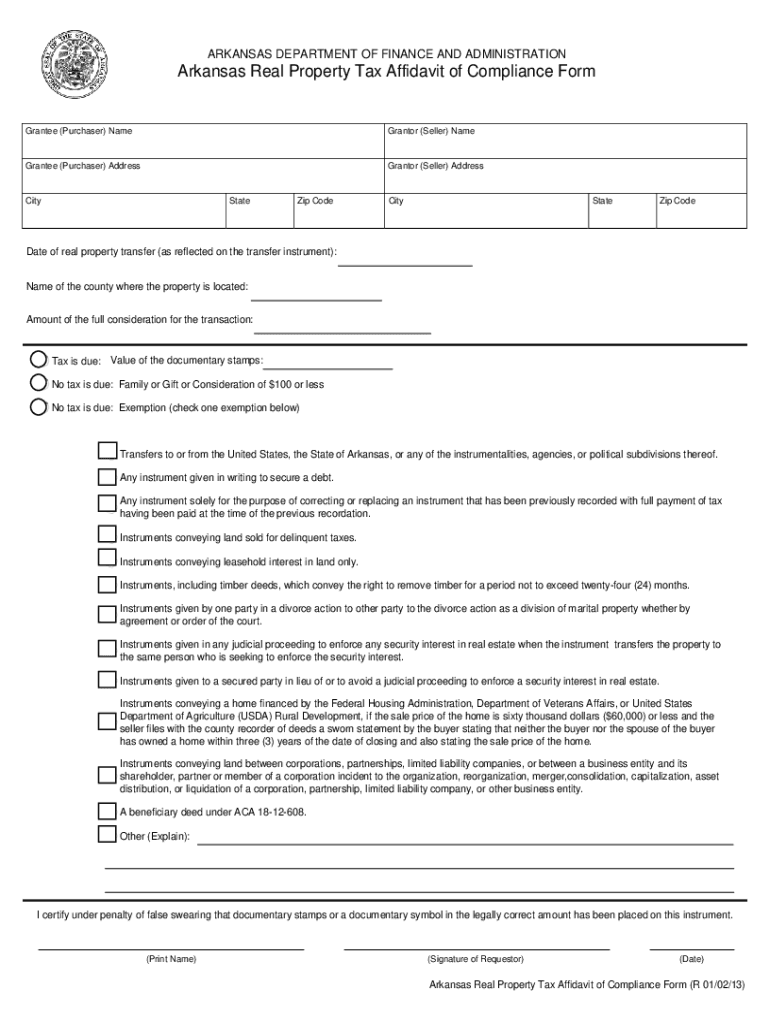

The Arkansas Real Property Tax Affidavit of Compliance Form is a legal document used to affirm compliance with property tax regulations in Arkansas. This form is particularly important for individuals or entities involved in property transactions, ensuring that all tax obligations are met before the transfer of property ownership. By completing this affidavit, signers declare that they have fulfilled all necessary tax requirements associated with the property in question, which helps prevent future disputes and ensures a smooth transaction process.

How to use the Arkansas Real Property Tax Affidavit of Compliance Form

Using the Arkansas Real Property Tax Affidavit of Compliance Form involves several key steps. First, it is essential to gather all relevant information about the property, including its legal description and tax identification number. Next, the form must be completed accurately, providing details about the property owner and confirming compliance with tax obligations. After completing the form, it should be signed and dated by the appropriate parties. This form can then be submitted to the relevant local tax authority or included with other property transfer documents.

Steps to complete the Arkansas Real Property Tax Affidavit of Compliance Form

Completing the Arkansas Real Property Tax Affidavit of Compliance Form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the form from a reliable source.

- Fill in the property details, including the address and legal description.

- Provide the names and contact information of the property owners.

- Confirm that all property taxes have been paid and include any relevant tax identification numbers.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the completed form to the appropriate local tax authority or with the property transfer documents.

Key elements of the Arkansas Real Property Tax Affidavit of Compliance Form

The Arkansas Real Property Tax Affidavit of Compliance Form contains several key elements that must be addressed for it to be valid. These include:

- Property Identification: Accurate details about the property, including its legal description and tax ID number.

- Owner Information: Names and addresses of the current property owners.

- Tax Compliance Statement: A declaration confirming that all property taxes have been paid.

- Signatures: Necessary signatures from all parties involved in the transaction.

- Date: The date on which the affidavit is signed, which is crucial for record-keeping.

Legal use of the Arkansas Real Property Tax Affidavit of Compliance Form

The legal use of the Arkansas Real Property Tax Affidavit of Compliance Form is essential in property transactions. This affidavit serves as a declaration that the property owner has met all tax obligations, which can protect all parties involved from potential legal issues. It is often required by local authorities before a property transfer can be finalized. Failing to provide a properly executed affidavit may result in delays or complications in the property transfer process.

Form Submission Methods

The Arkansas Real Property Tax Affidavit of Compliance Form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many local tax authorities offer online portals where forms can be submitted electronically.

- Mail: The completed form can be mailed directly to the local tax office.

- In-Person: Individuals may also choose to deliver the form in person at the local tax office.

Quick guide on how to complete arkansas real property tax affidavit of compliance form

Effortlessly Prepare Arkansas Real Property Tax Affidavit Of Compliance Form on Any Device

The management of online documents has become increasingly popular among both organizations and individuals. It presents an excellent eco-friendly substitute for traditional printed and signed documents, allowing users to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to quickly create, modify, and electronically sign your documents without any delays. Manage Arkansas Real Property Tax Affidavit Of Compliance Form across any platform via the airSlate SignNow Android or iOS applications, and enhance any document-centric process today.

How to Edit and Electronically Sign Arkansas Real Property Tax Affidavit Of Compliance Form with Ease

- Obtain Arkansas Real Property Tax Affidavit Of Compliance Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow efficiently manages all your document needs in just a few clicks from any device you choose. Modify and electronically sign Arkansas Real Property Tax Affidavit Of Compliance Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arkansas real property tax affidavit of compliance form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arkansas real property tax affidavit of compliance form?

The Arkansas real property tax affidavit of compliance form is a document required for property owners to signNow that they have complied with local property tax laws. This form is essential for ensuring that all tax obligations are met, and it helps maintain transparency in property ownership.

-

How can airSlate SignNow help in completing the Arkansas real property tax affidavit of compliance form?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the Arkansas real property tax affidavit of compliance form. Users can easily upload, edit, and sign the form electronically, saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the Arkansas real property tax affidavit of compliance form?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers. These plans are designed to be cost-effective while providing all the necessary features to efficiently manage documents, including the Arkansas real property tax affidavit of compliance form.

-

What features does airSlate SignNow offer for managing the Arkansas real property tax affidavit of compliance form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Arkansas real property tax affidavit of compliance form. These tools enhance the efficiency and security of your document management process.

-

Can I integrate airSlate SignNow with other applications for the Arkansas real property tax affidavit of compliance form?

Absolutely! airSlate SignNow offers various integrations with popular applications, making it easy to streamline your workflow when handling the Arkansas real property tax affidavit of compliance form. This includes CRM systems and cloud storage services.

-

What are the benefits of using airSlate SignNow for the Arkansas real property tax affidavit of compliance form?

Using airSlate SignNow for the Arkansas real property tax affidavit of compliance form provides numerous benefits, including increased efficiency, reduced errors, and better document security. The platform allows users to manage all aspects of the form digitally, which fosters a smoother process.

-

Is it safe to use airSlate SignNow for the Arkansas real property tax affidavit of compliance form?

Yes, airSlate SignNow prioritizes user security and compliance. The platform uses advanced encryption and adheres to legal standards, ensuring that your Arkansas real property tax affidavit of compliance form is handled safely.

Get more for Arkansas Real Property Tax Affidavit Of Compliance Form

Find out other Arkansas Real Property Tax Affidavit Of Compliance Form

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile