BUSINESS APPLICATION and REGISTRATION Rhode Island Tax Ri 2007

What is the BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri

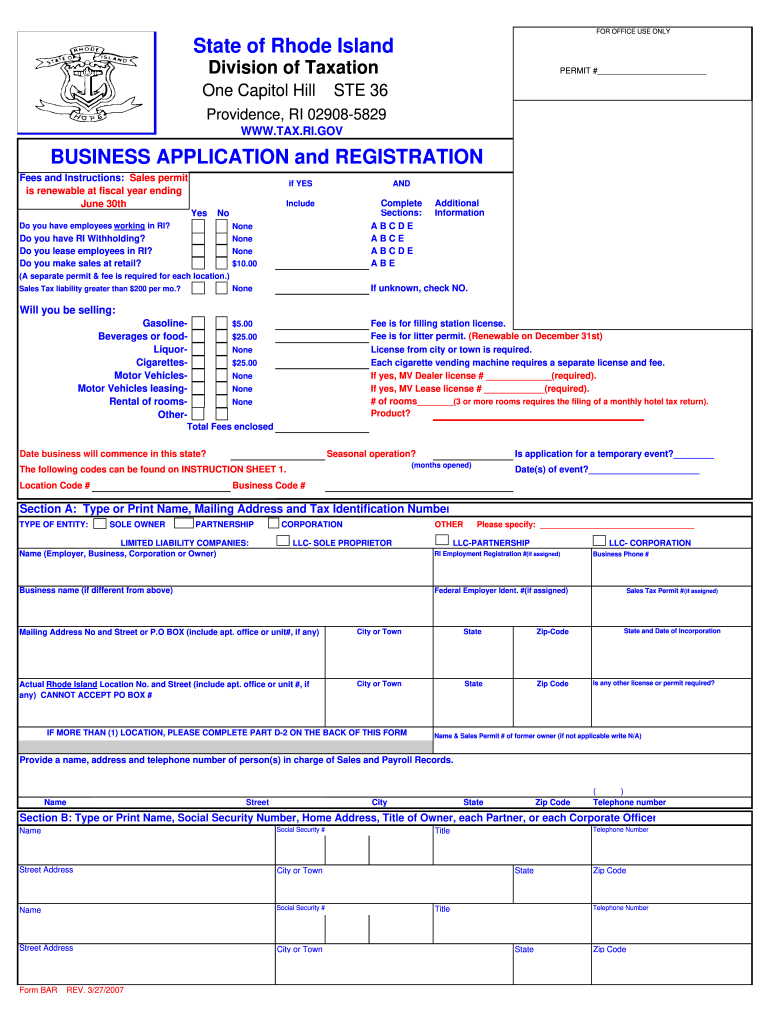

The BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri form is a crucial document for businesses operating in Rhode Island. This form serves as a formal request to register a business entity with the state and to obtain a tax identification number. Completing this form is essential for compliance with state regulations and for ensuring that your business can operate legally within Rhode Island. The form collects vital information such as the business name, address, ownership structure, and type of business activities.

Steps to complete the BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri

Completing the BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri form involves several key steps:

- Gather necessary information about your business, including the legal name, address, and ownership details.

- Determine the type of business entity you are registering, such as an LLC, corporation, or partnership.

- Access the form online through the appropriate state website or download a printable version.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or via mail, following the specific submission guidelines provided by the state.

Legal use of the BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri

The legal use of the BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri form is fundamental for establishing a business in compliance with state laws. By submitting this form, business owners affirm their intent to operate within Rhode Island and agree to adhere to local tax obligations. This form also helps protect the business name from being used by others, thereby establishing a legal identity for the business in the state.

Required Documents

When preparing to submit the BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri form, certain documents are typically required. These may include:

- Proof of identity for the business owner(s), such as a driver's license or state ID.

- Documentation that supports the business structure, such as articles of incorporation for corporations or operating agreements for LLCs.

- Any additional permits or licenses required for specific business activities, depending on the nature of the business.

Form Submission Methods

The BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri form can be submitted through various methods, ensuring flexibility for business owners. The primary submission methods include:

- Online submission through the Rhode Island Secretary of State's website, which provides a streamlined process.

- Mailing a printed version of the form to the appropriate state office.

- In-person submission at designated state offices, allowing for direct interaction with state officials.

Eligibility Criteria

To successfully complete the BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri form, applicants must meet certain eligibility criteria. These criteria typically include:

- Being at least eighteen years old and legally capable of entering into contracts.

- Having a valid business purpose that complies with state laws.

- Providing accurate and truthful information on the application to avoid penalties.

Quick guide on how to complete business application and registration rhode island tax ri

Your assistance manual on how to prepare your BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri

If you’re curious about how to finish and submit your BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri, here are some straightforward guidelines to simplify tax processing.

To begin, you just need to create your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, draft, and finalize your income tax documents with ease. Utilizing its editor, you can navigate between text, check boxes, and eSignatures and return to amend information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri in minutes:

- Create your account and start working on PDFs swiftly.

- Utilize our catalog to access any IRS tax form; explore different versions and schedules.

- Click Get form to open your BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in hard copy may increase return errors and delay refunds. It’s essential to check the IRS website for submission guidelines relevant to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct business application and registration rhode island tax ri

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Which American tax forms will you need to fill out if you have a full-time job and you started a small business of which you are the only employee?

If you are operating as a sole prietor, you would simply note the results of your operation on a Schedule C, and attach it to your form 1040. If however you have a Subchapter S corporation or an LLC you would have to fill out the pass through tax returns for them, and the profit or loss from your business would be reported to you on a K1 form which would also become part of your 1040 form. If you have a Subchapter C corporation, you would need to complete one of the 1120 tax returns. You may want to visit Bizdoks at www.bizdoks.com for a better understanding why operating under the sole proprietor form of business may not be in your best interest.

Create this form in 5 minutes!

How to create an eSignature for the business application and registration rhode island tax ri

How to generate an electronic signature for your Business Application And Registration Rhode Island Tax Ri in the online mode

How to generate an electronic signature for your Business Application And Registration Rhode Island Tax Ri in Google Chrome

How to generate an eSignature for signing the Business Application And Registration Rhode Island Tax Ri in Gmail

How to create an eSignature for the Business Application And Registration Rhode Island Tax Ri from your smartphone

How to make an electronic signature for the Business Application And Registration Rhode Island Tax Ri on iOS devices

How to generate an electronic signature for the Business Application And Registration Rhode Island Tax Ri on Android

People also ask

-

What is the airSlate SignNow solution for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI?

airSlate SignNow offers a streamlined solution for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI by allowing businesses to easily send and eSign documents. This user-friendly platform simplifies the process of completing necessary forms for tax registration in Rhode Island, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes looking for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI. Our competitive pricing ensures that you have access to essential features without breaking the bank, making it a cost-effective choice for your business needs.

-

What features does airSlate SignNow offer for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI?

With airSlate SignNow, you gain access to features specifically designed for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI, including customizable templates, secure eSigning, and real-time tracking. These features enhance the efficiency of your document workflows, making tax registration a hassle-free process.

-

Can I integrate airSlate SignNow with other tools for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI?

Yes, airSlate SignNow seamlessly integrates with various productivity tools to enhance your BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI experience. You can connect it with applications like Google Drive, Dropbox, and CRM systems, allowing for a more cohesive workflow and improved document management.

-

What are the benefits of using airSlate SignNow for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI?

Using airSlate SignNow for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI provides numerous benefits, including faster document turnaround times, enhanced security for sensitive information, and improved collaboration among team members. By leveraging our solution, businesses can focus more on growth rather than paperwork.

-

Is airSlate SignNow secure for handling BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents related to BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI are encrypted and compliant with industry standards. Our platform includes features like two-factor authentication and audit trails to safeguard your sensitive information.

-

How can I get started with airSlate SignNow for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI?

Getting started with airSlate SignNow for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax RI is simple. You can sign up for a free trial on our website, explore the features, and see how our platform can enhance your document management and eSigning processes before committing to a paid plan.

Get more for BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri

- Quitclaim deed from corporation to corporation rhode island form

- Warranty deed from corporation to corporation rhode island form

- Quitclaim deed from corporation to two individuals rhode island form

- Warranty deed from corporation to two individuals rhode island form

- Warranty deed from individual to a trust rhode island form

- Warranty deed from husband and wife to a trust rhode island form

- Warranty deed from husband to himself and wife rhode island form

- Quitclaim deed from husband to himself and wife rhode island form

Find out other BUSINESS APPLICATION And REGISTRATION Rhode Island Tax Ri

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document