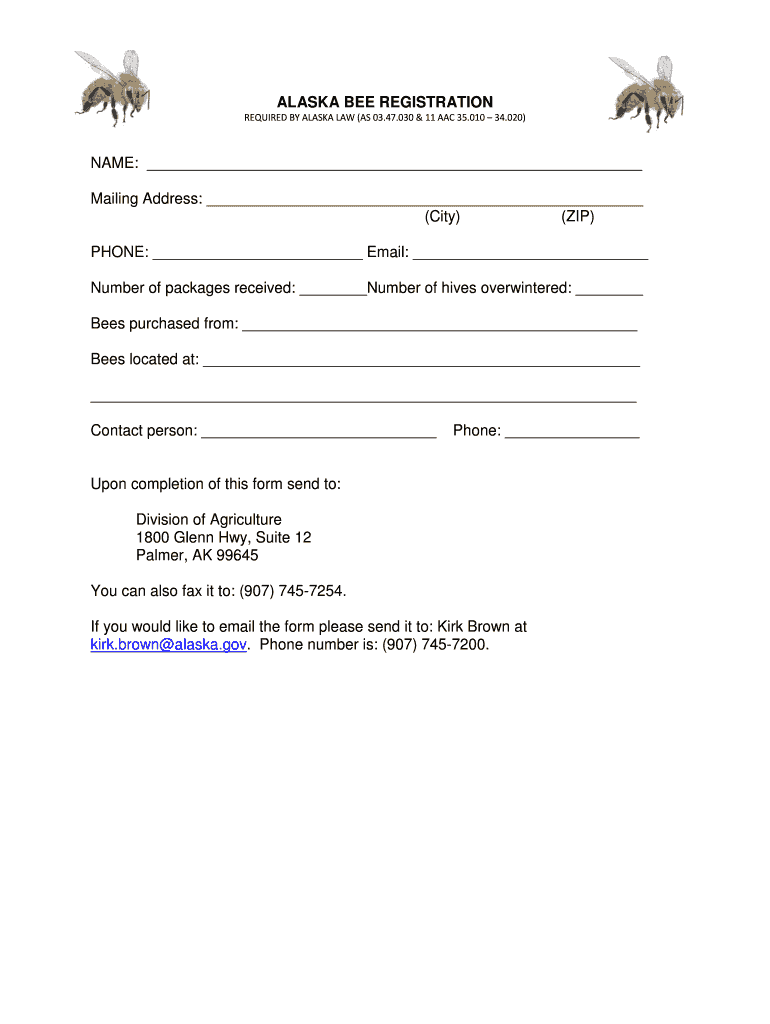

As 0347030 Registration of Bees Form

What is Form 2301?

Form 2301 is a tax document used primarily for the purpose of reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to accurately disclose their income and expenses, ensuring compliance with federal tax regulations. It is often utilized by self-employed individuals, small business owners, and other taxpayers who need to report detailed financial data.

How to Obtain Form 2301

To obtain Form 2301, individuals can visit the official IRS website, where the form is available for download in PDF format. Additionally, taxpayers can request a physical copy by contacting the IRS directly or by visiting local IRS offices. It is important to ensure that you are using the most current version of the form to avoid any issues with filing.

Steps to Complete Form 2301

Completing Form 2301 involves several key steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Review the information for accuracy and completeness before submission.

- Sign and date the form to validate it.

- Submit the form to the IRS either electronically or via mail, depending on your preference.

Legal Use of Form 2301

Form 2301 serves as a legally binding document when filled out correctly and submitted to the IRS. It is crucial to adhere to all tax laws and regulations to ensure that the information reported is accurate and truthful. Failure to comply with these regulations may result in penalties or further legal action by the IRS.

Filing Deadlines for Form 2301

Filing deadlines for Form 2301 typically align with the annual tax filing deadline, which is usually April 15 for most taxpayers. However, specific circumstances such as extensions or different tax statuses may alter these dates. It is advisable to check the IRS website or consult a tax professional for the most accurate and up-to-date information regarding deadlines.

Required Documents for Form 2301

When completing Form 2301, it is important to have the following documents ready:

- Income statements, such as W-2s or 1099s.

- Expense records, including receipts and invoices.

- Any prior year tax returns that may provide relevant information.

- Documentation of deductions or credits that you plan to claim.

Quick guide on how to complete form 2301

Complete form 2301 effortlessly on any gadget

Online document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Handle form 2301 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign form 2301 smoothly

- Obtain form 2301 and click Get Form to begin.

- Employ the tools provided to complete your documentation.

- Emphasize critical sections of the documents or redact sensitive data using the tools offered by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Select your preferred method to send your document, either by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Alter and eSign form 2301 and ensure effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs form 2301

-

How do I fill out the ICSI registration form?

Online Registration for CS Foundation | Executive | ProfessionalCheck this site

-

Do we have to fill out the registration form for various medical colleges before the NEET results as at AMU?

With the current scenario and INTRODUCTION of one medical exam for one nation , there is no requirement of filling up the separate forms and waste money.For the AMU the MCI conducts counselling on their website https://mcc.nic.in/ . overall it is CENTRALISED COUNSELLING FOR BHU , AMU etcCounselling for the various medical colleges and deemed UNIVERSITY will be done on SINGLE WINDOW for ALL INDIA QUOTA .However for the state government quota seat various DME (DIRECTOR OF MEDICAL EDUCATION) unit conducts the counselling procedure.From REGISTERING THEMSELVES to obtaing seat in the medical college for state quota all are managed by the State unit.

-

Can I fill out the CPT form and the registration in ICAI before the examination of 12th class? How?

First of all I would like to say that CPT is now converted into CA Foundation. I have qualified CPT exam in 2012 and many things have changed now. So, despite giving my openion and suggestion, I am sharing here the link of ICAI for your all queries related to CA course The Institute of Chartered Accountants of IndiaI am also attaching relevant pdf uploaded on ICAI for your convenience.https://resource.cdn.icai.org/45...https://resource.cdn.icai.org/45...Hope! it’ll help you :)

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

Related searches to form 2301

Create this form in 5 minutes!

How to create an eSignature for the form 2301

How to create an eSignature for your As 0347030 Registration Of Bees Form in the online mode

How to create an eSignature for your As 0347030 Registration Of Bees Form in Google Chrome

How to make an eSignature for signing the As 0347030 Registration Of Bees Form in Gmail

How to create an eSignature for the As 0347030 Registration Of Bees Form straight from your smart phone

How to make an electronic signature for the As 0347030 Registration Of Bees Form on iOS devices

How to create an eSignature for the As 0347030 Registration Of Bees Form on Android

People also ask form 2301

-

What is form 2301 and how does it work with airSlate SignNow?

Form 2301 is a critical document for businesses needing to manage tax credits effectively. With airSlate SignNow, you can easily create, send, and eSign form 2301, ensuring streamlined approvals and secure storage. This simplifies the management of your important tax documentation.

-

How much does it cost to use airSlate SignNow for form 2301?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Depending on the features you require for handling form 2301, you can choose from several subscription options, ensuring a cost-effective solution for your document signing needs.

-

What features does airSlate SignNow provide for managing form 2301?

airSlate SignNow comes with a variety of features designed for efficient document management, including customizable templates for form 2301, automated workflows, and secure storage options. These features help reduce paperwork and enhance productivity.

-

Can I integrate airSlate SignNow with other software for processing form 2301?

Yes, airSlate SignNow seamlessly integrates with popular tools like Google Drive, Salesforce, and Dropbox. This allows you to enhance your workflows further while processing form 2301 and other documents, ensuring a smooth experience.

-

What are the benefits of using airSlate SignNow for form 2301?

Using airSlate SignNow for form 2301 brings numerous benefits such as improved efficiency, faster turnaround times, and reduced errors. The platform’s user-friendly interface makes it easy for all team members to handle important documents easily.

-

Is airSlate SignNow secure for managing sensitive information in form 2301?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When handling sensitive information in form 2301, you can trust that your data is well-protected.

-

Can I edit form 2301 after it has been created in airSlate SignNow?

Yes, airSlate SignNow allows you to edit your form 2301 documents even after creation. This flexibility enables you to make necessary modifications as your business needs evolve without starting from scratch.

Get more for form 2301

- Schedule k 1 form n 20 partneramp39s share of income formsend

- Schedule k 1 form n 35 rev 2005 shareholderamp39s formsend

- Fr 399qualified high technology companies formsend

- Articles of incorporation pursuant to article 1528e texas formsend

- Pa schedule c ez 2004 form

- Wr 1 formpdffillercom

- Vec fc 21 form formsend

- Form n 35 rev 2006 s corporation income tax return formsend

Find out other form 2301

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter