Schedule K 1 Form N 35 Rev Shareholder's FormSend 2005

What is the Schedule K-1 Form N-35 Rev Shareholder's FormSend

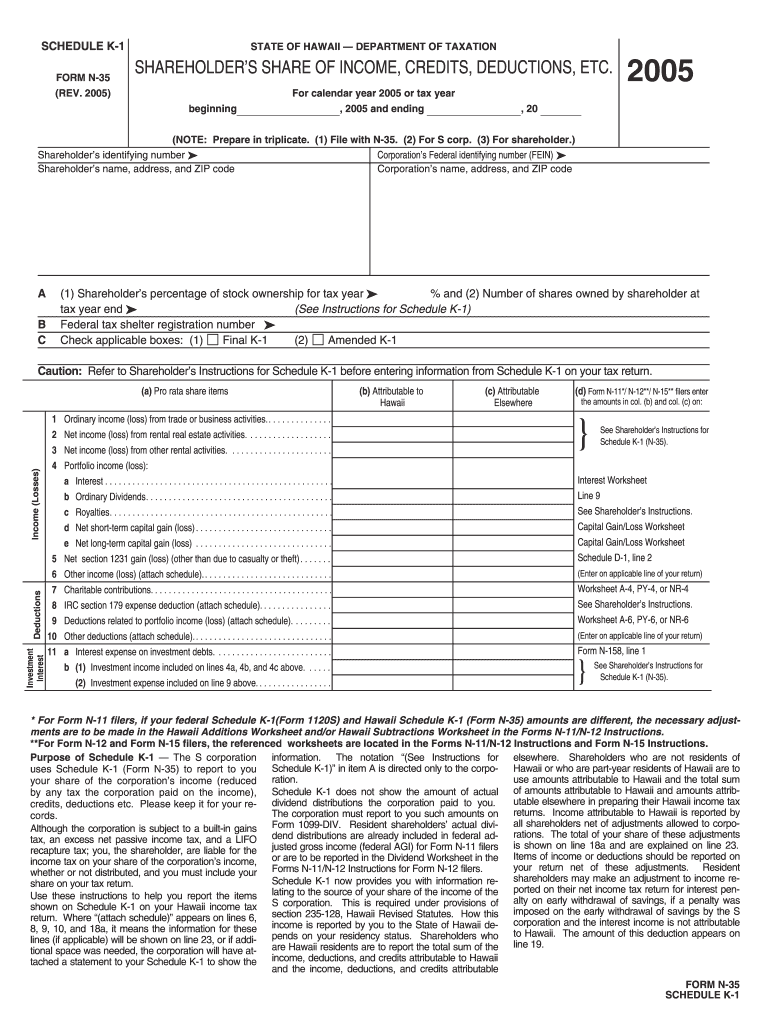

The Schedule K-1 Form N-35 Rev is a tax document used by partnerships, S corporations, and LLCs to report income, deductions, and credits to shareholders. Each shareholder receives a K-1 that details their share of the entity's income, which they must report on their personal tax returns. This form is essential for ensuring that income is accurately reported to the IRS and that shareholders fulfill their tax obligations.

How to use the Schedule K-1 Form N-35 Rev Shareholder's FormSend

Using the Schedule K-1 Form N-35 Rev involves several steps. First, the entity must complete the form, detailing the income and deductions allocated to each shareholder. Once the form is filled out, it should be distributed to shareholders, who will then use the information to complete their individual tax returns. It is important for shareholders to review the form carefully to ensure accuracy before filing their taxes.

Steps to complete the Schedule K-1 Form N-35 Rev Shareholder's FormSend

Completing the Schedule K-1 Form N-35 Rev requires careful attention to detail. Follow these steps:

- Gather necessary financial information, including income and expenses of the partnership or corporation.

- Fill out the entity’s details, including name, address, and tax identification number.

- Report each shareholder's allocated income, deductions, and credits accurately.

- Ensure all required fields are completed, including any additional information specific to the shareholders.

- Review the form for accuracy and compliance with IRS guidelines.

- Distribute the completed forms to shareholders for their records and tax filing.

Legal use of the Schedule K-1 Form N-35 Rev Shareholder's FormSend

The Schedule K-1 Form N-35 Rev is legally valid when completed accurately and in compliance with IRS regulations. It is crucial for entities to provide correct information to avoid penalties or audits. Shareholders must also use the K-1 information responsibly when preparing their tax returns to ensure compliance with tax laws.

Key elements of the Schedule K-1 Form N-35 Rev Shareholder's FormSend

Key elements of the Schedule K-1 Form N-35 Rev include:

- Entity information: Name, address, and tax identification number.

- Shareholder details: Name, address, and ownership percentage.

- Income and deductions: Breakdown of the shareholder's share of income, losses, and credits.

- Tax year: The specific tax year for which the K-1 is issued.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 Form N-35 Rev are typically aligned with the tax return deadlines for the entity. Generally, partnerships and S corporations must provide K-1 forms to shareholders by March 15, while shareholders must report this information on their personal tax returns by April 15. It is important to stay informed about any changes to these deadlines to ensure timely compliance.

Quick guide on how to complete schedule k 1 form n 35 rev 2005 shareholderamp39s formsend

Your assistance manual on how to prepare your Schedule K 1 Form N 35 Rev Shareholder's FormSend

If you’re uncertain about how to create and submit your Schedule K 1 Form N 35 Rev Shareholder's FormSend, here are a few brief guidelines on how to make tax submission less cumbersome.

To get started, you simply need to set up your airSlate SignNow profile to change the way you handle documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to modify, draft, and finalize your income tax forms with ease. With its editor, you can alternate between text, check boxes, and electronic signatures, and return to modify responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Schedule K 1 Form N 35 Rev Shareholder's FormSend in no time:

- Establish your account and begin working on PDFs in just a few minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Schedule K 1 Form N 35 Rev Shareholder's FormSend in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if necessary).

- Examine your document and rectify any mistakes.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in paper format can lead to increased errors and delays in reimbursements. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 35 rev 2005 shareholderamp39s formsend

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 35 rev 2005 shareholderamp39s formsend

How to generate an electronic signature for your Schedule K 1 Form N 35 Rev 2005 Shareholderamp39s Formsend online

How to create an eSignature for your Schedule K 1 Form N 35 Rev 2005 Shareholderamp39s Formsend in Chrome

How to create an eSignature for signing the Schedule K 1 Form N 35 Rev 2005 Shareholderamp39s Formsend in Gmail

How to create an eSignature for the Schedule K 1 Form N 35 Rev 2005 Shareholderamp39s Formsend right from your mobile device

How to generate an eSignature for the Schedule K 1 Form N 35 Rev 2005 Shareholderamp39s Formsend on iOS

How to create an eSignature for the Schedule K 1 Form N 35 Rev 2005 Shareholderamp39s Formsend on Android devices

People also ask

-

What is the Schedule K 1 Form N 35 Rev Shareholder's FormSend?

The Schedule K 1 Form N 35 Rev Shareholder's FormSend is a specific tax form used to report income, deductions, and credits for shareholders in a corporation. This form details each shareholder's share of the corporation's income, which is essential for accurate tax filing. Using airSlate SignNow, you can easily send and eSign this form digitally, streamlining the process for all parties involved.

-

How does airSlate SignNow facilitate the completion of the Schedule K 1 Form N 35 Rev Shareholder's FormSend?

airSlate SignNow simplifies the completion of the Schedule K 1 Form N 35 Rev Shareholder's FormSend by providing intuitive templates and electronic signature options. Users can fill out the form online, ensuring that all necessary information is captured accurately. This efficiency reduces errors and speeds up the overall document processing time.

-

Is there a cost associated with using airSlate SignNow for the Schedule K 1 Form N 35 Rev Shareholder's FormSend?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the ability to manage documents like the Schedule K 1 Form N 35 Rev Shareholder's FormSend. Each plan includes features such as unlimited eSignatures and document storage, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for managing the Schedule K 1 Form N 35 Rev Shareholder's FormSend?

airSlate SignNow provides a range of features tailored for managing the Schedule K 1 Form N 35 Rev Shareholder's FormSend, including customizable templates, real-time collaboration, and secure document storage. Users can track the status of their forms and receive notifications when actions are completed, ensuring a smooth workflow.

-

Can I integrate airSlate SignNow with other applications when using the Schedule K 1 Form N 35 Rev Shareholder's FormSend?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage the Schedule K 1 Form N 35 Rev Shareholder's FormSend alongside your existing tools. Whether you use CRM systems, cloud storage solutions, or accounting software, these integrations enhance your productivity and document management.

-

What are the benefits of using airSlate SignNow for the Schedule K 1 Form N 35 Rev Shareholder's FormSend?

Using airSlate SignNow for the Schedule K 1 Form N 35 Rev Shareholder's FormSend offers numerous benefits, including enhanced efficiency, reduced processing time, and improved accuracy. The platform’s user-friendly interface ensures that even those unfamiliar with digital forms can navigate the process with ease. Plus, the electronic signature feature ensures compliance and security.

-

Is airSlate SignNow secure for sending the Schedule K 1 Form N 35 Rev Shareholder's FormSend?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption to protect sensitive information when sending the Schedule K 1 Form N 35 Rev Shareholder's FormSend. The platform complies with industry standards, ensuring that your documents are safe from unauthorized access. Users can confidently manage their forms, knowing their data is protected.

Get more for Schedule K 1 Form N 35 Rev Shareholder's FormSend

- Rcw 424115 validity of agreement to indemnify against form

- Trade policy review world trade organization home page form

- 4425 miscellaneousinternal revenue service form

- S 1a secgovhome form

- 13 procedural issues form

- Subject to the foregoing the events of force majeure shall form

- Cercla enforcement policy compendium update form

- Sample force majeure clausespublic private partnership form

Find out other Schedule K 1 Form N 35 Rev Shareholder's FormSend

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile