Schedule K 1 Form N 20 Partner's Share of Income FormSend 2003

What is the Schedule K-1 Form N-20 Partner's Share of Income?

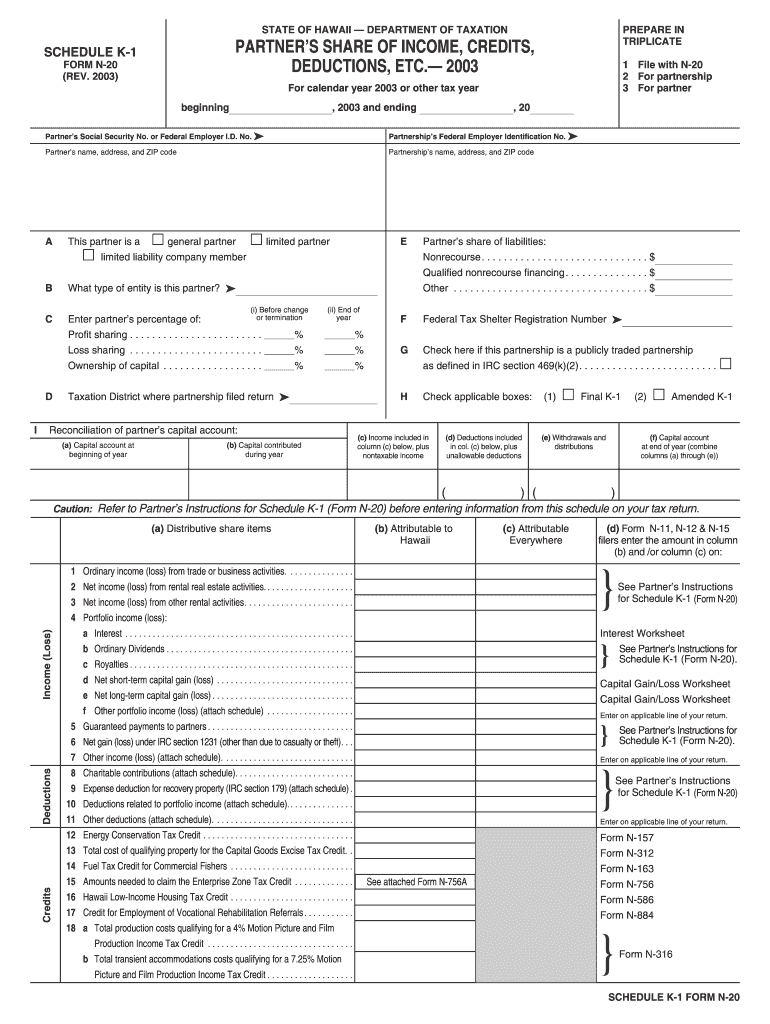

The Schedule K-1 Form N-20 is a tax document used in the United States to report income, deductions, and credits for partners in a partnership. This form provides detailed information about each partner's share of the partnership's income, which is essential for accurate tax reporting. It is typically issued by partnerships to their partners, allowing them to report their income on their individual tax returns. The Schedule K-1 is crucial for ensuring that all income is correctly reported to the Internal Revenue Service (IRS).

Steps to Complete the Schedule K-1 Form N-20

Completing the Schedule K-1 Form N-20 involves several key steps:

- Gather Necessary Information: Collect all relevant financial data from the partnership, including income, deductions, and credits.

- Fill Out the Form: Enter the partner's name, address, and taxpayer identification number. Then, input the partnership's income, deductions, and credits as reported.

- Review for Accuracy: Double-check all entries for accuracy to avoid discrepancies that could lead to issues with the IRS.

- Distribute Copies: Provide a copy of the completed Schedule K-1 to each partner and retain one for the partnership's records.

Legal Use of the Schedule K-1 Form N-20

The Schedule K-1 Form N-20 is legally recognized by the IRS as a valid document for reporting income from partnerships. It must be filled out accurately to ensure compliance with federal tax laws. Partners use this form to report their share of income on their individual tax returns, which is essential for maintaining transparency and legality in tax reporting. Failure to accurately complete and file this form can lead to penalties and interest on unpaid taxes.

Filing Deadlines for the Schedule K-1 Form N-20

Filing deadlines for the Schedule K-1 Form N-20 align with the tax return deadlines for partnerships. Typically, partnerships must provide the Schedule K-1 to partners by March 15 of the following tax year. Partners then use this information to file their individual tax returns by April 15. It is important to adhere to these deadlines to avoid penalties and ensure timely tax reporting.

Who Issues the Schedule K-1 Form N-20?

The Schedule K-1 Form N-20 is issued by partnerships to their partners. Each partner receives a K-1 that details their share of the partnership's income, deductions, and credits. The partnership is responsible for ensuring that the information reported on the K-1 is accurate and complete, as it directly affects the partners' individual tax filings.

Examples of Using the Schedule K-1 Form N-20

Partners in various types of business entities, such as limited liability companies (LLCs) and general partnerships, use the Schedule K-1 Form N-20 to report their income. For instance, if a partner receives a share of $50,000 in income from the partnership, this amount must be reported on their individual tax return using the information provided on the K-1. This ensures that all income is accounted for and taxed appropriately according to IRS regulations.

Quick guide on how to complete schedule k 1 form n 20 partneramp39s share of income formsend

Your assistance manual for preparing your Schedule K 1 Form N 20 Partner's Share Of Income FormSend

If you’re curious about how to generate and submit your Schedule K 1 Form N 20 Partner's Share Of Income FormSend, here are some straightforward guidelines to simplify the tax submission process.

To start, you only need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document management system that enables you to modify, draft, and finalize your income tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, allowing you to revisit and alter information as necessary. Enhance your tax handling with cutting-edge PDF editing, eSigning, and easy sharing options.

Complete the following steps to finalize your Schedule K 1 Form N 20 Partner's Share Of Income FormSend in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Click Obtain form to access your Schedule K 1 Form N 20 Partner's Share Of Income FormSend in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to include your legally-recognized eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Leverage this guide to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper may increase return mistakes and delay refunds. Naturally, before e-filing your taxes, review the IRS website for filing guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 20 partneramp39s share of income formsend

FAQs

-

According to instructions, if you earn less than $1,500, say $15 in interest, you don't have to fill out a Schedule B--if it's ordinary income, where do you put it on the new forms? (I know the government won't give up a penny in tax.)

If you have less than $1500 in interest income, and do not attach Schedule B, you should report your total taxable interest directly on Form 1040, Line 2b.

-

How do you prove that [math]\displaystyle\lim_{n\to\infty}\prod_{k=1}^n\left(1+\frac{10\ln(2)}{n}\right)=1024[/math] without using exponentiation (any form of [math]a^b[/math]) in the proof?

Here is hint or outline.You need to know that e is defined by taking the limit as n approaches infinity of terms [math](1 + 1/n)^n[/math]. Also, [limit of [math]1 + r/n)^n[/math]][math]= e^r[/math].Notice that the only role of k is to use repeated multiplication.Compare given to the limit of [math]P(n) = (1 + 10 ln(2)/n)^n[/math] as n grows. Notice the match to #1 above with understanding rate r = 10 ln(2) here.Recognize r = 10 ln(2) = ln(2^10) = ln(1024) so e^r = e^ln(1024) = 1024.So, original limit equals e^(10 ln(2)) = 1024. QED

-

As a partner in an LLC also hired by it as a contractor, with the LLC reporting all my income on a schedule K-1, what tax forms should I use (Federal and California)? Am I allowed to contribute to a personal SEP IRA as if I were self-employed?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling. And, Treasury does not consider the payments we dicuss below as employee payments (Treasury Regulation Section 1.707–1(c)).Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 20 partneramp39s share of income formsend

How to generate an eSignature for your Schedule K 1 Form N 20 Partneramp39s Share Of Income Formsend in the online mode

How to generate an electronic signature for your Schedule K 1 Form N 20 Partneramp39s Share Of Income Formsend in Google Chrome

How to generate an electronic signature for signing the Schedule K 1 Form N 20 Partneramp39s Share Of Income Formsend in Gmail

How to create an electronic signature for the Schedule K 1 Form N 20 Partneramp39s Share Of Income Formsend right from your smartphone

How to create an electronic signature for the Schedule K 1 Form N 20 Partneramp39s Share Of Income Formsend on iOS

How to create an electronic signature for the Schedule K 1 Form N 20 Partneramp39s Share Of Income Formsend on Android

People also ask

-

What is a Schedule K-1 and why is it important?

A Schedule K-1 is an essential tax document used to report income, deductions, and credits from partnerships, S corporations, or estates. For individuals involved in these entities, understanding your Schedule K-1 is crucial for accurate tax reporting and compliance. airSlate SignNow simplifies this process by providing an easy platform to eSign and manage your K-1 documents securely.

-

How can airSlate SignNow help with eSigning my Schedule K-1?

With airSlate SignNow, you can easily eSign your Schedule K-1 documents without the hassle of printing or scanning. Our platform allows you to sign digitally from anywhere, ensuring that your documents are completed efficiently and securely. This streamlined process is particularly beneficial during tax season when time is of the essence.

-

Is there a cost associated with using airSlate SignNow for Schedule K-1 documents?

Yes, airSlate SignNow offers a pricing model that is both cost-effective and transparent. Our plans are designed to fit various business needs, from small startups to larger enterprises, allowing you to manage and eSign your Schedule K-1 documents without breaking the bank. Check our website for current pricing and package details.

-

Can I integrate airSlate SignNow with my accounting software for Schedule K-1 processing?

Absolutely! airSlate SignNow offers seamless integrations with many popular accounting software solutions. This means you can import your Schedule K-1 data directly for eSigning, saving you time and reducing the risk of errors. Check our integrations page to see all compatible applications.

-

What are the benefits of using airSlate SignNow for Schedule K-1 document management?

Using airSlate SignNow for your Schedule K-1 document management offers various benefits including efficiency, security, and accessibility. You can sign, send, and track your documents in real-time, reducing paperwork and improving workflow. Our platform also ensures that your sensitive information remains protected throughout the signing process.

-

How secure is my information when using airSlate SignNow for Schedule K-1 forms?

Security is a top priority at airSlate SignNow. Our platform employs industry-leading encryption and security protocols to protect your Schedule K-1 forms and personal information. You can trust that your data is safe while you eSign and manage your documents from anywhere.

-

Can multiple users collaborate on a Schedule K-1 document using airSlate SignNow?

Yes! airSlate SignNow allows multiple users to collaborate on a Schedule K-1 document, making it easy for teams to work together. You can invite colleagues to review or sign the document, and track changes in real-time for improved collaboration and efficiency.

Get more for Schedule K 1 Form N 20 Partner's Share Of Income FormSend

- Governing law and forum selection form

- Verified petition and exhibits new york state attorney general form

- Appellate division first department new york law journal form

- Arbitration under chapter 11 of the north american free trade form

- 1 in the matter of an arbitration italaw form

- Exhaustion of adminstrative remedies in illinois the state form

- Blonder tongue laboratories inc form 8 k received 0316

- Form 424b2 credit suisse ag

Find out other Schedule K 1 Form N 20 Partner's Share Of Income FormSend

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now