Form N 35, Rev , S Corporation Income Tax Return FormSend 2006

What is the Form N 35, Rev , S Corporation Income Tax Return FormSend

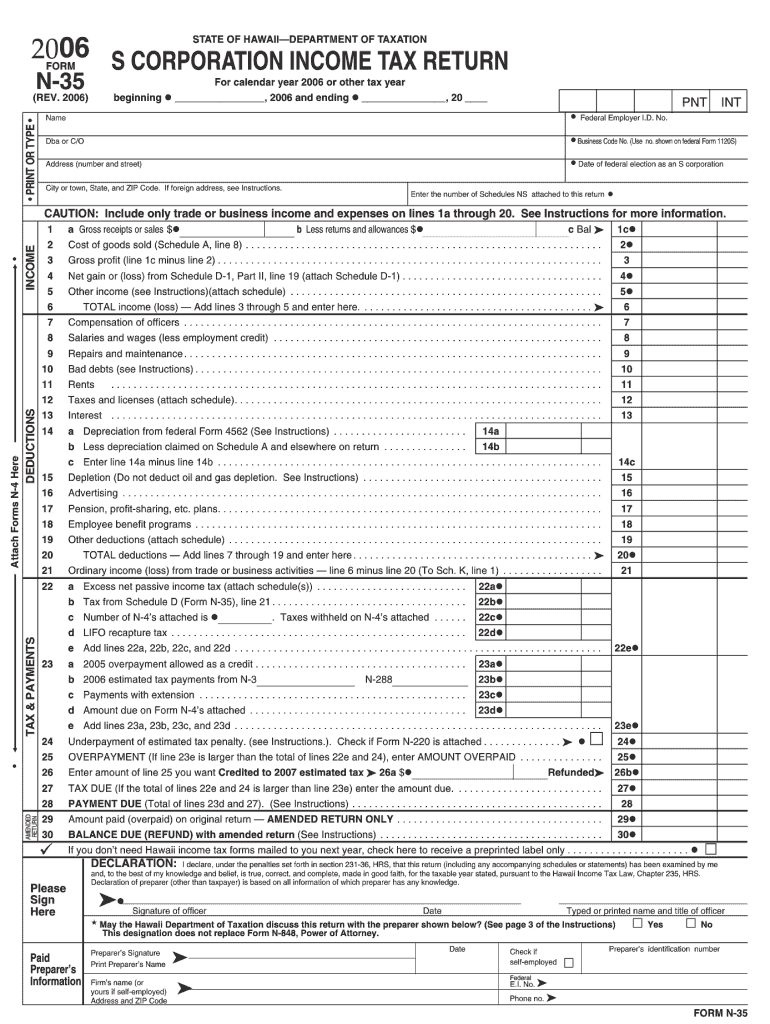

The Form N 35, Rev , S Corporation Income Tax Return FormSend is a tax document specifically designed for S corporations in the United States. This form is utilized to report the income, deductions, and credits of an S corporation. It is essential for ensuring compliance with federal tax regulations and provides a clear overview of the corporation's financial activities for the tax year. The form must be accurately completed and submitted to the Internal Revenue Service (IRS) to avoid penalties and ensure proper tax reporting.

How to use the Form N 35, Rev , S Corporation Income Tax Return FormSend

Using the Form N 35, Rev , S Corporation Income Tax Return FormSend involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, access the form through the IRS website or a trusted tax software platform. Fill in the required fields with accurate information, ensuring that all calculations are correct. Once completed, review the form for any errors before submitting it electronically or via mail. Utilizing an eSignature solution can streamline the signing process, making it easier to submit the form on time.

Steps to complete the Form N 35, Rev , S Corporation Income Tax Return FormSend

Completing the Form N 35, Rev , S Corporation Income Tax Return FormSend involves a systematic approach:

- Gather all financial records, including income, expenses, and deductions.

- Download or access the form from the IRS website.

- Fill in the corporation's name, address, and Employer Identification Number (EIN).

- Report income and deductions in the appropriate sections of the form.

- Calculate the total tax liability based on the reported figures.

- Review the form for accuracy and completeness.

- Sign the form electronically or manually, depending on submission method.

- Submit the form by the designated deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form N 35, Rev , S Corporation Income Tax Return FormSend. Typically, the form must be filed on or before the fifteenth day of the third month following the end of the tax year. For S corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Timely filing helps avoid penalties and ensures compliance with IRS regulations.

Required Documents

To successfully complete the Form N 35, Rev , S Corporation Income Tax Return FormSend, several documents are required:

- Income statements that detail revenue generated by the corporation.

- Expense records, including receipts and invoices for deductions.

- Balance sheets showing the corporation's financial position.

- Previous year’s tax return for reference.

- Any additional documentation that supports claims made on the form.

Legal use of the Form N 35, Rev , S Corporation Income Tax Return FormSend

The legal use of the Form N 35, Rev , S Corporation Income Tax Return FormSend is governed by IRS regulations. It is essential for S corporations to file this form to report their income and comply with federal tax laws. Failure to file or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes. Therefore, it is important for corporations to ensure that all information is accurate and complete, reflecting their financial activities for the tax year.

Quick guide on how to complete form n 35 rev 2006 s corporation income tax return formsend

Your assistance manual on how to prepare your Form N 35, Rev , S Corporation Income Tax Return FormSend

If you’re looking to learn how to generate and submit your Form N 35, Rev , S Corporation Income Tax Return FormSend, here are a few straightforward instructions on how to make tax filing more manageable.

To begin, you just need to create your airSlate SignNow account to transform the way you handle documents online. airSlate SignNow is a highly intuitive and robust document solution that allows you to modify, draft, and finalize your income tax forms with ease. Utilizing its editor, you can alternate between text, checkboxes, and electronic signatures and revisit to amend information as required. Streamline your tax handling with enhanced PDF editing, eSigning, and easy sharing options.

Follow the steps below to complete your Form N 35, Rev , S Corporation Income Tax Return FormSend in mere minutes:

- Set up your account and start working on PDFs within moments.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Form N 35, Rev , S Corporation Income Tax Return FormSend in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it onto your device.

Refer to this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to increased return errors and delayed refunds. Furthermore, before e-filing your taxes, consult the IRS website for the submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 35 rev 2006 s corporation income tax return formsend

Create this form in 5 minutes!

How to create an eSignature for the form n 35 rev 2006 s corporation income tax return formsend

How to create an electronic signature for your Form N 35 Rev 2006 S Corporation Income Tax Return Formsend in the online mode

How to generate an electronic signature for your Form N 35 Rev 2006 S Corporation Income Tax Return Formsend in Google Chrome

How to make an eSignature for signing the Form N 35 Rev 2006 S Corporation Income Tax Return Formsend in Gmail

How to create an eSignature for the Form N 35 Rev 2006 S Corporation Income Tax Return Formsend straight from your mobile device

How to create an electronic signature for the Form N 35 Rev 2006 S Corporation Income Tax Return Formsend on iOS devices

How to create an electronic signature for the Form N 35 Rev 2006 S Corporation Income Tax Return Formsend on Android

People also ask

-

What is Form N 35, Rev , S Corporation Income Tax Return FormSend?

Form N 35, Rev , S Corporation Income Tax Return FormSend is a specialized form used by S corporations in Hawaii to report income, deductions, and taxes owed. This form ensures compliance with state tax regulations and helps streamline the filing process through electronic submission.

-

How can airSlate SignNow help me with Form N 35, Rev , S Corporation Income Tax Return FormSend?

airSlate SignNow offers an efficient platform that allows you to prepare, send, and eSign your Form N 35, Rev , S Corporation Income Tax Return FormSend seamlessly. With our user-friendly interface, you can easily manage your tax documents and ensure timely submissions.

-

Is there a cost associated with using airSlate SignNow for Form N 35, Rev , S Corporation Income Tax Return FormSend?

Yes, airSlate SignNow provides various pricing plans designed to meet different business needs, including options for handling Form N 35, Rev , S Corporation Income Tax Return FormSend. You can choose a plan based on your frequency of use and the number of users in your organization.

-

What features does airSlate SignNow offer for managing Form N 35, Rev , S Corporation Income Tax Return FormSend?

airSlate SignNow offers a variety of features that enhance the management of Form N 35, Rev , S Corporation Income Tax Return FormSend, including automated templates, eSignature capabilities, and cloud storage. These features help simplify the filing process and improve document organization.

-

Can I integrate airSlate SignNow with other accounting software for Form N 35, Rev , S Corporation Income Tax Return FormSend?

Yes, airSlate SignNow supports integrations with various accounting and tax software, allowing you to manage Form N 35, Rev , S Corporation Income Tax Return FormSend alongside your existing tools. This integration ensures a smooth workflow and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for Form N 35, Rev , S Corporation Income Tax Return FormSend?

Using airSlate SignNow for your Form N 35, Rev , S Corporation Income Tax Return FormSend offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. By digitizing your tax documents, you can save time and focus on your core business activities.

-

Is it easy to eSign Form N 35, Rev , S Corporation Income Tax Return FormSend with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign your Form N 35, Rev , S Corporation Income Tax Return FormSend. With just a few clicks, you can send your form for signatures, track its status, and ensure that all parties have signed promptly.

Get more for Form N 35, Rev , S Corporation Income Tax Return FormSend

- An analytical approach to drafting assignments smu scholar form

- Exv10w41 secgov form

- Silica sand lease and mining agreement dated as secgov form

- Knox v shell western e p inc 531 so 2d 1181casetext form

- What a grantee is in real estate the balance form

- Bizarre clauses in term royalty deed ownership and title form

- A partition deed fails in texasenergy ampamp the law form

- Deed of trust assignment of leases and rents security form

Find out other Form N 35, Rev , S Corporation Income Tax Return FormSend

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile