About Form 2441, Child and Dependent Care ExpensesAbout Form 2441, Child and Dependent Care ExpensesInstructions for Form 2441 I 2022

Understanding Form 2441: Child and Dependent Care Expenses

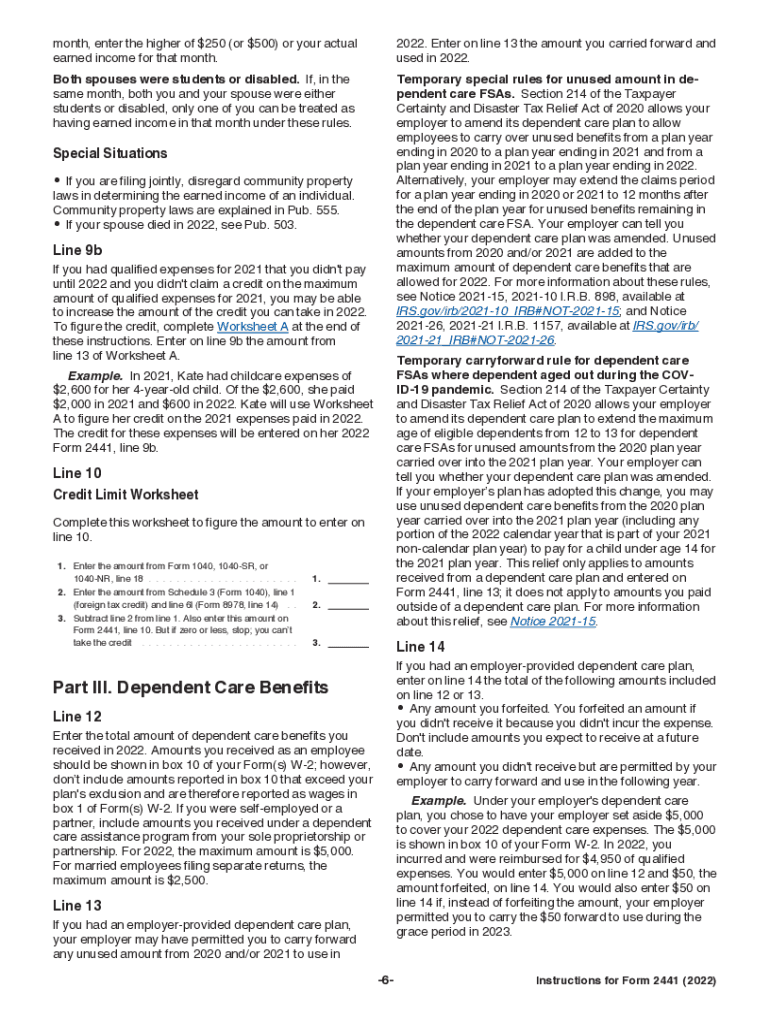

Form 2441 is a tax form used by taxpayers in the United States to claim the Child and Dependent Care Credit. This credit helps offset the costs of care for children under the age of thirteen or for dependents who are physically or mentally incapable of self-care. The form requires detailed information about the care provider, the expenses incurred, and the taxpayer's eligibility for the credit. By accurately completing Form 2441, taxpayers can potentially reduce their tax liability significantly.

Steps to Complete Form 2441

Completing Form 2441 involves several key steps to ensure accuracy and compliance with IRS guidelines:

- Gather necessary documentation, including receipts for child care expenses and the care provider's information.

- Fill out your personal information at the top of the form, including your filing status and the number of qualifying persons.

- Detail the care expenses in the designated section, providing the name, address, and taxpayer identification number of the care provider.

- Calculate the credit based on your total expenses and the applicable percentage, as outlined in the IRS instructions.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Form 2441

To qualify for the Child and Dependent Care Credit using Form 2441, taxpayers must meet specific eligibility requirements:

- The care must be provided for a child under the age of thirteen or a dependent who cannot care for themselves.

- Both parents (if married) must be working or actively seeking employment during the time care is provided.

- Expenses must be incurred for care provided so that the taxpayer can work or look for work.

- The care provider must be identified and cannot be a relative of the taxpayer.

Required Documents for Form 2441

When filling out Form 2441, taxpayers should have the following documents ready:

- Receipts or statements from the care provider detailing the amounts paid.

- The care provider's name, address, and taxpayer identification number.

- Proof of employment or job search efforts, if necessary.

IRS Guidelines for Form 2441

The IRS provides specific guidelines to ensure that Form 2441 is completed correctly. Taxpayers should refer to the latest IRS instructions for detailed information on eligibility, calculation of the credit, and submission procedures. These guidelines help ensure compliance with tax laws and maximize potential credits.

Filing Deadlines for Form 2441

Form 2441 must be filed along with the taxpayer's annual income tax return. The standard deadline for filing is April fifteenth of the following year. If taxpayers require additional time, they may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete about form 2441 child and dependent care expensesabout form 2441 child and dependent care expensesinstructions for form 2441

Effortlessly Prepare About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care ExpensesInstructions For Form 2441 I on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any holdups. Manage About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care ExpensesInstructions For Form 2441 I on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care ExpensesInstructions For Form 2441 I Seamlessly

- Obtain About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care ExpensesInstructions For Form 2441 I and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal value as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care ExpensesInstructions For Form 2441 I to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 2441 child and dependent care expensesabout form 2441 child and dependent care expensesinstructions for form 2441

Create this form in 5 minutes!

How to create an eSignature for the about form 2441 child and dependent care expensesabout form 2441 child and dependent care expensesinstructions for form 2441

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2441 and why is it important for tax filing?

Form 2441 is used to claim the Child and Dependent Care Expenses Credit on your tax return. It is crucial for those who pay for child care or care for a disabled dependent while they work or look for work. Understanding what is form 2441 helps you maximize your tax benefits and ensure you're filing correctly.

-

How can airSlate SignNow assist with the completion of form 2441?

airSlate SignNow can streamline the process of completing form 2441 by allowing you to create, fill out, and eSign documents securely. With intuitive templates and easy access to documents, airSlate SignNow makes it simple to manage all necessary paperwork. Knowing what is form 2441 helps you utilize our eSigning capabilities effectively.

-

Is airSlate SignNow affordable for small businesses needing to file form 2441?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses. Our pricing structure is designed to accommodate various needs, ensuring that even small businesses can efficiently handle form 2441 and other documents without breaking the bank. It's an essential tool for managing expenses related to your tax credits.

-

What features does airSlate SignNow provide for managing form 2441?

airSlate SignNow provides features such as customizable templates, electronic signatures, and document tracking, which streamline the management of form 2441. These features ensure you can create accurate documents, track changes, and maintain compliance with tax regulations. Understanding what is form 2441 is easier with our integrated tools.

-

Can I integrate airSlate SignNow with my accounting software for form 2441?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your ability to file form 2441 efficiently. This integration allows you to import and export data easily, making tax preparation a breeze. It's a perfect solution for streamlining your tax filing process.

-

How does using airSlate SignNow improve the efficiency of filing form 2441?

Using airSlate SignNow signNowly improves the efficiency of filing form 2441 by simplifying the documentation process. With features like templates and automated reminders, you can keep track of deadlines and ensure that all necessary information is gathered before submission. This efficiency can save valuable time during tax season.

-

What should I consider when preparing to file form 2441 with airSlate SignNow?

When preparing to file form 2441 with airSlate SignNow, consider gathering all required information, such as expenses incurred for child care or dependent care. Familiarizing yourself with what is form 2441 will also help you understand eligibility requirements and ensure you meet them. Proper preparation leads to accurate and timely submissions.

Get more for About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care ExpensesInstructions For Form 2441 I

- Rubrics for seminar evaluation form

- Csi form 12 1a pdf

- Aramex authorization letter form

- Pay gov billing worksheet form

- Foil request form pdf

- Fee 15 00 department of agriculture and markets ny gov form

- Certified nursing assistant skills checklist lnt staffing llc form

- Vendor managed inventory materials storage agreement october 24 1docx form

Find out other About Form 2441, Child And Dependent Care ExpensesAbout Form 2441, Child And Dependent Care ExpensesInstructions For Form 2441 I

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile