Employee's Withholding Certificate Federal & State 2023

Understanding the Maryland W-4 Withholding Form

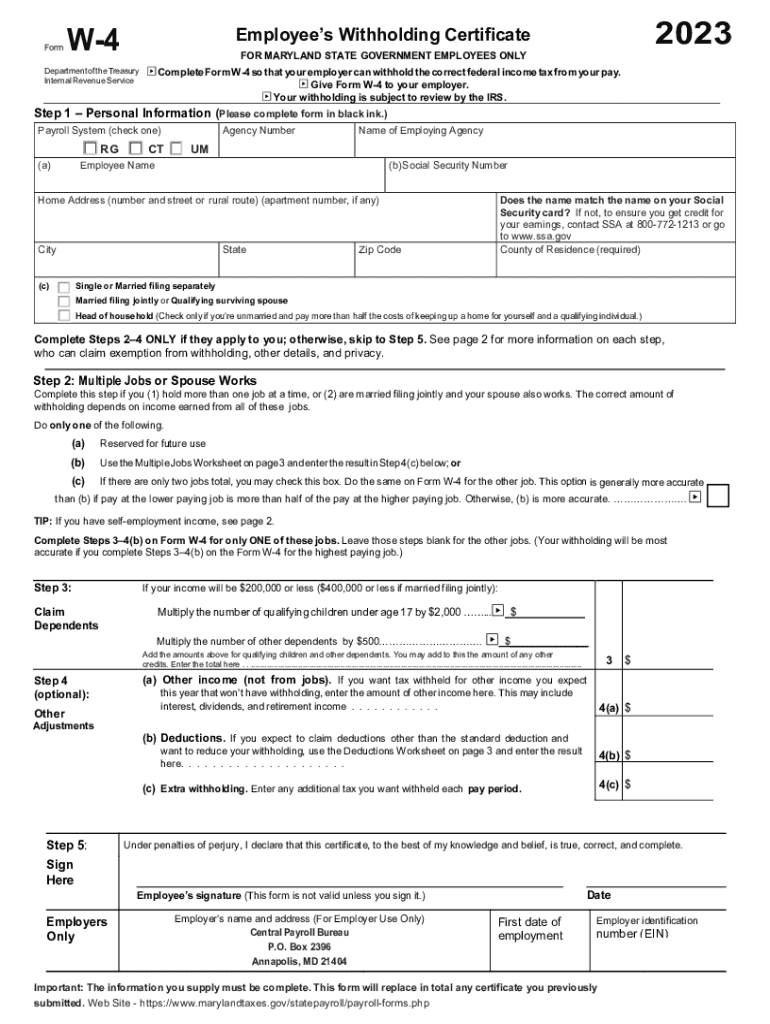

The Maryland W-4 withholding form, officially known as the Maryland Employee's Withholding Certificate, is essential for employees to communicate their tax withholding preferences to their employers. This form determines the amount of state income tax that will be withheld from an employee's paycheck. It is crucial for ensuring that the correct amount of taxes is paid throughout the year, helping to avoid underpayment penalties or large tax bills at year-end.

Steps to Complete the Maryland W-4 Withholding Form

Filling out the Maryland W-4 withholding form involves several key steps:

- Personal Information: Begin by entering your full name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household, as this affects your withholding rate.

- Allowances: Calculate the number of allowances you are claiming. More allowances typically mean less tax withheld.

- Additional Withholding: If you wish to have an additional amount withheld from each paycheck, specify that amount in the designated section.

- Signature: Finally, sign and date the form to validate your submission.

Legal Use of the Maryland W-4 Withholding Form

The Maryland W-4 withholding form is legally binding once signed and submitted to your employer. It complies with state tax regulations, ensuring that your employer withholds the appropriate amount of state income tax from your wages. It is important to keep your information updated, especially if there are changes in your personal or financial situation, such as marriage, divorce, or changes in dependents.

Filing Deadlines for the Maryland W-4 Withholding Form

There are no specific deadlines for submitting the Maryland W-4 withholding form, but it is advisable to complete it as soon as you start a new job or experience a significant life change. Updating your form promptly ensures that your employer withholds the correct amount of taxes from your paychecks, helping you avoid any tax liabilities at the end of the year.

Form Submission Methods for the Maryland W-4 Withholding Form

The Maryland W-4 withholding form can be submitted to your employer in several ways:

- In-Person: Hand the completed form directly to your employer's payroll department.

- Mail: If your employer allows it, you can mail the form to their payroll office.

- Digital Submission: Many employers now accept electronic submissions of the W-4 form, allowing you to fill it out and send it via email or through a secure employee portal.

Key Elements of the Maryland W-4 Withholding Form

Understanding the key elements of the Maryland W-4 withholding form is crucial for accurate completion. The form includes sections for personal information, filing status, number of allowances, additional withholding amounts, and a signature line. Each of these components plays a vital role in determining the correct amount of state income tax withheld from your paycheck, which can significantly impact your overall tax liability.

Quick guide on how to complete employees withholding certificate federal ampamp state

Prepare Employee's Withholding Certificate Federal & State seamlessly on any device

Online document management has become increasingly popular with organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and store it securely online. airSlate SignNow provides all the features you require to create, edit, and eSign your files rapidly without delays. Manage Employee's Withholding Certificate Federal & State on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Employee's Withholding Certificate Federal & State effortlessly

- Obtain Employee's Withholding Certificate Federal & State and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Alter and eSign Employee's Withholding Certificate Federal & State and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employees withholding certificate federal ampamp state

Create this form in 5 minutes!

How to create an eSignature for the employees withholding certificate federal ampamp state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Maryland W4 withholding form?

The Maryland W4 withholding form is used by employees in Maryland to determine the amount of state income tax that should be withheld from their paychecks. By accurately completing this form, employees can ensure that they are meeting their tax obligations without overpaying or underpaying. The right withholding can help in managing finances throughout the year and prevent surprises during tax season.

-

How can airSlate SignNow help with managing the Maryland W4 withholding process?

airSlate SignNow offers a streamlined solution for managing the Maryland W4 withholding process by enabling easy electronic signing and document management. With our platform, businesses can quickly send the W4 form to employees for e-signature, ensuring faster completion and compliance. This not only enhances efficiency but also saves time and reduces paperwork.

-

Is there a cost associated with using airSlate SignNow for Maryland W4 withholding?

Yes, airSlate SignNow has various pricing plans tailored to meet the needs of small to large businesses. The cost-effective solution allows organizations to manage their Maryland W4 withholding and other document signing needs without incurring excessive expenses. Pricing varies based on features and the number of users, ensuring that businesses only pay for what they need.

-

What features does airSlate SignNow offer for handling Maryland W4 withholding forms?

airSlate SignNow provides a range of features that facilitate the handling of Maryland W4 withholding forms, including customizable templates, audit trails, and secure cloud storage. These features help ensure compliance with state regulations while providing a user-friendly experience for both employers and employees. Additionally, users can integrate with existing HR and payroll systems to streamline the process.

-

Can airSlate SignNow integrate with payroll systems for Maryland W4 withholding?

Absolutely! airSlate SignNow offers seamless integrations with various payroll systems, making it easier for businesses to manage Maryland W4 withholding. This integration ensures that once the W4 forms are signed, the relevant data is transferred directly to the payroll system, enhancing accuracy and reducing administrative burdens.

-

What are the benefits of using airSlate SignNow for Maryland W4 withholding?

Using airSlate SignNow for Maryland W4 withholding provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced compliance. The platform allows for easy e-signing, which signNowly speeds up the process of collecting necessary tax information from employees. Ultimately, it helps businesses maintain accurate records and streamline their HR processes.

-

How secure is the airSlate SignNow platform for handling sensitive information like Maryland W4 withholding forms?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and secure cloud storage to protect sensitive information such as Maryland W4 withholding forms. Additionally, comprehensive audit trails ensure that all actions taken on documents are tracked, further enhancing the security and integrity of sensitive employee data.

Get more for Employee's Withholding Certificate Federal & State

Find out other Employee's Withholding Certificate Federal & State

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter