W 4 Withholding Form 2022

What is the W-4 Withholding Form

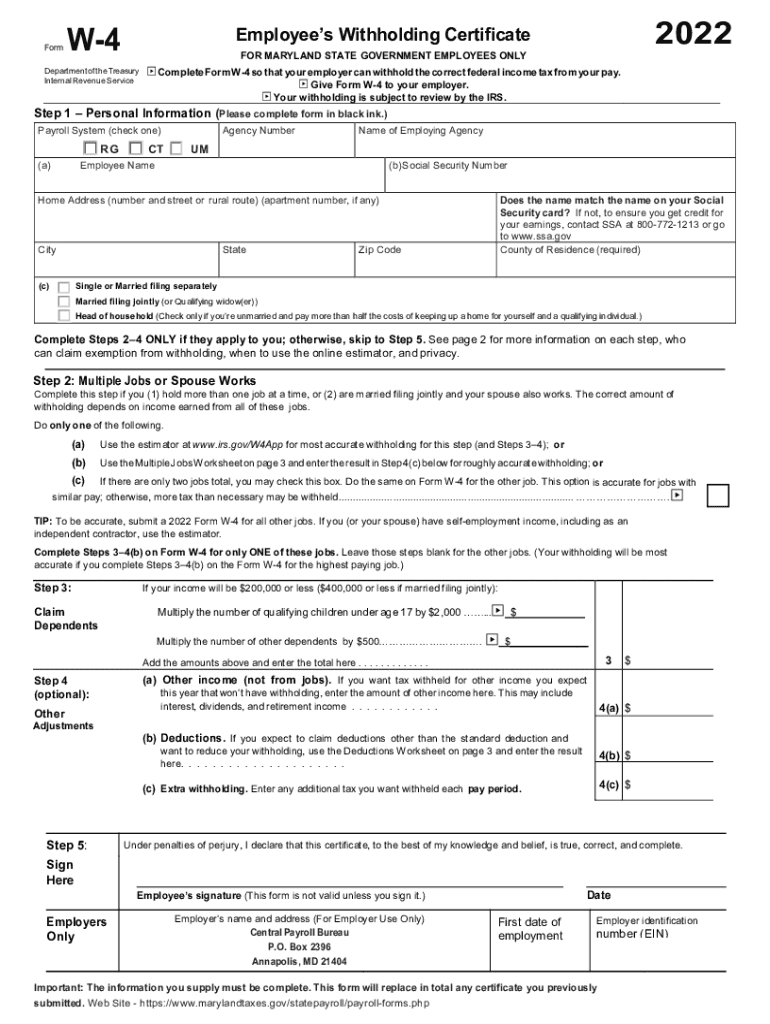

The W-4 withholding form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employers about their tax situation. This form helps determine the amount of federal income tax to withhold from an employee's paycheck. By accurately completing the W-4, employees can ensure that they pay the correct amount of taxes throughout the year, which can help avoid owing a large sum at tax time or receiving an unnecessarily large refund.

How to use the W-4 Withholding Form

Using the W-4 withholding form involves a few straightforward steps. First, employees should obtain the form from their employer or download it from the IRS website. Next, they need to fill out personal information, including their name, address, and Social Security number. Employees will also indicate their filing status and any additional adjustments they wish to make based on their financial situation, such as claiming dependents or additional income. Once completed, the form should be submitted to the employer, who will then use the information to calculate the appropriate withholding amount.

Steps to complete the W-4 Withholding Form

Completing the W-4 form involves several key steps:

- Begin by entering your personal information, including your full name, address, and Social Security number.

- Choose your filing status: single, married filing jointly, married filing separately, or head of household.

- Complete the section for dependents if applicable, which allows you to claim tax credits for qualifying children or other dependents.

- Consider any additional income or deductions that may affect your withholding and fill out the relevant sections.

- Sign and date the form before submitting it to your employer.

Legal use of the W-4 Withholding Form

The W-4 withholding form is legally binding when completed and submitted correctly. Employers are required to use the information provided on the form to determine the appropriate amount of federal income tax to withhold from employees' paychecks. It is essential for employees to provide accurate information to avoid potential legal issues, such as underpayment of taxes, which could result in penalties or interest charges from the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing the W-4 form to ensure compliance with federal tax laws. Employees are encouraged to review these guidelines to understand how their tax situation may affect their withholding. The IRS also updates the W-4 form periodically, so it is important for employees to use the most current version. Additionally, the IRS offers a withholding calculator on its website to help individuals determine the correct amount of withholding based on their unique financial circumstances.

Form Submission Methods

Employees can submit the W-4 withholding form to their employer through various methods. The most common method is to hand in a printed copy of the completed form directly to the payroll or human resources department. Alternatively, some employers may allow electronic submission of the form through their internal systems. It is important for employees to confirm the submission method preferred by their employer to ensure timely processing of their withholding information.

Quick guide on how to complete w 4 withholding form

Effortlessly Prepare W 4 Withholding Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed papers, enabling you to access the required form and securely keep it online. airSlate SignNow equips you with all necessary tools to create, alter, and electronically sign your documents quickly and without delays. Manage W 4 Withholding Form across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign W 4 Withholding Form with Ease

- Find W 4 Withholding Form and click Get Form to begin.

- Utilize the provided tools to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign W 4 Withholding Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 4 withholding form

Create this form in 5 minutes!

People also ask

-

What is the process for w4 employees print using airSlate SignNow?

To w4 employees print, simply upload your W4 document to airSlate SignNow. Our platform allows you to customize and eSign your documents electronically, ensuring that you can print them easily once completed. This streamlines the process for your employees and saves time.

-

Is airSlate SignNow suitable for handling multiple w4 employees print requests?

Yes, airSlate SignNow is designed to efficiently manage multiple w4 employees print requests. Our platform supports batch signing, which means you can send out several W4 documents to employees simultaneously, facilitating a faster workflow. This feature is especially beneficial during peak hiring seasons.

-

What are the pricing options for using airSlate SignNow for w4 employees print?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options for unlimited document signing and printing. By selecting a plan that includes features like w4 employees print, you can maximize your ROI while ensuring compliance and efficiency. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other HR software for w4 employees print?

Absolutely! airSlate SignNow easily integrates with various HR software platforms, allowing you to manage w4 employees print alongside your other HR processes. This integration ensures that all data is seamlessly transferred and helps maintain organized employee records.

-

What benefits does airSlate SignNow offer for w4 employees print compared to traditional methods?

Using airSlate SignNow for w4 employees print enhances convenience and efficiency. With electronic signatures, your employees can complete and submit W4 forms from anywhere, reducing paperwork and processing time. This transition not only improves employee experience but also helps your business save resources.

-

Is there a mobile app for completing w4 employees print with airSlate SignNow?

Yes, airSlate SignNow has an intuitive mobile app that allows users to print and sign W4 documents on the go. This feature is perfect for remote workers or those who travel frequently, ensuring that employees can easily manage their W4 forms anytime and anywhere.

-

How secure is the information when I w4 employees print using airSlate SignNow?

Security is our top priority at airSlate SignNow. When you w4 employees print documents, all data is encrypted and stored securely. This ensures that sensitive information related to your employees’ tax forms is protected against unauthorized access.

Get more for W 4 Withholding Form

Find out other W 4 Withholding Form

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo