Inactive PA Corporate Net Income Report RCT 101 I 2022

What is the Inactive PA Corporate Net Income Report RCT 101 I

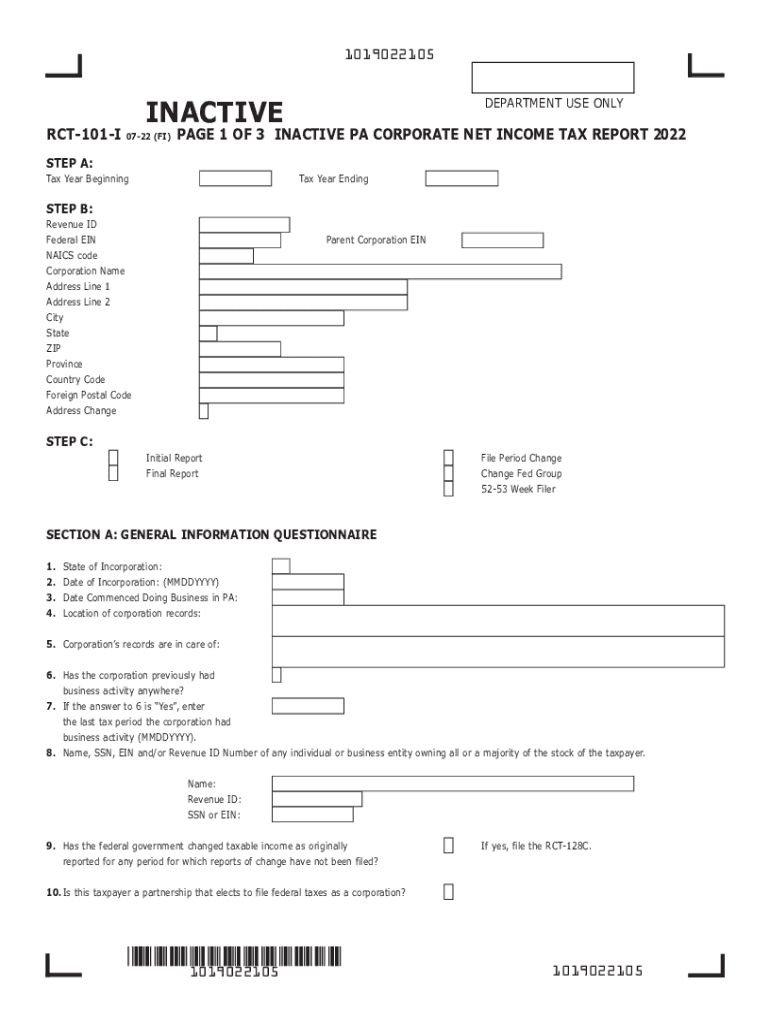

The Inactive PA Corporate Net Income Report RCT 101 I is a tax form used by corporations in Pennsylvania that are inactive for the tax year. This form allows these entities to officially report their status to the Pennsylvania Department of Revenue. It is crucial for maintaining compliance with state regulations, even if the corporation has not conducted any business activities during the reporting period. Filing this form helps avoid penalties and ensures that the corporation remains in good standing.

Steps to complete the Inactive PA Corporate Net Income Report RCT 101 I

Completing the RCT 101 I involves several key steps:

- Gather necessary information about the corporation, including its legal name, address, and Employer Identification Number (EIN).

- Indicate the tax year for which the report is being filed.

- Provide details confirming the corporation's inactive status, including any relevant documentation if required.

- Review the completed form for accuracy before submission.

- Submit the form either electronically or via mail, depending on the chosen submission method.

Legal use of the Inactive PA Corporate Net Income Report RCT 101 I

The RCT 101 I is legally recognized as a valid document for reporting the status of inactive corporations in Pennsylvania. It must be completed accurately to fulfill state requirements. Proper filing ensures that the corporation is not subject to unnecessary taxes or penalties associated with non-compliance. By submitting this form, corporations can maintain their legal standing and avoid complications with the Pennsylvania Department of Revenue.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Inactive PA Corporate Net Income Report RCT 101 I to avoid penalties. Generally, the form must be filed by the 15th day of the fourth month following the end of the tax year. For example, if the tax year ends on December 31, the form is due by April 15 of the following year. Staying informed about these deadlines helps ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The RCT 101 I can be submitted through various methods, providing flexibility for corporations. Options include:

- Online Submission: Corporations can file electronically through the Pennsylvania Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address specified by the Department of Revenue.

- In-Person: Corporations may also deliver the form in person at designated state offices.

Key elements of the Inactive PA Corporate Net Income Report RCT 101 I

Understanding the key elements of the RCT 101 I is crucial for accurate completion. Important components include:

- Entity Information: This includes the corporation's name, address, and EIN.

- Tax Year: The specific year for which the corporation is reporting its inactive status.

- Confirmation of Inactive Status: A declaration that the corporation has not engaged in business activities during the tax year.

Quick guide on how to complete 2022 inactive pa corporate net income report rct 101 i

Effortlessly prepare Inactive PA Corporate Net Income Report RCT 101 I on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage Inactive PA Corporate Net Income Report RCT 101 I on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related operations today.

Simplest method to edit and eSign Inactive PA Corporate Net Income Report RCT 101 I with ease

- Obtain Inactive PA Corporate Net Income Report RCT 101 I and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Inactive PA Corporate Net Income Report RCT 101 I and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 inactive pa corporate net income report rct 101 i

Create this form in 5 minutes!

How to create an eSignature for the 2022 inactive pa corporate net income report rct 101 i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rct101i tax and how does it affect my business?

The rct101i tax is a tax form required for various businesses to report their income and expenses. Understanding this form is essential as it impacts your tax obligations and can affect your overall financial planning. Utilizing tools like airSlate SignNow can help streamline the document management process related to the rct101i tax.

-

How can airSlate SignNow help me manage my rct101i tax documents?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your rct101i tax documents securely. This solution not only simplifies the documentation process but also ensures compliance with state regulations. You can easily track the status of your tax forms in real-time, ensuring timely submissions.

-

What are the pricing options for airSlate SignNow regarding rct101i tax features?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs, including features for handling rct101i tax documents. Whether you're a small business or a larger enterprise, you can find a suitable plan that fits your budget. Our affordable solutions help you save time and money when managing tax-related tasks.

-

Is airSlate SignNow compliant with the latest regulations for rct101i tax?

Yes, airSlate SignNow is committed to compliance with the latest state and federal regulations, including those related to the rct101i tax. Our platform regularly updates to ensure that all functionalities meet legal requirements for electronic signatures and document management. This way, you can confidently manage your tax forms.

-

What integrations does airSlate SignNow offer for managing rct101i tax documents?

airSlate SignNow integrates seamlessly with various accounting and tax software solutions, facilitating the easy management of rct101i tax documents. These integrations enhance your workflow by allowing you to pull in necessary data directly from your existing systems. This streamlined process saves you time and minimizes errors.

-

Can airSlate SignNow help with the eSigning of rct101i tax documents?

Absolutely! airSlate SignNow is designed to make eSigning easy and secure for all your rct101i tax documents. Users can send forms for signature, track the signing process, and receive notifications once the document is fully signed, ensuring a hassle-free experience.

-

What are the key benefits of using airSlate SignNow for rct101i tax management?

Using airSlate SignNow for rct101i tax management offers numerous benefits, including enhanced efficiency, cost savings, and improved compliance. Our platform reduces the time needed for document handling and eliminates the risk of human error in tax filing. Additionally, the secure storage options help protect sensitive financial information.

Get more for Inactive PA Corporate Net Income Report RCT 101 I

Find out other Inactive PA Corporate Net Income Report RCT 101 I

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile