Inactive PA Corporate Net Income Report RCT 101 I FormsPublications 2021

Understanding the Inactive PA Corporate Net Income Report RCT 101 I

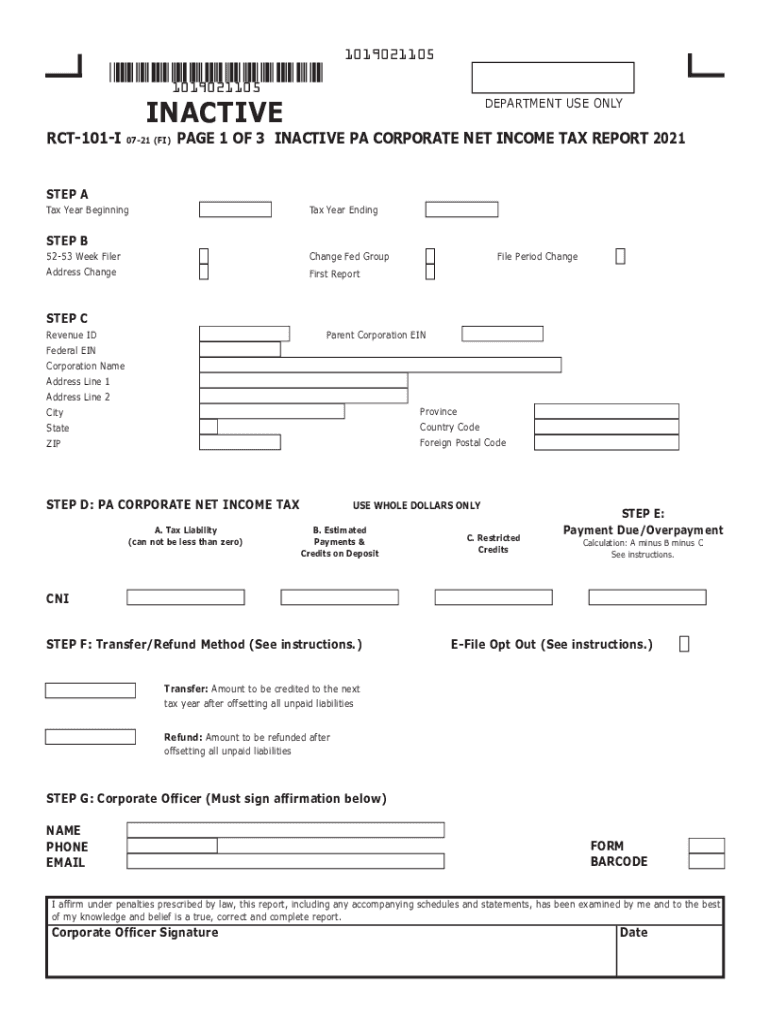

The Inactive PA Corporate Net Income Report RCT 101 I is a tax form used by corporations in Pennsylvania that are not actively conducting business. This form is essential for reporting income and ensuring compliance with state tax regulations, even for inactive entities. It allows the Pennsylvania Department of Revenue to maintain accurate records of corporate entities and their tax obligations.

Steps to Complete the Inactive PA Corporate Net Income Report RCT 101 I

Filling out the RCT 101 I form involves several key steps:

- Gather necessary information about the corporation, including its legal name, address, and federal employer identification number (EIN).

- Determine the reporting period for which the form is being submitted.

- Complete the form with accurate financial information, even if the corporation had no income during the reporting period.

- Review the form for accuracy and completeness before submission.

- Submit the form either online or via mail, ensuring it is sent to the appropriate Pennsylvania Department of Revenue address.

Legal Use of the Inactive PA Corporate Net Income Report RCT 101 I

The RCT 101 I form serves a legal purpose by documenting the status of a corporation's income in Pennsylvania. Filing this form is required by law for all corporations, including those that are inactive, to avoid penalties. Compliance with this requirement helps maintain good standing with the state and ensures that the corporation is not subject to unnecessary fines or legal issues.

Filing Deadlines for the Inactive PA Corporate Net Income Report RCT 101 I

It is crucial to be aware of the filing deadlines for the RCT 101 I form to avoid penalties. The form is typically due on the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations using a calendar year, this means the form is due by April 15. Timely submission is essential to maintain compliance and avoid any late fees.

Form Submission Methods for the Inactive PA Corporate Net Income Report RCT 101 I

The RCT 101 I form can be submitted through various methods:

- Online: Corporations can file electronically through the Pennsylvania Department of Revenue's e-Services portal.

- Mail: The completed form can be sent to the appropriate address provided by the Pennsylvania Department of Revenue.

- In-Person: Corporations may also choose to submit the form in person at designated Pennsylvania Department of Revenue offices.

Key Elements of the Inactive PA Corporate Net Income Report RCT 101 I

Understanding the key elements of the RCT 101 I form is vital for accurate completion. Important sections include:

- Entity Information: This section requires the corporation's name, address, and EIN.

- Income Reporting: Even if the corporation is inactive, it must report any income received during the period.

- Signature and Certification: An authorized representative must sign the form, certifying that the information provided is accurate and complete.

Quick guide on how to complete 2021 inactive pa corporate net income report rct 101 i formspublications

Effortlessly prepare Inactive PA Corporate Net Income Report RCT 101 I FormsPublications on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documentation, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to generate, modify, and electronically sign your documents swiftly without unnecessary delays. Manage Inactive PA Corporate Net Income Report RCT 101 I FormsPublications on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

Easily edit and electronically sign Inactive PA Corporate Net Income Report RCT 101 I FormsPublications

- Obtain Inactive PA Corporate Net Income Report RCT 101 I FormsPublications and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or conceal sensitive data using the tools that airSlate SignNow provides for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Inactive PA Corporate Net Income Report RCT 101 I FormsPublications and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 inactive pa corporate net income report rct 101 i formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2021 inactive pa corporate net income report rct 101 i formspublications

The way to make an e-signature for your PDF file online

The way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is rct 101 i and how does it work?

The rct 101 i is an innovative solution offered by airSlate SignNow that allows businesses to easily send and eSign documents. With its user-friendly interface, users can quickly upload documents, add eSignature fields, and send them for signing in just a few clicks. This streamlined process saves time and enhances productivity.

-

What are the key features of rct 101 i?

Key features of rct 101 i include customizable templates, real-time tracking, and secure storage. These features ensure that document workflows are efficient and secure, allowing users to keep track of every document's status. Additionally, rct 101 i supports multiple file formats for maximum flexibility.

-

How much does rct 101 i cost?

The pricing for rct 101 i varies based on the plan selected, with options to suit businesses of all sizes. airSlate SignNow offers competitive pricing models, including monthly and annual subscriptions. Users can start with a free trial to explore the full capabilities of rct 101 i before committing.

-

What are the benefits of using rct 101 i for my business?

Using rct 101 i can signNowly enhance your business's efficiency by reducing the time spent on document management and approval processes. The solution also improves accuracy by minimizing errors related to manual handling of documents. Enhanced security features ensure that your sensitive information remains protected.

-

Can rct 101 i integrate with other software?

Yes, rct 101 i seamlessly integrates with various software solutions, including CRM, project management, and cloud storage platforms. This integration capability allows businesses to maintain their existing workflows while leveraging the powerful eSigning features of airSlate SignNow. Check our integration page for a complete list of compatible applications.

-

Is rct 101 i suitable for remote teams?

Absolutely! rct 101 i is ideal for remote teams as it allows users to sign documents from anywhere with an internet connection. The platform's cloud-based nature ensures that team members can collaborate and complete document workflows efficiently, regardless of their location. This flexibility boosts overall productivity.

-

What security measures are in place for rct 101 i?

Security is a top priority for rct 101 i, with measures including encryption of data during transmission and at rest. Additionally, the platform complies with industry regulations such as GDPR and eIDAS. Users can also utilize various authentication methods to ensure only authorized individuals can access and sign documents.

Get more for Inactive PA Corporate Net Income Report RCT 101 I FormsPublications

- Fencing contract for contractor massachusetts form

- Hvac contract for contractor massachusetts form

- Landscape contract for contractor massachusetts form

- Ma contract form

- Excavator contract for contractor massachusetts form

- Renovation contract for contractor massachusetts form

- Concrete mason contract for contractor massachusetts form

- Demolition contract for contractor massachusetts form

Find out other Inactive PA Corporate Net Income Report RCT 101 I FormsPublications

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free