PA Inactive PA Corporate Net Income Report RCT 101 I 2023-2026

What is the PA Inactive PA Corporate Net Income Report RCT 101 I

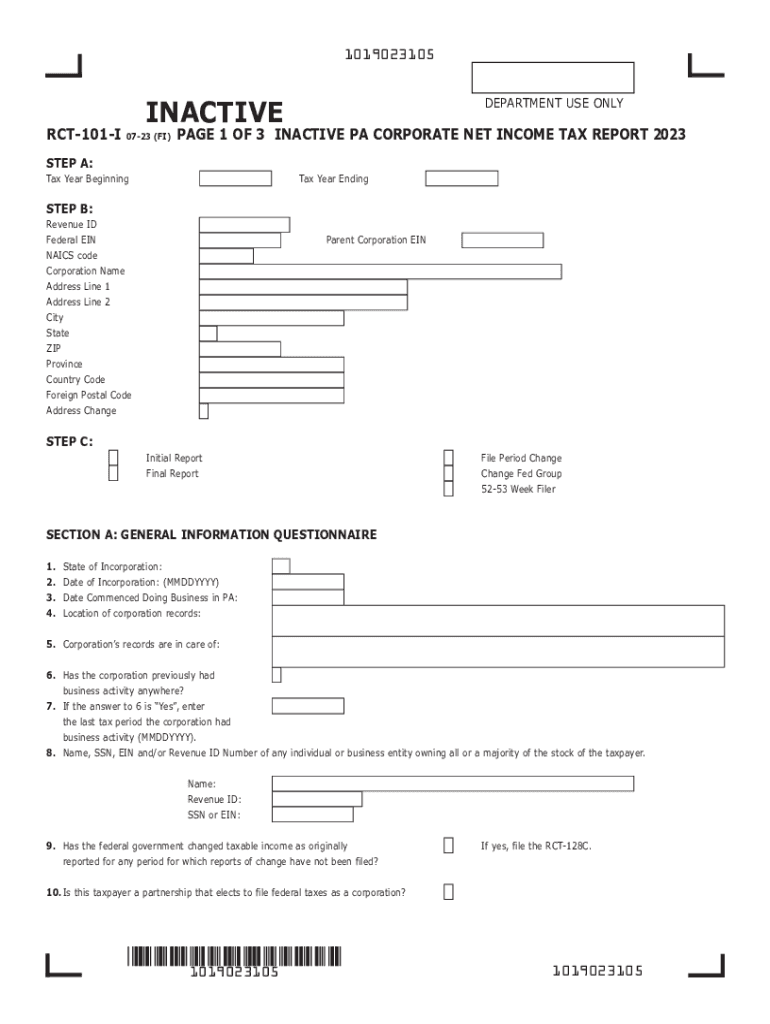

The PA Inactive PA Corporate Net Income Report RCT 101 I is a specific tax form used by corporations in Pennsylvania that are inactive for a given tax year. This form is essential for reporting the corporate net income tax status of entities that have ceased operations but still need to fulfill their tax obligations. By filing the RCT 101 I, corporations can officially declare their inactive status to the Pennsylvania Department of Revenue, ensuring compliance and avoiding unnecessary penalties.

How to use the PA Inactive PA Corporate Net Income Report RCT 101 I

Using the RCT 101 I involves accurately completing the form to reflect the corporation's inactive status. Corporations must provide essential information such as the entity's name, address, and tax identification number. Additionally, they should indicate the period of inactivity and any relevant financial details, even if they are minimal. This form serves as a formal notification to the state that the corporation is not currently conducting business and does not owe corporate net income tax for the reported period.

Steps to complete the PA Inactive PA Corporate Net Income Report RCT 101 I

To complete the RCT 101 I, follow these steps:

- Gather necessary information, including the corporation's name, address, and tax identification number.

- Indicate the period during which the corporation was inactive.

- Provide any required financial details, even if they are minimal.

- Review the form for accuracy and completeness.

- Submit the completed form to the Pennsylvania Department of Revenue by the specified deadline.

Legal use of the PA Inactive PA Corporate Net Income Report RCT 101 I

The legal use of the RCT 101 I is crucial for maintaining compliance with Pennsylvania tax regulations. Filing this form protects corporations from potential penalties associated with failing to report their inactive status. It serves as an official record that the corporation is not conducting business, which can be important for legal and financial documentation. Ensuring that the form is filed correctly and on time helps avoid complications with state tax authorities.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the RCT 101 I. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. It is essential to mark this date on the calendar to ensure timely submission and avoid late fees or penalties. Keeping track of these important dates helps maintain compliance with Pennsylvania tax laws.

Penalties for Non-Compliance

Failing to file the RCT 101 I can result in significant penalties for corporations. Non-compliance may lead to fines, interest on unpaid taxes, and potential legal repercussions. It is vital for corporations to understand the importance of filing this form to avoid these consequences. Timely and accurate submission of the RCT 101 I safeguards against unnecessary financial burdens and maintains good standing with the Pennsylvania Department of Revenue.

Quick guide on how to complete pa inactive pa corporate net income report rct 101 i

Complete PA Inactive PA Corporate Net Income Report RCT 101 I seamlessly on any device

Digital document management has become increasingly popular with organizations and individuals alike. It presents a superb eco-friendly substitute for traditional printed and signed documents, enabling you to locate the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage PA Inactive PA Corporate Net Income Report RCT 101 I on any device using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign PA Inactive PA Corporate Net Income Report RCT 101 I effortlessly

- Find PA Inactive PA Corporate Net Income Report RCT 101 I and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal value as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Modify and eSign PA Inactive PA Corporate Net Income Report RCT 101 I and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa inactive pa corporate net income report rct 101 i

Create this form in 5 minutes!

How to create an eSignature for the pa inactive pa corporate net income report rct 101 i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean if my corporation form is inactive?

If your corporation form is inactive, it typically indicates that your business entity has not fulfilled necessary requirements for compliance, such as filing annual reports or taxes. This status can restrict your ability to conduct business legally. Reinstating your corporation form is vital to resume normal operations.

-

How can airSlate SignNow help with managing an inactive corporation form?

airSlate SignNow offers an efficient way to eSign and manage critical documents needed to address issues surrounding an inactive corporation form. By digitizing the document signing process, you can easily complete required forms and ensure timely submissions. This greatly reduces the risk of your corporation remaining inactive for extended periods.

-

What features does airSlate SignNow offer for businesses with inactive corporation forms?

With airSlate SignNow, you gain access to a suite of features designed to streamline the management of your inactive corporation form. Features include customizable templates, secure document storage, and efficient eSigning capabilities. These tools can help you quickly address outstanding requirements, making the reinstatement process smoother.

-

Is there a cost associated with using airSlate SignNow for an inactive corporation form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the specific needs of businesses, including those dealing with an inactive corporation form. Our cost-effective options ensure you have access to vital features without overspending. You can choose a plan that aligns with your business size and needs.

-

Can airSlate SignNow integrate with other systems to assist with my inactive corporation form?

Absolutely! airSlate SignNow offers seamless integrations with numerous platforms, enhancing your ability to manage your inactive corporation form efficiently. By connecting with popular tools such as CRM systems and cloud storage services, you can streamline your workflow and ensure all necessary documents are handled promptly.

-

What benefits does airSlate SignNow provide for businesses addressing an inactive corporation form?

By using airSlate SignNow, businesses can quickly and effectively address issues related to an inactive corporation form. The platform facilitates faster processing times and reduces the likelihood of errors in document submission. Additionally, the user-friendly interface makes it easy for teams to collaborate on correcting any compliance issues.

-

How secure is airSlate SignNow when dealing with sensitive information related to my inactive corporation form?

Security is a top priority for airSlate SignNow, especially when managing sensitive information concerning your inactive corporation form. Our platform employs industry-leading encryption standards and secure data storage solutions. This ensures that your documents are protected and accessible only to authorized individuals.

Get more for PA Inactive PA Corporate Net Income Report RCT 101 I

Find out other PA Inactive PA Corporate Net Income Report RCT 101 I

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online