Instructions for Form 662SF Alaska Mining License Tax 2022-2026

Understanding the Instructions for Form 662SF Alaska Mining License Tax

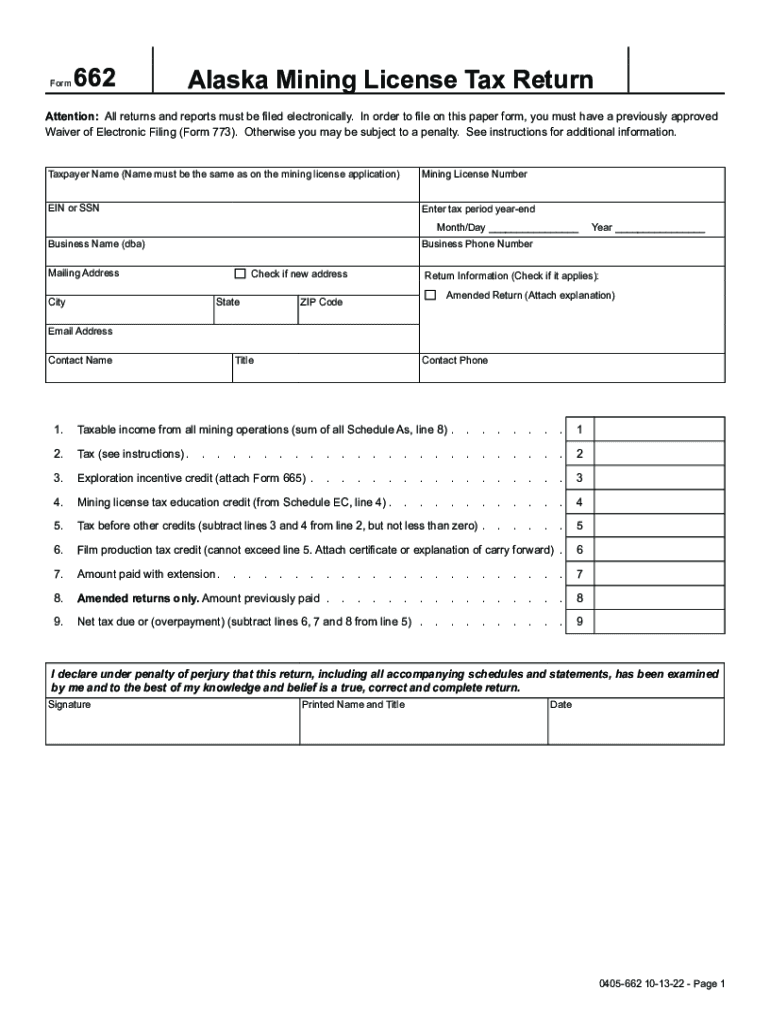

The Instructions for Form 662SF Alaska Mining License Tax provide essential guidance for individuals and businesses engaged in mining activities in Alaska. This form is crucial for reporting and paying the mining license tax, which is a requirement for those operating within the state's mining sector. The instructions detail the necessary steps to complete the form accurately, ensuring compliance with state regulations. Understanding these instructions is vital to avoid penalties and ensure timely submission.

Steps to Complete the Instructions for Form 662SF Alaska Mining License Tax

Completing the Instructions for Form 662SF involves several key steps:

- Gather all necessary financial records related to mining operations, including income statements and expense reports.

- Carefully read through the instructions to understand the specific requirements for reporting income and deductions.

- Fill out the form accurately, ensuring all information is complete and corresponds with your financial records.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid late fees or penalties.

Legal Use of the Instructions for Form 662SF Alaska Mining License Tax

The legal use of the Instructions for Form 662SF is governed by Alaska state tax laws. Compliance with these instructions ensures that the submitted form is valid and recognized by state authorities. It is important to follow the guidelines provided to maintain the legality of your mining operations and tax reporting. Failure to adhere to these instructions may result in legal repercussions, including fines or loss of mining privileges.

Required Documents for Form 662SF Submission

When preparing to submit the Instructions for Form 662SF, certain documents are required to support your tax reporting:

- Proof of income from mining operations, such as sales records or contracts.

- Expense documentation, including receipts for operational costs.

- Any prior tax returns related to mining activities, if applicable.

- Identification documents that may be required for business verification.

Filing Deadlines for Form 662SF

Timely filing of the Instructions for Form 662SF is critical to avoid penalties. The specific deadlines for submission are typically outlined in the state tax calendar. Generally, the form must be filed annually, and any changes to the deadlines will be communicated by the Alaska Department of Revenue. It is advisable to mark these dates in your calendar to ensure compliance.

Who Issues the Form 662SF Alaska Mining License Tax

The Form 662SF Alaska Mining License Tax is issued by the Alaska Department of Revenue. This department is responsible for administering tax laws and ensuring compliance among mining operators in the state. For any inquiries or clarifications regarding the form, individuals can contact the department directly for assistance.

Quick guide on how to complete instructions for form 662sf alaska mining license tax

Complete Instructions For Form 662SF Alaska Mining License Tax effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage Instructions For Form 662SF Alaska Mining License Tax on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign Instructions For Form 662SF Alaska Mining License Tax with ease

- Find Instructions For Form 662SF Alaska Mining License Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download to your computer.

Say goodbye to lost or misplaced files, tiring document searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Instructions For Form 662SF Alaska Mining License Tax and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 662sf alaska mining license tax

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 662sf alaska mining license tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the alaska form mining return?

The alaska form mining return is a crucial document that miners in Alaska are required to submit for reporting their production and sales. It ensures compliance with state mining regulations and helps in tracking mining activities for tax purposes.

-

How does airSlate SignNow assist with the alaska form mining return?

airSlate SignNow streamlines the process of filling out and eSigning the alaska form mining return. Our platform allows miners to easily create, share, and send these forms, ensuring they are submitted promptly and accurately.

-

Is airSlate SignNow cost-effective for filing the alaska form mining return?

Yes, airSlate SignNow offers a cost-effective solution for handling the alaska form mining return. With flexible pricing plans, businesses can choose an option that fits their budget while ensuring compliance with mining regulations.

-

What features does airSlate SignNow provide for the alaska form mining return?

Our platform includes essential features such as customizable templates, electronic signatures, and real-time tracking for the alaska form mining return. These tools enhance efficiency, making it easier for businesses to manage their documents.

-

Can I integrate airSlate SignNow with other tools for managing the alaska form mining return?

Absolutely! airSlate SignNow offers integration with a wide range of applications to enhance your workflow for the alaska form mining return. This ensures a seamless process from data entry to submission, allowing for better document management across platforms.

-

What are the benefits of using airSlate SignNow for the alaska form mining return?

Using airSlate SignNow for the alaska form mining return provides numerous benefits, including reduced paperwork, faster processing times, and enhanced compliance. These advantages help miners focus on their core business instead of administrative tasks.

-

How secure is the airSlate SignNow platform when filing the alaska form mining return?

Security is a top priority for airSlate SignNow. When you file the alaska form mining return through our platform, all documents are encrypted and securely stored to protect sensitive information from unauthorized access.

Get more for Instructions For Form 662SF Alaska Mining License Tax

Find out other Instructions For Form 662SF Alaska Mining License Tax

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now