Income Tax Forms for Individuals & Families Tax Colorado 2022-2026

What is the income tax form for individuals & families in Colorado?

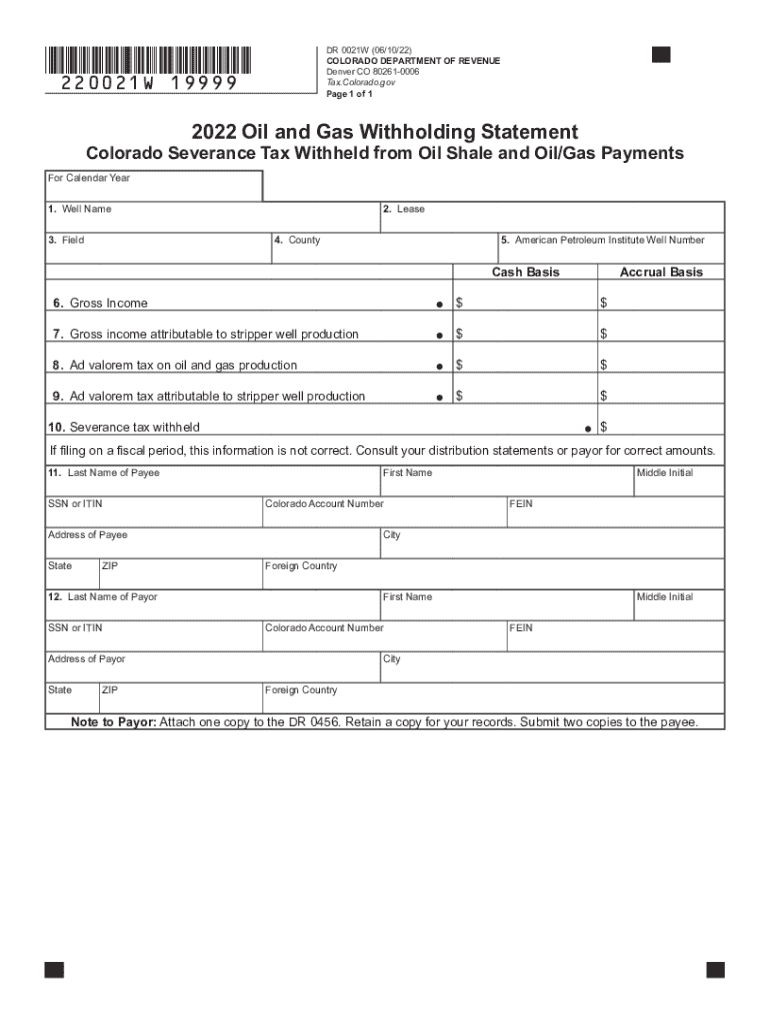

The and dr 0021w form, commonly referred to as the Colorado withholding statement, is essential for individuals and families in Colorado. This form is used to report the amount of state income tax that has been withheld from wages or other income. It serves as a crucial document for taxpayers to ensure that they are meeting their tax obligations and helps in accurately filing their state income tax returns.

Steps to complete the income tax form for individuals & families in Colorado

Completing the and dr 0021w form involves several key steps:

- Gather necessary information, including your Social Security number, employer details, and income amounts.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check your entries for accuracy to avoid potential issues with your tax filing.

- Sign and date the form to validate your submission.

Once completed, the form can be submitted electronically or mailed to the appropriate state tax authority.

Legal use of the income tax form for individuals & families in Colorado

The and dr 0021w form is legally recognized in Colorado and must be filled out in compliance with state tax regulations. The form ensures that the correct amount of state income tax is withheld from your earnings, which is crucial for meeting your tax obligations. Failure to submit this form or inaccuracies may result in penalties or additional tax liabilities.

Filing deadlines and important dates for the income tax form in Colorado

It is important to be aware of the filing deadlines associated with the and dr 0021w form. Typically, the form must be submitted by the end of the tax year, which is December thirty-first. However, specific deadlines may vary based on individual circumstances, such as whether you are filing as an employee or self-employed. Staying informed about these dates helps ensure compliance and avoids potential penalties.

Who issues the income tax form for individuals & families in Colorado?

The and dr 0021w form is issued by the Colorado Department of Revenue. This state agency is responsible for administering tax laws and ensuring that forms are available for taxpayers. The department provides resources and guidance to assist individuals and families in understanding their tax responsibilities and completing the necessary forms accurately.

Required documents for the income tax form in Colorado

When completing the and dr 0021w form, certain documents are required to ensure accuracy and compliance. These may include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- W-2 forms from employers detailing your earnings and tax withholdings.

- Any additional income statements relevant to your tax situation.

Having these documents on hand will streamline the completion process and help avoid errors.

Examples of using the income tax form for individuals & families in Colorado

The and dr 0021w form is utilized in various scenarios. For instance, employees receiving wages from an employer will use this form to report their withholding amounts. Additionally, self-employed individuals may also need to complete this form to report any estimated tax payments made throughout the year. Understanding how to use this form in different contexts is essential for accurate tax reporting.

Quick guide on how to complete income tax forms for individuals ampamp families tax colorado

Complete Income Tax Forms For Individuals & Families Tax Colorado effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and e-sign your documents promptly without delays. Handle Income Tax Forms For Individuals & Families Tax Colorado on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and e-sign Income Tax Forms For Individuals & Families Tax Colorado without hassle

- Locate Income Tax Forms For Individuals & Families Tax Colorado and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select how you'd like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and e-sign Income Tax Forms For Individuals & Families Tax Colorado and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax forms for individuals ampamp families tax colorado

Create this form in 5 minutes!

How to create an eSignature for the income tax forms for individuals ampamp families tax colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow and dr 0021w solution?

The airSlate SignNow and dr 0021w solution allows businesses to easily send and eSign documents online. This user-friendly platform helps streamline the signing process, making it efficient for various types of documents while ensuring security and compliance.

-

How much does airSlate SignNow and dr 0021w cost?

Pricing for airSlate SignNow and dr 0021w varies depending on the features you choose. The service offers flexible plans suitable for small businesses to large enterprises, ensuring that you get the right solution at a competitive price.

-

What features are included in the airSlate SignNow and dr 0021w package?

The airSlate SignNow and dr 0021w package includes features like document templating, real-time tracking, and comprehensive audit trails. These features enhance workflow efficiency and improve document management across your organization.

-

Can I integrate airSlate SignNow and dr 0021w with other software?

Yes, airSlate SignNow and dr 0021w seamlessly integrates with numerous software applications such as CRM tools and cloud storage services. This integration enables a streamlined workflow and enhances productivity by connecting your essential business tools.

-

What are the benefits of using airSlate SignNow and dr 0021w for my business?

Using airSlate SignNow and dr 0021w allows your business to save time and reduce costs associated with traditional paper-based processes. Its electronic signing capabilities increase efficiency, allowing quick turnaround times for important documents.

-

Is airSlate SignNow and dr 0021w secure?

Absolutely! airSlate SignNow and dr 0021w prioritizes security, offering encryption and compliance with industry standards. Your documents and signatures are protected, ensuring the integrity of sensitive business information.

-

How user-friendly is the airSlate SignNow and dr 0021w platform?

The airSlate SignNow and dr 0021w platform is designed for user-friendliness, ensuring that individuals at all skill levels can navigate it easily. With an intuitive interface and straightforward functionality, your team can start eSigning documents in no time.

Get more for Income Tax Forms For Individuals & Families Tax Colorado

Find out other Income Tax Forms For Individuals & Families Tax Colorado

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF