Oil and Gas Withholding Statement DR 0021W Colorado 2014

What is the Oil And Gas Withholding Statement DR 0021W Colorado

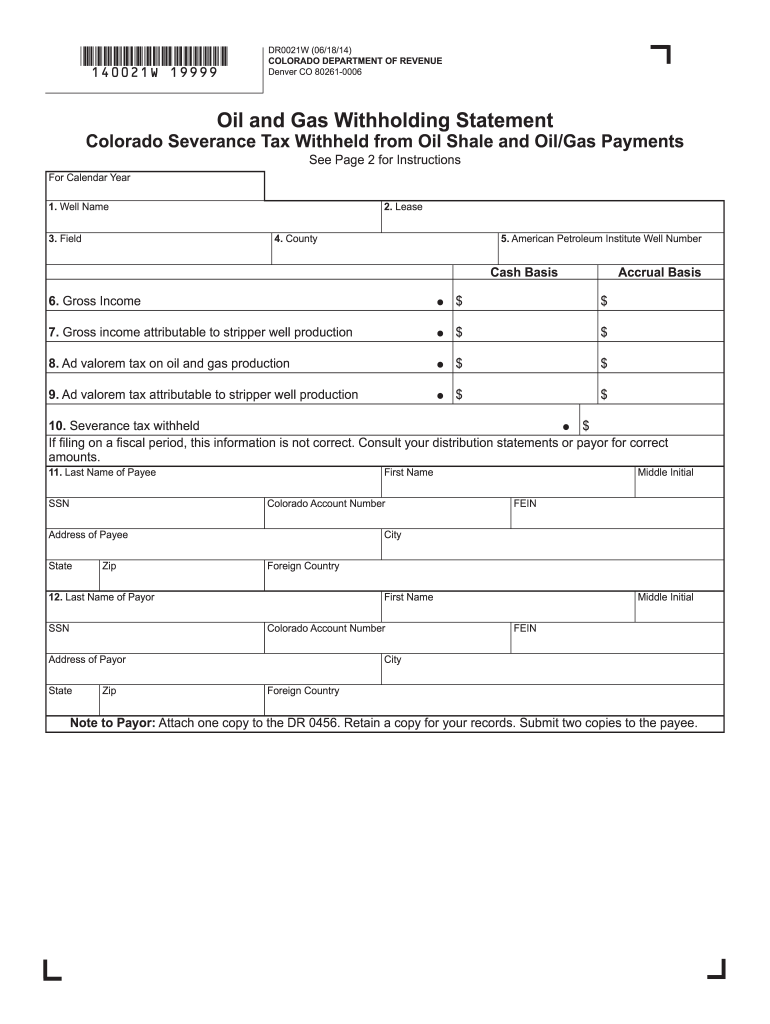

The Oil And Gas Withholding Statement DR 0021W Colorado is a tax form used by individuals and businesses engaged in the oil and gas industry in Colorado. This form is essential for reporting withholding amounts on payments made to non-resident individuals or entities for services rendered in the state. It ensures compliance with Colorado state tax laws and helps facilitate accurate tax reporting and collection.

How to use the Oil And Gas Withholding Statement DR 0021W Colorado

To use the Oil And Gas Withholding Statement DR 0021W Colorado, taxpayers must accurately complete the form with the required information, including the payer's details, payee's information, and the amount withheld. This form can be filled out electronically, allowing for easier data entry and submission. Once completed, the form should be submitted to the Colorado Department of Revenue along with any required payments.

Steps to complete the Oil And Gas Withholding Statement DR 0021W Colorado

Completing the Oil And Gas Withholding Statement DR 0021W Colorado involves several key steps:

- Gather all necessary information, including payer and payee details.

- Enter the total amount paid to the payee and the amount withheld.

- Review the form for accuracy to ensure compliance with state regulations.

- Submit the form electronically or by mail to the Colorado Department of Revenue.

Legal use of the Oil And Gas Withholding Statement DR 0021W Colorado

The legal use of the Oil And Gas Withholding Statement DR 0021W Colorado is crucial for both payers and payees. Payers must use this form to report and remit withholding taxes to the state, while payees can use it to claim credits for taxes withheld on their behalf. Proper completion and submission of this form help prevent penalties and ensure compliance with Colorado tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Oil And Gas Withholding Statement DR 0021W Colorado are typically aligned with state tax deadlines. It is essential to submit the form by the specified due date to avoid penalties. Taxpayers should stay informed about any changes to deadlines, which may vary based on the specific tax year or legislative updates.

Form Submission Methods (Online / Mail / In-Person)

The Oil And Gas Withholding Statement DR 0021W Colorado can be submitted through various methods. Taxpayers have the option to file the form online via the Colorado Department of Revenue's website, or they may choose to mail the completed form to the appropriate address. In-person submissions may also be accepted at designated state offices, ensuring flexibility for taxpayers in meeting their filing obligations.

Quick guide on how to complete oil and gas withholding statement dr 0021w colorado

Your assistance manual on how to prepare your Oil And Gas Withholding Statement DR 0021W Colorado

If you’re wondering how to generate and submit your Oil And Gas Withholding Statement DR 0021W Colorado, here are a few straightforward instructions on how to facilitate tax submissions.

To get started, you only need to create your airSlate SignNow account to transform your document management online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax documents effortlessly. Through its editor, you can alternate between text, checkboxes, and eSignatures and revert to amend details when necessary. Streamline your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your Oil And Gas Withholding Statement DR 0021W Colorado in just a few minutes:

- Establish your account and begin working on PDFs within minutes.

- Utilize our catalog to obtain any IRS tax form; explore various versions and schedules.

- Select Get form to access your Oil And Gas Withholding Statement DR 0021W Colorado in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically using airSlate SignNow. Please be aware that submitting physically can lead to errors in returns and delays in refunds. Naturally, prior to e-filing your taxes, consult the IRS website for submission guidelines relevant to your state.

Create this form in 5 minutes or less

Find and fill out the correct oil and gas withholding statement dr 0021w colorado

FAQs

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

Create this form in 5 minutes!

How to create an eSignature for the oil and gas withholding statement dr 0021w colorado

How to create an electronic signature for your Oil And Gas Withholding Statement Dr 0021w Colorado in the online mode

How to make an electronic signature for the Oil And Gas Withholding Statement Dr 0021w Colorado in Chrome

How to create an electronic signature for signing the Oil And Gas Withholding Statement Dr 0021w Colorado in Gmail

How to make an eSignature for the Oil And Gas Withholding Statement Dr 0021w Colorado right from your smartphone

How to create an electronic signature for the Oil And Gas Withholding Statement Dr 0021w Colorado on iOS

How to generate an eSignature for the Oil And Gas Withholding Statement Dr 0021w Colorado on Android devices

People also ask

-

What is the Oil And Gas Withholding Statement DR 0021W Colorado?

The Oil And Gas Withholding Statement DR 0021W Colorado is a tax form required for reporting the withholding tax on payments made to oil and gas workers in Colorado. This document ensures compliance with state tax laws and helps businesses avoid penalties. By utilizing airSlate SignNow, you can easily create, sign, and manage this form efficiently.

-

How can airSlate SignNow help with the Oil And Gas Withholding Statement DR 0021W Colorado?

airSlate SignNow simplifies the process of preparing and eSigning the Oil And Gas Withholding Statement DR 0021W Colorado. Our platform allows you to fill out the form digitally, ensuring accuracy and compliance. Furthermore, you can store and access your documents securely, making tax season stress-free.

-

Is there a cost associated with using airSlate SignNow for the Oil And Gas Withholding Statement DR 0021W Colorado?

Yes, airSlate SignNow offers various pricing plans that are affordable and cater to different business needs. These plans include features tailored for managing documents like the Oil And Gas Withholding Statement DR 0021W Colorado efficiently. Visit our pricing page for more details and find a plan that suits your requirements.

-

What features does airSlate SignNow offer for the Oil And Gas Withholding Statement DR 0021W Colorado?

Our platform provides a range of features including document templates, eSignature capabilities, and secure storage. With airSlate SignNow, you can collaborate seamlessly with your team when preparing the Oil And Gas Withholding Statement DR 0021W Colorado. Additionally, our intuitive interface makes it easy to navigate and utilize all available tools.

-

What are the benefits of using airSlate SignNow for the Oil And Gas Withholding Statement DR 0021W Colorado?

Using airSlate SignNow for the Oil And Gas Withholding Statement DR 0021W Colorado provides numerous benefits such as time savings, enhanced accuracy, and improved compliance with state regulations. The platform allows you to track the status of your documents in real-time and decreases the likelihood of errors in filling out forms. This ultimately streamlines your workflow and reduces administrative burdens.

-

Can I integrate airSlate SignNow with other software for processing the Oil And Gas Withholding Statement DR 0021W Colorado?

Yes, airSlate SignNow offers integration capabilities with several popular applications like CRM, accounting, and project management software. This allows for a seamless workflow when managing the Oil And Gas Withholding Statement DR 0021W Colorado. Check our integrations page to see a full list of compatible applications.

-

How secure is airSlate SignNow for handling the Oil And Gas Withholding Statement DR 0021W Colorado?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and authentication measures to protect your documents, including the Oil And Gas Withholding Statement DR 0021W Colorado. You can rest assured that your sensitive information is safe with us while complying with industry standards.

Get more for Oil And Gas Withholding Statement DR 0021W Colorado

Find out other Oil And Gas Withholding Statement DR 0021W Colorado

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF