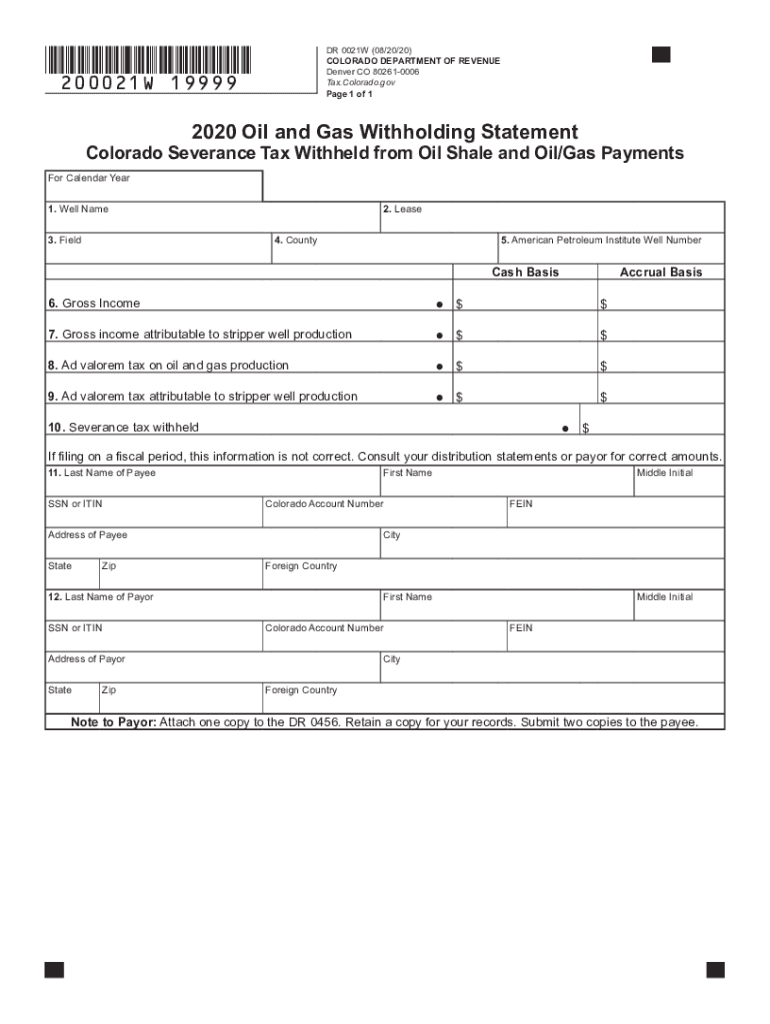

DR 0021W 2020

What is the DR 0021W?

The DR 0021W is a Colorado withholding statement used by businesses to report the amount of state income tax withheld from employees' wages. This form is essential for employers to ensure compliance with Colorado tax regulations. It provides the state with necessary information regarding employee earnings and the corresponding tax deductions made throughout the year. Understanding the purpose of the DR 0021W is crucial for both employers and employees to maintain accurate tax records and fulfill state obligations.

How to use the DR 0021W

Using the DR 0021W involves several steps to ensure accurate reporting of withheld taxes. Employers must complete the form by entering details such as the employee's name, Social Security number, and the total amount withheld. Once filled out, the form should be submitted to the Colorado Department of Revenue, either electronically or via mail. It is important for employers to keep a copy of the completed form for their records, as it serves as verification of compliance with state tax laws.

Steps to complete the DR 0021W

Completing the DR 0021W requires careful attention to detail. Follow these steps:

- Gather employee information, including names and Social Security numbers.

- Calculate the total amount of state income tax withheld for each employee.

- Fill out the DR 0021W form with the required information.

- Review the form for accuracy before submission.

- Submit the completed form to the Colorado Department of Revenue.

Legal use of the DR 0021W

The DR 0021W serves a legal purpose in the context of tax compliance. It is a legally binding document that must be filled out accurately to reflect the correct amounts withheld from employees' wages. Failure to complete or submit the form can result in penalties for employers, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is essential for businesses operating in Colorado.

Key elements of the DR 0021W

Several key elements must be included in the DR 0021W to ensure its validity:

- Employee's full name and Social Security number.

- Total wages paid during the reporting period.

- Amount of state income tax withheld.

- Employer's information, including name and identification number.

- Signature of the employer or authorized representative.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the DR 0021W to avoid penalties. Typically, the form is due on or before January 31 of the year following the tax year being reported. Employers should also keep track of quarterly deadlines for submitting withholding payments to ensure compliance with Colorado tax regulations.

Quick guide on how to complete dr 0021w

Effortlessly Prepare DR 0021W on Any Device

Managing documents online has become a favored choice for both companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle DR 0021W on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and eSign DR 0021W with Ease

- Find DR 0021W and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional written signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign DR 0021W and ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 0021w

Create this form in 5 minutes!

How to create an eSignature for the dr 0021w

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an e-signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is a Colorado withholding statement?

A Colorado withholding statement is a tax document that employers must provide to employees detailing the amount of state income tax withheld from their wages. This statement is essential for individuals when filing their Colorado state tax returns.

-

How can airSlate SignNow help with managing Colorado withholding statements?

airSlate SignNow allows businesses to efficiently send, sign, and manage Colorado withholding statements digitally. By streamlining the document workflow, businesses can ensure timely delivery and compliance with state regulations, making tax season easier.

-

Is there a cost associated with using airSlate SignNow for Colorado withholding statements?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to provide a cost-effective solution for managing Colorado withholding statements seamlessly, with features that enhance overall productivity.

-

What features does airSlate SignNow offer for handling Colorado withholding statements?

airSlate SignNow provides features such as customizable templates for Colorado withholding statements, secure eSignature capabilities, and automated reminders. These features help ensure that documents are completed accurately and promptly.

-

Can I integrate airSlate SignNow with accounting software for Colorado withholding statements?

Absolutely! airSlate SignNow offers integrations with popular accounting and payroll software, which simplifies the process of generating and sending Colorado withholding statements. This ensures a cohesive workflow for managing employee information and tax documents.

-

What are the benefits of using airSlate SignNow for Colorado withholding statements?

Using airSlate SignNow for Colorado withholding statements enhances accuracy and compliance while reducing manual paperwork. Additionally, our platform increases efficiency, allowing your team to focus on core business functions instead of administrative tasks.

-

How secure is the information submitted through airSlate SignNow for Colorado withholding statements?

Security is a top priority for airSlate SignNow. We use advanced encryption protocols and secure data storage to protect all information submitted, including Colorado withholding statements, ensuring that your sensitive information remains confidential.

Get more for DR 0021W

- Legal last will and testament form for married person with minor children connecticut

- Connecticut partner form

- Codicil will form 497301405

- Mutual wills package with last wills and testaments for married couple with adult children connecticut form

- Mutual wills package with last wills and testaments for married couple with no children connecticut form

- Mutual wills package with last wills and testaments for married couple with minor children connecticut form

- Legal last will and testament form for married person with adult and minor children from prior marriage connecticut

- Legal last will and testament form for civil union partner with adult and minor children from prior marriage connecticut

Find out other DR 0021W

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template