Fillable Online PHYSICIAN ASSISTANT SITE VISIT FORM Fax 2019

Understanding Oil Withholding

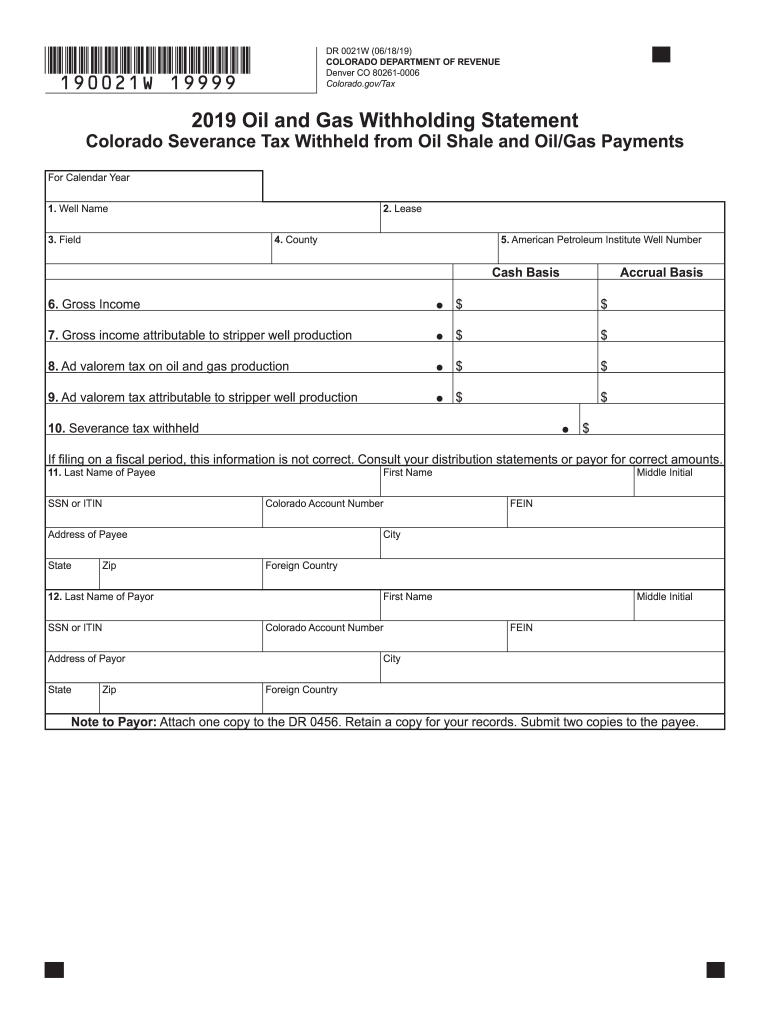

Oil withholding refers to the process by which a portion of an individual's or entity's income related to oil production is withheld for tax purposes. This withholding is often mandated by federal or state tax regulations to ensure that taxes are collected upfront on income generated from oil activities. It is crucial for taxpayers involved in the oil industry to understand how this withholding impacts their overall tax obligations and financial reporting.

Steps to Complete the Oil Withholding Form

Completing the oil withholding form involves several key steps:

- Gather necessary information, including your tax identification number and details about your oil production income.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the appropriate channels, whether online or via mail.

Legal Use of the Oil Withholding Form

The oil withholding form is a legal document that must be completed in compliance with federal and state tax laws. It serves as a record of the income withheld and is essential for accurate tax reporting. Failure to properly complete and submit this form can result in penalties or additional tax liabilities. It is advisable to consult with a tax professional to ensure compliance with all legal requirements.

Filing Deadlines and Important Dates

Taxpayers involved in oil production should be aware of specific filing deadlines associated with the oil withholding form. These deadlines can vary based on federal and state regulations. Typically, forms must be submitted by the end of the tax year or as specified by the tax authority. Keeping track of these dates is essential to avoid late fees or penalties.

Required Documents for Oil Withholding

To complete the oil withholding form, certain documents may be required, including:

- Proof of income from oil production activities.

- Tax identification number or Social Security number.

- Previous tax returns, if applicable.

Having these documents ready can streamline the process and ensure accuracy in reporting.

Penalties for Non-Compliance

Non-compliance with oil withholding regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for individuals and businesses involved in oil production to understand the implications of failing to comply with withholding requirements and to take proactive measures to meet their obligations.

Quick guide on how to complete fillable online physician assistant site visit form fax

Effortlessly Prepare Fillable Online PHYSICIAN ASSISTANT SITE VISIT FORM Fax on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Fillable Online PHYSICIAN ASSISTANT SITE VISIT FORM Fax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Fillable Online PHYSICIAN ASSISTANT SITE VISIT FORM Fax with Ease

- Locate Fillable Online PHYSICIAN ASSISTANT SITE VISIT FORM Fax and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or missing files, tedious form retrieval, and errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Fillable Online PHYSICIAN ASSISTANT SITE VISIT FORM Fax to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online physician assistant site visit form fax

Create this form in 5 minutes!

How to create an eSignature for the fillable online physician assistant site visit form fax

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is oil withholding and how does it affect my business?

Oil withholding refers to the practice of holding back a portion of oil revenues for tax purposes. Understanding oil withholding is crucial for businesses in the oil industry as it can directly impact cash flow and profitability. Effective management of oil withholding can ensure compliance and maximize financial returns.

-

How can airSlate SignNow help with oil withholding documentation?

AirSlate SignNow simplifies the process of managing documents related to oil withholding. Our platform allows you to easily create, sign, and store necessary paperwork, ensuring that you stay compliant with regulations. With its user-friendly interface, you can focus on your business without the hassle of complicated documentation.

-

What features does airSlate SignNow offer for managing oil withholding contracts?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and document storage that are perfect for managing oil withholding contracts. These tools help eliminate delays in signing and improve document accuracy. You can also track document status in real-time, ensuring all parties are informed and accountable.

-

Is airSlate SignNow cost-effective for oil withholding document management?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing oil withholding. Our transparent pricing plans ensure that you only pay for what you need, with no hidden fees. This affordability makes it accessible for both small businesses and larger enterprises in the oil sector.

-

Can I integrate airSlate SignNow with other tools for oil withholding processes?

Absolutely! AirSlate SignNow offers seamless integrations with various applications to streamline your oil withholding processes. Whether you use CRM systems, accounting software, or cloud storage platforms, our solution can connect with them, allowing for efficient document management across the board.

-

What benefits does eSigning offer for oil withholding agreements?

ESigning with airSlate SignNow provides several benefits for oil withholding agreements, including speed and efficiency. It eliminates the need for printing, scanning, and mailing documents, saving time and resources. Additionally, eSigned documents are legally binding, ensuring that your agreements hold up in compliance audits.

-

How secure is airSlate SignNow for handling oil withholding documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive oil withholding documents. Our platform employs advanced encryption, secure data storage, and strict access controls to protect your information. You can confidently manage your documents knowing they are safeguarded against unauthorized access.

Get more for Fillable Online PHYSICIAN ASSISTANT SITE VISIT FORM Fax

- Release minor child 497427234 form

- Waiver and release from liability for adult for snowmobile form

- Waiver and release from liability for minor child for snowmobile form

- Waiver and release from liability for adult for disc golf form

- Waiver release liability form 497427238

- Waiver hunting form

- Waiver and release from liability for minor child for duck hunting form

- Waiver liability house 497427241 form

Find out other Fillable Online PHYSICIAN ASSISTANT SITE VISIT FORM Fax

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document