IL 1040 X V Payment Voucher for Amended Individual Income 2022

What is the IL 1040 X V Payment Voucher For Amended Individual Income

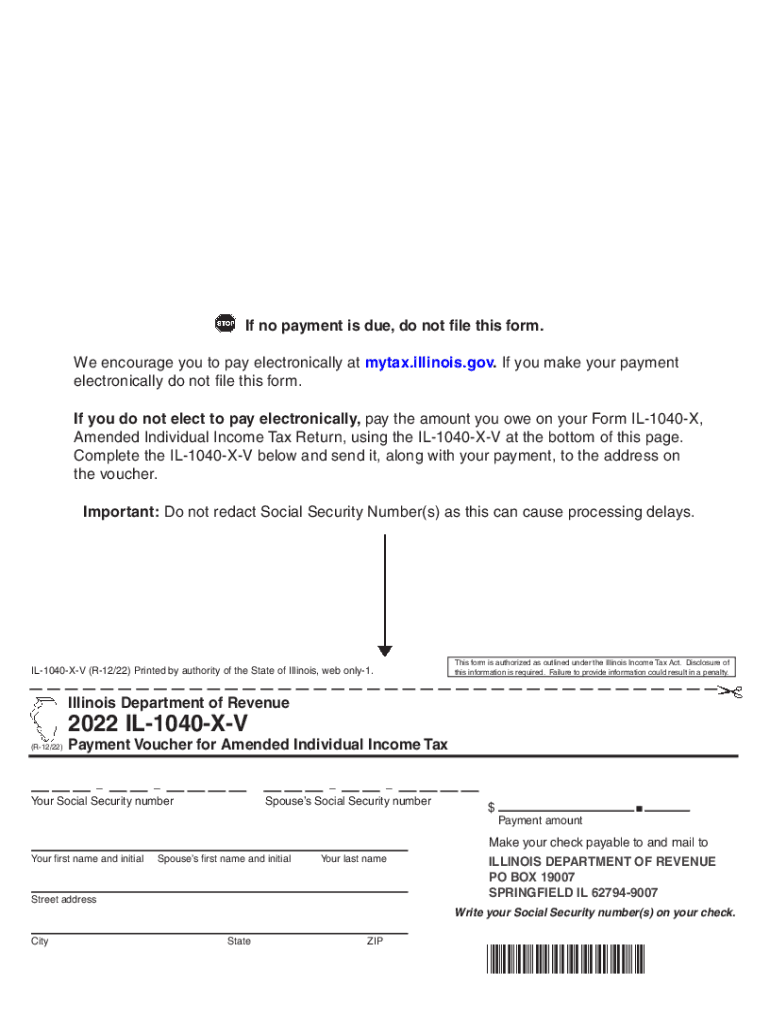

The IL 1040 X V Payment Voucher for Amended Individual Income is a specific form used by taxpayers in Illinois to submit payments related to amended individual income tax returns. When a taxpayer needs to correct or update their previously filed tax return, this voucher facilitates the payment of any additional tax owed. It is essential for ensuring that the payment is properly credited to the correct tax year and return, thus helping to avoid potential penalties or interest for late payments.

How to use the IL 1040 X V Payment Voucher For Amended Individual Income

Using the IL 1040 X V Payment Voucher involves several straightforward steps. First, ensure that you have completed your amended tax return, typically using Form IL-1040-X. After determining the amount owed, fill out the payment voucher accurately, including your name, address, Social Security number, and the payment amount. It is crucial to include the correct tax year on the voucher. Once completed, send the voucher along with your payment to the designated address provided by the Illinois Department of Revenue.

Steps to complete the IL 1040 X V Payment Voucher For Amended Individual Income

Completing the IL 1040 X V Payment Voucher requires careful attention to detail. Follow these steps:

- Obtain the IL 1040 X V Payment Voucher form from the Illinois Department of Revenue website or your tax professional.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are making the payment.

- Enter the total amount you owe as determined by your amended return.

- Review the form for accuracy before submission.

After completing these steps, submit the voucher along with your payment to ensure it is processed correctly.

Legal use of the IL 1040 X V Payment Voucher For Amended Individual Income

The legal use of the IL 1040 X V Payment Voucher is crucial for compliance with Illinois tax laws. This form serves as an official record of payment for any additional taxes owed due to amendments made to your original return. Proper use of the voucher helps to avoid disputes with the Illinois Department of Revenue and ensures that your payment is applied correctly. It is important to retain a copy of the voucher and any related documents for your records.

Filing Deadlines / Important Dates

Timely filing is essential when using the IL 1040 X V Payment Voucher. The payment must be submitted by the due date specified for the amended return to avoid penalties and interest. Generally, taxpayers have up to three years from the original filing date to amend their returns. It is advisable to check the Illinois Department of Revenue's website for specific deadlines related to your tax year, as these can vary.

Form Submission Methods (Online / Mail / In-Person)

The IL 1040 X V Payment Voucher can be submitted through various methods, depending on your preference. The primary submission options include:

- Mail: Send the completed voucher and payment to the address specified by the Illinois Department of Revenue.

- In-Person: Deliver the voucher and payment directly to a local Illinois Department of Revenue office.

Currently, online submission of the voucher is not available, so ensure you choose one of the above methods for your payment.

Quick guide on how to complete 2022 il 1040 x v payment voucher for amended individual income

Complete IL 1040 X V Payment Voucher For Amended Individual Income effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and store it securely online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly and without delays. Manage IL 1040 X V Payment Voucher For Amended Individual Income on any platform through airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign IL 1040 X V Payment Voucher For Amended Individual Income with ease

- Find IL 1040 X V Payment Voucher For Amended Individual Income and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing out new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Edit and eSign IL 1040 X V Payment Voucher For Amended Individual Income and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 il 1040 x v payment voucher for amended individual income

Create this form in 5 minutes!

How to create an eSignature for the 2022 il 1040 x v payment voucher for amended individual income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1040 X V Payment Voucher For Amended Individual Income?

The IL 1040 X V Payment Voucher For Amended Individual Income is a tax form used by individuals in Illinois to submit payments related to their amended income tax returns. This voucher ensures that you remit the correct amount due after making changes to your original tax filing.

-

How can airSlate SignNow help with submitting the IL 1040 X V Payment Voucher?

airSlate SignNow simplifies the process of completing and submitting the IL 1040 X V Payment Voucher For Amended Individual Income by allowing users to eSign documents quickly and securely. With user-friendly templates, you can fill out your voucher seamlessly and ensure it is submitted on time.

-

What features does airSlate SignNow offer for the IL 1040 X V Payment Voucher?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage that facilitate the completion of the IL 1040 X V Payment Voucher For Amended Individual Income. These features help streamline your tax filing process and improve overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the IL 1040 X V Payment Voucher?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs. While there may be a fee for using the platform, the investment can save you time and reduce errors when submitting your IL 1040 X V Payment Voucher For Amended Individual Income.

-

What are the benefits of using airSlate SignNow for tax documents?

Utilizing airSlate SignNow for your tax documents, including the IL 1040 X V Payment Voucher For Amended Individual Income, offers benefits such as improved accuracy, enhanced compliance, and faster processing times. The platform’s automation features help you avoid pitfalls associated with manual submissions.

-

Can I integrate airSlate SignNow with other accounting software for the IL 1040 X V Payment Voucher?

Yes, airSlate SignNow can be integrated with various accounting software, allowing users to import data directly into the IL 1040 X V Payment Voucher For Amended Individual Income. This integration streamlines the workflow, making it easier to fill out and manage tax documents.

-

Is it safe to use airSlate SignNow for sensitive tax information like the IL 1040 X V Payment Voucher?

Absolutely! airSlate SignNow prioritizes the security of your sensitive information, including the IL 1040 X V Payment Voucher For Amended Individual Income. The platform employs industry-standard encryption and security protocols to protect your data during the entire process.

Get more for IL 1040 X V Payment Voucher For Amended Individual Income

Find out other IL 1040 X V Payment Voucher For Amended Individual Income

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation