Alabama Individual Income Tax Return 2022

What is the Alabama Individual Income Tax Return

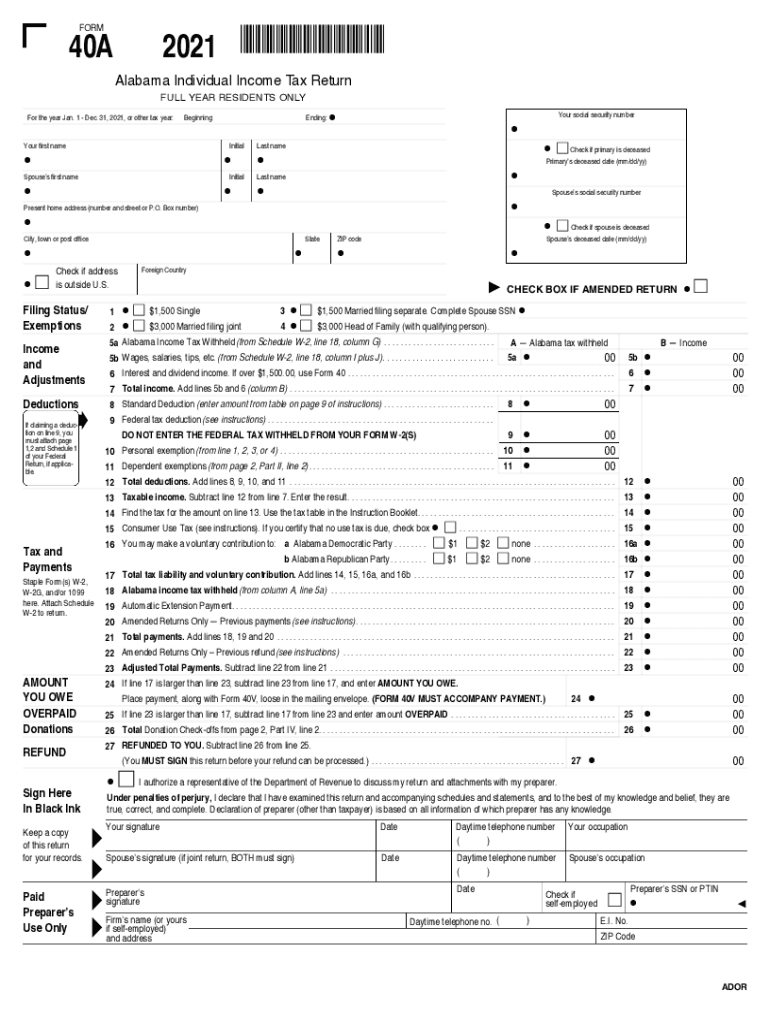

The Alabama Individual Income Tax Return is a form that residents of Alabama must complete to report their income and calculate their state tax liability. This form is essential for ensuring compliance with state tax laws and is used to determine the amount of tax owed or the refund due. The form captures various types of income, deductions, and credits available to taxpayers, making it a critical document for financial reporting in Alabama.

Steps to Complete the Alabama Individual Income Tax Return

Completing the Alabama Individual Income Tax Return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain deductions.

- Fill out the form accurately, ensuring all income sources are reported and deductions claimed.

- Review the completed form for accuracy, checking for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Legal Use of the Alabama Individual Income Tax Return

The Alabama Individual Income Tax Return is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must provide accurate information and necessary signatures. Electronic submissions are recognized as valid under the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), provided that the process meets specific legal requirements.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of filing deadlines to avoid penalties. The standard deadline for submitting the Alabama Individual Income Tax Return is typically April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of any extensions or changes announced by the Alabama Department of Revenue.

Required Documents

To complete the Alabama Individual Income Tax Return, several documents are necessary:

- W-2 forms from employers

- 1099 forms for additional income sources

- Documentation for deductions, such as mortgage interest statements

- Records of any tax credits being claimed

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Alabama have multiple options for submitting their Individual Income Tax Return. The form can be filed electronically through approved e-filing services, which often provide a more efficient and faster processing time. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address or submit them in person at designated state tax offices. Each method has its own set of guidelines and requirements that should be followed for successful submission.

Key Elements of the Alabama Individual Income Tax Return

The Alabama Individual Income Tax Return includes several key elements that taxpayers must understand:

- Personal information, including name, address, and Social Security number

- Income details from various sources

- Deductions and credits that apply to the taxpayer's situation

- Signature and date, confirming the accuracy of the information provided

Quick guide on how to complete alabama individual income tax return

Complete Alabama Individual Income Tax Return seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Engage with Alabama Individual Income Tax Return on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Alabama Individual Income Tax Return effortlessly

- Find Alabama Individual Income Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Alabama Individual Income Tax Return and guarantee excellent communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the alabama individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AL 40A individual income tax return?

The AL 40A individual income tax return is a specific form used by residents of Alabama to report their individual income for state tax purposes. This form includes various details regarding income sources, deductions, and credits. It's essential to accurately complete this form to ensure compliance with state tax regulations.

-

How can airSlate SignNow assist with filing an AL 40A individual income tax return?

airSlate SignNow simplifies the process of preparing and signing documents, including your AL 40A individual income tax return. With its eSignature feature, you can quickly send and sign your tax documents securely online. This eliminates the need for printing, faxing, or mailing forms, making tax filing more efficient.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers various pricing plans tailored to different business needs, ranging from individual users to larger organizations. Each plan includes features that can facilitate the signing and management of important documents like the AL 40A individual income tax return. You can choose a plan that best fits your requirements and budget.

-

Is airSlate SignNow secure for handling my AL 40A individual income tax return?

Yes, airSlate SignNow is designed with security in mind, employing encryption and secure data storage protocols. Your sensitive information, including details on your AL 40A individual income tax return, is protected against unauthorized access. This ensures that your documents remain confidential and safe at all times.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features like eSigning, document templates, and automated workflows to streamline your tax document management. These tools are especially useful when handling forms such as the AL 40A individual income tax return. You can create, send, and track your documents with ease, making tax season less stressful.

-

Can I integrate airSlate SignNow with other tools I use for tax preparation?

Yes, airSlate SignNow can integrate with several other applications to enhance your tax preparation workflow. By connecting with tools you already use, you can easily access features that assist in completing and managing your AL 40A individual income tax return. This integration helps streamline your processes for better efficiency.

-

What are the advantages of using airSlate SignNow for signing my AL 40A individual income tax return?

Using airSlate SignNow to sign your AL 40A individual income tax return offers numerous advantages, including convenience and speed. You can securely sign your tax return from anywhere, at any time, without the need for physical paperwork. This feature signNowly speeds up the filing process and provides peace of mind knowing your documents are handled securely.

Get more for Alabama Individual Income Tax Return

Find out other Alabama Individual Income Tax Return

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter