Fiscal Period for Income Tax Purposes Canada Ca 2022

Understanding the Fiscal Period for Income Tax Purposes

The fiscal period for income tax purposes refers to the specific time frame during which a business or individual calculates their income and expenses for tax reporting. In the United States, the fiscal year can differ from the calendar year, depending on the entity's accounting methods. Most businesses use a calendar year, ending on December thirty-first, while some may choose a different fiscal year based on their operational needs. Understanding this period is crucial for accurate tax reporting and compliance.

Steps to Complete the Fiscal Period for Income Tax Purposes

Completing the fiscal period for income tax involves several key steps:

- Determine your fiscal year-end date based on your accounting method.

- Gather all financial records, including income statements and expense reports, for the period.

- Calculate total income and allowable deductions for the fiscal year.

- Prepare the necessary tax forms, ensuring they align with the fiscal period.

- Review and submit the completed forms by the designated filing deadline.

Required Documents for the Fiscal Period

To accurately report income during the fiscal period, certain documents are essential:

- Income statements detailing revenue generated.

- Expense reports outlining all business-related costs.

- Receipts and invoices for deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation required by state or federal tax authorities.

Filing Deadlines and Important Dates

Filing deadlines for the fiscal period can vary based on the type of entity and its fiscal year. Generally, businesses must file their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. For example, if a business operates on a fiscal year ending June thirtieth, the tax return would be due by October fifteenth. It is important to stay informed about these deadlines to avoid penalties.

IRS Guidelines for Fiscal Period Reporting

The IRS provides specific guidelines regarding the fiscal period for income tax purposes. Taxpayers must adhere to these guidelines to ensure compliance. Key points include:

- Choosing the appropriate accounting method (cash or accrual).

- Maintaining accurate records throughout the fiscal period.

- Understanding the implications of changing the fiscal year.

- Meeting all reporting requirements as outlined in IRS publications.

Penalties for Non-Compliance

Failure to comply with fiscal period reporting requirements can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes.

- Potential audits from the IRS or state tax authorities.

It is essential to understand these consequences to maintain compliance and avoid financial repercussions.

Quick guide on how to complete fiscal period for income tax purposes canadaca

Effortlessly prepare Fiscal Period For Income Tax Purposes Canada ca on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle Fiscal Period For Income Tax Purposes Canada ca on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to edit and electronically sign Fiscal Period For Income Tax Purposes Canada ca with ease

- Locate Fiscal Period For Income Tax Purposes Canada ca and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Fiscal Period For Income Tax Purposes Canada ca and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiscal period for income tax purposes canadaca

Create this form in 5 minutes!

How to create an eSignature for the fiscal period for income tax purposes canadaca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

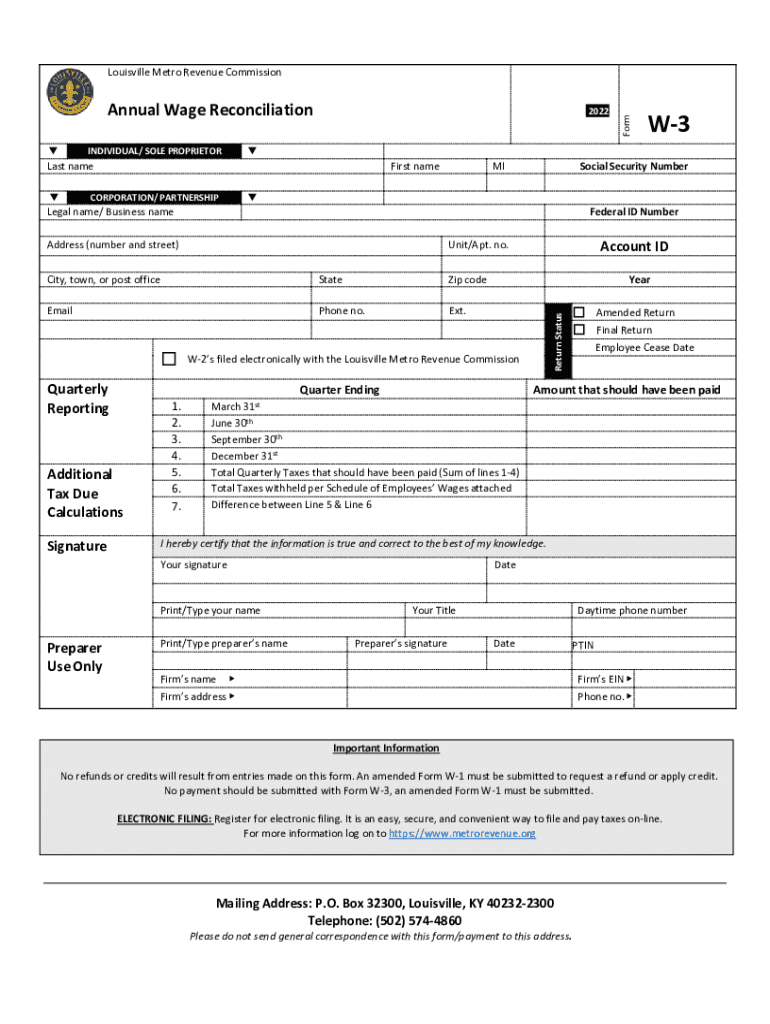

What is the ky form w3 louisville metro revenue used for?

The ky form w3 louisville metro revenue is a crucial form for businesses operating in Louisville Metro. It summarizes the employer’s wage and tax statements, providing essential information for tax purposes. Properly completing this form ensures compliance with local revenue regulations.

-

How can airSlate SignNow help with the ky form w3 louisville metro revenue?

airSlate SignNow streamlines the process of completing and submitting the ky form w3 louisville metro revenue. With its user-friendly eSignature capabilities, businesses can easily gather electronic signatures and securely send documents. This ensures that the form is completed accurately and submitted on time.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial which allows prospective users to explore its features, including handling forms like the ky form w3 louisville metro revenue. During the trial, businesses can evaluate the cost-effectiveness and ease of use before committing to a paid plan. This provides a risk-free opportunity to experience its benefits.

-

What pricing options does airSlate SignNow provide?

airSlate SignNow offers multiple pricing plans tailored to fit various business needs. Whether you are a small business or a large organization dealing with forms like the ky form w3 louisville metro revenue, there’s a plan that suits you. Each plan provides different features to ensure you get the best solution for your document signing needs.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow provides seamless integrations with a variety of applications like CRMs, cloud storage, and productivity tools. This allows businesses to automatically manage documents related to the ky form w3 louisville metro revenue within their existing workflows, enhancing efficiency and reducing errors.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers several advantages, such as enhanced security, faster processing times, and ease of use. Specifically for forms like the ky form w3 louisville metro revenue, the platform ensures that you can collect signatures quickly and securely. This leads to improved compliance and operational efficiency for your business.

-

Is airSlate SignNow compliant with local regulations?

Yes, airSlate SignNow is designed to comply with various local and federal regulations, including those related to eSignatures. This ensures that when you're handling the ky form w3 louisville metro revenue, you can be confident in the platform’s adherence to legal standards. This compliance helps protect your business from potential legal issues.

Get more for Fiscal Period For Income Tax Purposes Canada ca

- Fontana unified school district transfer form

- Georgia board of nursing license renewal form

- Panunumpa ng propesyonal sample filled up form

- Appaloosa horse club transfer form

- Symbols of st patricks day answer key form

- Law 553 fl arb eps 9 19 form

- Summerfall box tops for education participating products form

- Civil subpoena 790888746 form

Find out other Fiscal Period For Income Tax Purposes Canada ca

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template