Annual Reconciliation of Employers Quarterly Return of 2018

What is the Annual Reconciliation Of Employers Quarterly Return Of

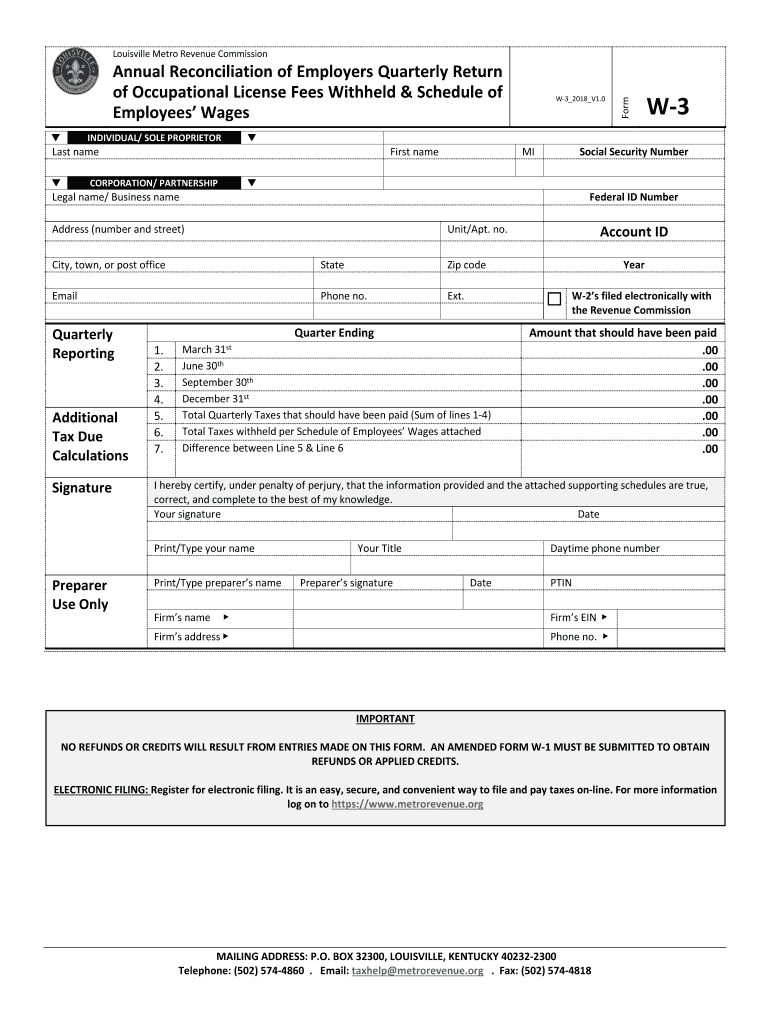

The Annual Reconciliation Of Employers Quarterly Return Of is a crucial form used by employers to summarize and reconcile the quarterly payroll tax returns submitted throughout the year. This form ensures that all payroll taxes, including federal income tax, Social Security, and Medicare taxes, are accurately reported and accounted for. It serves as a comprehensive overview of an employer's tax obligations and payments, ensuring compliance with federal tax regulations.

Steps to complete the Annual Reconciliation Of Employers Quarterly Return Of

Completing the Annual Reconciliation Of Employers Quarterly Return Of involves several key steps:

- Gather all quarterly payroll tax returns submitted during the year.

- Verify the accuracy of reported wages, tips, and taxes withheld.

- Calculate the total payroll taxes owed for the year.

- Compare the total with payments made throughout the year to identify any discrepancies.

- Complete the reconciliation form, ensuring all figures are accurate and consistent.

- Submit the completed form to the appropriate tax authority by the designated deadline.

Legal use of the Annual Reconciliation Of Employers Quarterly Return Of

The legal use of the Annual Reconciliation Of Employers Quarterly Return Of is critical for maintaining compliance with federal tax laws. This form must be completed accurately to avoid potential penalties or legal issues. Employers are required to retain copies of the form and any supporting documentation for a specified period, typically four years, to ensure they can provide evidence of compliance if audited by the IRS or state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Annual Reconciliation Of Employers Quarterly Return Of are typically set by the IRS and may vary by year. Generally, the form must be submitted by January 31 of the following year, aligning with the deadline for filing W-2 forms. Employers should be aware of these dates to ensure timely submission and avoid penalties for late filings.

Required Documents

To accurately complete the Annual Reconciliation Of Employers Quarterly Return Of, employers need to gather several key documents:

- Quarterly payroll tax returns (Form 941 or 944).

- W-2 forms issued to employees.

- Records of payroll payments made throughout the year.

- Any correspondence from the IRS regarding payroll taxes.

Who Issues the Form

The Annual Reconciliation Of Employers Quarterly Return Of is issued by the Internal Revenue Service (IRS). Employers must ensure they are using the most current version of the form, as updates and changes can occur. It is essential to stay informed about any modifications to ensure compliance with federal tax regulations.

Quick guide on how to complete annual reconciliation of employers quarterly return of

Effortlessly Prepare Annual Reconciliation Of Employers Quarterly Return Of on Any Device

Managing documents online has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Work on Annual Reconciliation Of Employers Quarterly Return Of from any device using the airSlate SignNow applications for Android or iOS and enhance your document-related processes today.

How to Edit and eSign Annual Reconciliation Of Employers Quarterly Return Of with Ease

- Locate Annual Reconciliation Of Employers Quarterly Return Of and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for such purposes.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Annual Reconciliation Of Employers Quarterly Return Of to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual reconciliation of employers quarterly return of

Create this form in 5 minutes!

How to create an eSignature for the annual reconciliation of employers quarterly return of

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the Annual Reconciliation Of Employers Quarterly Return Of?

The Annual Reconciliation Of Employers Quarterly Return Of is a process that ensures all payroll discrepancies are resolved by summarizing the quarterly returns submitted by employers. It is essential for maintaining accurate records for tax purposes and ensuring compliance with regulations. Businesses utilize this reconciliation to verify calculations and identify any necessary adjustments.

-

How can airSlate SignNow assist with the Annual Reconciliation Of Employers Quarterly Return Of?

airSlate SignNow provides a streamlined solution for sending and eSigning documents related to the Annual Reconciliation Of Employers Quarterly Return Of. By digitizing the process, it reduces the risk of errors and ensures timely submissions. The platform allows for easy tracking of documents, thereby enhancing organizational efficiency.

-

What are the pricing options for using airSlate SignNow for the Annual Reconciliation Of Employers Quarterly Return Of?

airSlate SignNow offers flexible pricing plans designed to meet the needs of businesses of all sizes working with the Annual Reconciliation Of Employers Quarterly Return Of. Plans typically include features like unlimited eSigning, templates, and integrations. Detailed pricing information can be found on our website, allowing you to choose a plan that fits your budget.

-

What features does airSlate SignNow offer that are beneficial for the Annual Reconciliation Of Employers Quarterly Return Of?

Key features of airSlate SignNow that are beneficial for the Annual Reconciliation Of Employers Quarterly Return Of include customizable templates, automated reminders, and secure cloud storage. These features help simplify the eSigning process, ensure accuracy, and keep all related documents organized and accessible at any time.

-

How does airSlate SignNow ensure the security of documents related to the Annual Reconciliation Of Employers Quarterly Return Of?

airSlate SignNow prioritizes the security of your documents through advanced encryption, secure cloud storage, and two-factor authentication. This ensures that all data related to the Annual Reconciliation Of Employers Quarterly Return Of is protected against unauthorized access. You can confidently manage sensitive information with our robust security measures in place.

-

Can airSlate SignNow integrate with other software for the Annual Reconciliation Of Employers Quarterly Return Of?

Yes, airSlate SignNow seamlessly integrates with many popular business applications, making it easier to manage your documentation for the Annual Reconciliation Of Employers Quarterly Return Of. These integrations improve workflow efficiencies and allow you to sync data across platforms for consistent record-keeping and compliance.

-

What benefits do businesses experience when using airSlate SignNow for the Annual Reconciliation Of Employers Quarterly Return Of?

Businesses using airSlate SignNow for the Annual Reconciliation Of Employers Quarterly Return Of benefit from increased efficiency, reduced processing time, and improved accuracy in document handling. The platform simplifies the eSigning process, allowing for faster turnaround times and minimizing delays associated with paper documents.

Get more for Annual Reconciliation Of Employers Quarterly Return Of

Find out other Annual Reconciliation Of Employers Quarterly Return Of

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online