SC1040TC SC Department of Revenue 2022-2026

What is the SC1040TC SC Department Of Revenue

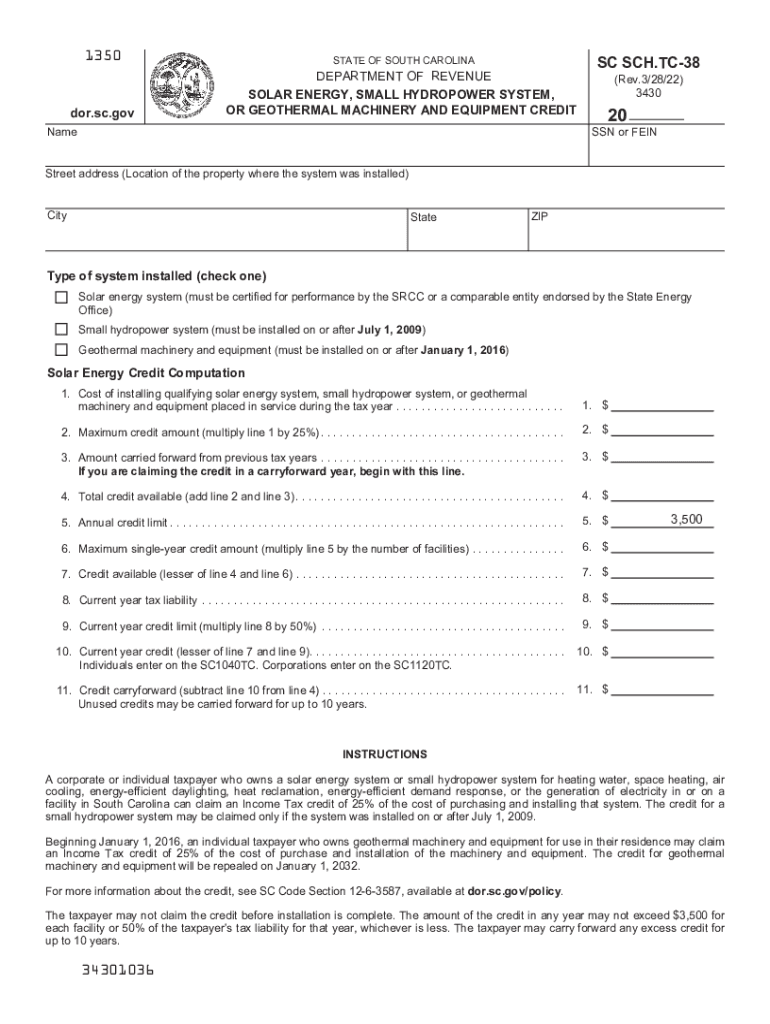

The SC1040TC is a form issued by the South Carolina Department of Revenue, specifically designed for taxpayers to claim tax credits related to solar energy systems. This form is essential for individuals and businesses that have invested in solar technology, allowing them to receive financial benefits through tax deductions. Understanding the SC1040TC is crucial for ensuring compliance with state tax regulations while maximizing available credits.

Steps to complete the SC1040TC SC Department Of Revenue

Completing the SC1040TC involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of purchase and installation of the solar energy system. Next, fill out the form by providing personal information, details of the solar installation, and the amount of the credit being claimed. It is important to double-check all entries for accuracy before submission. Finally, submit the completed form according to the guidelines provided by the South Carolina Department of Revenue, either online or via mail.

Legal use of the SC1040TC SC Department Of Revenue

The legal use of the SC1040TC is governed by state tax laws that outline eligibility for tax credits related to solar energy systems. To ensure the form is used appropriately, taxpayers must adhere to the specific requirements set forth by the South Carolina Department of Revenue. This includes ensuring that the solar system meets state standards and that all claims are substantiated with proper documentation. Non-compliance can result in penalties or denial of the claimed credits.

Eligibility Criteria for the SC1040TC SC Department Of Revenue

Eligibility for the SC1040TC is primarily based on the installation of solar energy systems in South Carolina. Taxpayers must have a qualified solar energy system installed on their property, which meets the criteria established by the state. Additionally, the taxpayer must be the owner of the system and have incurred eligible expenses related to its purchase and installation. It is advisable to review the specific eligibility requirements outlined by the South Carolina Department of Revenue to ensure compliance.

Required Documents for the SC1040TC SC Department Of Revenue

To successfully complete the SC1040TC, taxpayers must provide several key documents. These typically include proof of purchase for the solar energy system, installation receipts, and any relevant warranties or contracts. Additionally, documentation demonstrating that the system meets state requirements may be necessary. Keeping organized records will facilitate a smoother filing process and help substantiate claims made on the form.

Filing Deadlines / Important Dates for the SC1040TC SC Department Of Revenue

Filing deadlines for the SC1040TC align with the general tax filing deadlines set by the South Carolina Department of Revenue. Typically, taxpayers must submit their forms by the state tax return due date, which is usually April fifteenth. It is important to stay informed about any changes to these deadlines, as late submissions may result in penalties or the loss of potential credits. Marking important dates on a calendar can help ensure timely filing.

Form Submission Methods for the SC1040TC SC Department Of Revenue

Taxpayers have multiple options for submitting the SC1040TC to the South Carolina Department of Revenue. The form can be filed electronically through the department's online portal, which offers a streamlined process. Alternatively, taxpayers may choose to print the form and submit it via mail. In-person submissions may also be possible at designated tax offices. Each method has its own guidelines, so it is essential to follow the instructions provided for the chosen submission method.

Quick guide on how to complete sc1040tc sc department of revenue

Complete SC1040TC SC Department Of Revenue effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly and without delays. Manage SC1040TC SC Department Of Revenue on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to modify and eSign SC1040TC SC Department Of Revenue seamlessly

- Find SC1040TC SC Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document versions. airSlate SignNow efficiently addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign SC1040TC SC Department Of Revenue to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc1040tc sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sc sch tc 38 in relation to airSlate SignNow?

SC Sch TC 38 refers to a specific classification for document management solutions that meet certain compliance and security standards. airSlate SignNow aligns with these standards, ensuring that businesses can safely and effectively send and eSign documents without worrying about regulatory violations.

-

How does airSlate SignNow ensure compliance with sc sch tc 38?

airSlate SignNow ensures compliance with SC Sch TC 38 by employing robust security measures including encryption, user authentication, and audit trails. Our platform adheres to industry regulations to provide a safe environment for all document transactions, giving users peace of mind regarding their compliance requirements.

-

What are the key features of airSlate SignNow related to sc sch tc 38?

Key features of airSlate SignNow in relation to SC Sch TC 38 include customizable workflows, digital signatures, and real-time document tracking. These features not only enhance efficiency but also ensure that all document actions remain compliant with industry standards.

-

Is airSlate SignNow suitable for small businesses looking to comply with sc sch tc 38?

Yes, airSlate SignNow is absolutely suitable for small businesses looking to comply with SC Sch TC 38. Our platform offers an easy-to-use, cost-effective solution that helps small enterprises manage their document signing needs while maintaining compliance with necessary regulations.

-

What pricing plans does airSlate SignNow offer for users concerned about sc sch tc 38?

airSlate SignNow provides various pricing plans to cater to different business needs, including options that comply with SC Sch TC 38 standards. Each plan is designed to be budget-friendly while delivering all essential document management features required for compliance.

-

How can airSlate SignNow integrate with existing systems while addressing sc sch tc 38?

airSlate SignNow easily integrates with popular business applications and systems, helping users maintain compliance with SC Sch TC 38 effortlessly. Our API and pre-built integrations facilitate a seamless workflow, ensuring that your existing tools work smoothly together.

-

What benefits does airSlate SignNow provide for companies dealing with sc sch tc 38?

Companies dealing with SC Sch TC 38 will benefit from airSlate SignNow’s reliable document security, efficient eSignatures, and streamlined workflows. Moreover, users can quickly adapt to regulatory changes, ensuring ongoing compliance for business operations.

Get more for SC1040TC SC Department Of Revenue

- Dui certificate of completion form

- Boy scout service hours form

- The interior design handbook pdf download form

- Arizona residency documentation form

- Elements of architecture from form to place pdf

- Indiana state form 962

- Employee statement form 456251226

- Form of safe simple agreement for future equity

Find out other SC1040TC SC Department Of Revenue

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast