34301028 INSTRUCTIONS SC SCH TC 38 1350 2019

What is the SC 38 2016?

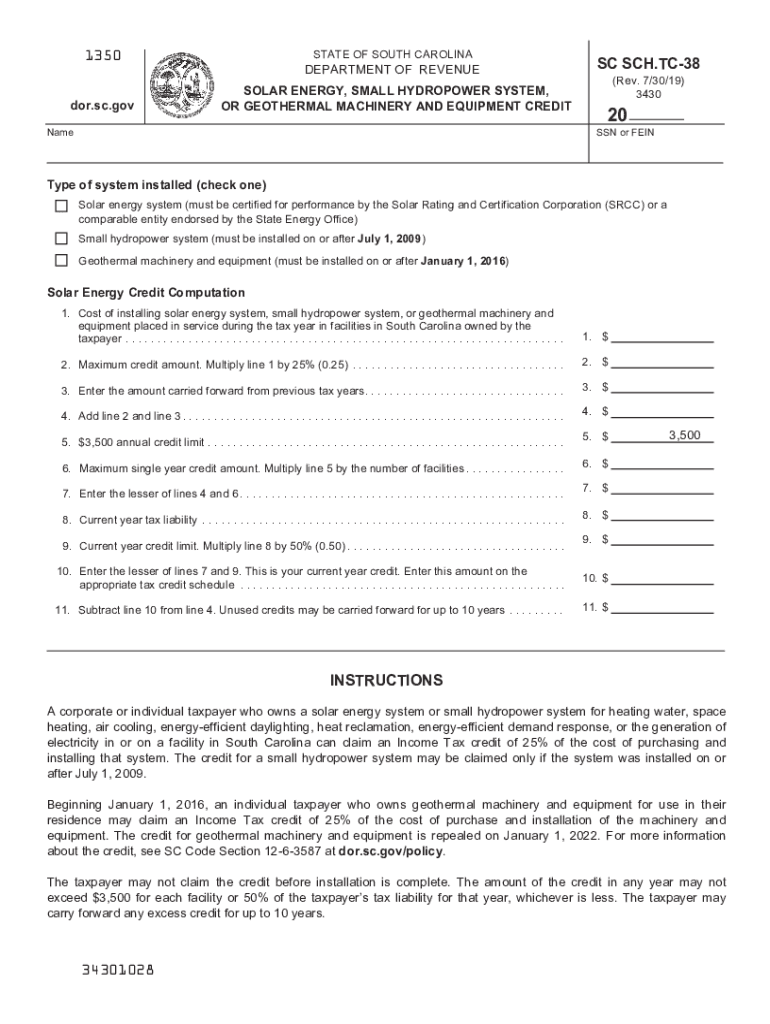

The SC 38 2016, also known as the South Carolina Solar Tax Credit Form, is a document used by taxpayers in South Carolina to claim tax credits for solar energy systems installed on residential or commercial properties. This form is essential for individuals or businesses that have invested in solar technology, allowing them to benefit from state tax incentives aimed at promoting renewable energy usage. By completing this form, taxpayers can receive a credit equal to a percentage of the total cost incurred for the solar installation, which can significantly reduce their tax liability.

Key elements of the SC 38 2016

The SC 38 2016 includes several key elements that are crucial for proper completion and submission. These elements typically consist of:

- Taxpayer Information: This section requires the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Installation Details: Taxpayers must provide information about the solar energy system, including installation dates and costs.

- Credit Calculation: The form outlines how to calculate the solar tax credit based on the total eligible expenses.

- Signature: A signature is required to certify that the information provided is accurate and complete.

Steps to complete the SC 38 2016

Completing the SC 38 2016 involves several steps to ensure accuracy and compliance with state regulations. Here are the steps to follow:

- Gather all necessary documentation, including receipts for the solar installation and any relevant contracts.

- Fill out the taxpayer information section with accurate personal details.

- Provide specific information about the solar energy system, including installation costs and dates.

- Calculate the tax credit based on the guidelines provided in the form.

- Review the completed form for accuracy before signing and dating it.

- Submit the form along with your state tax return by the designated deadline.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the SC 38 2016 to ensure timely submission and avoid penalties. Generally, the form must be filed with the South Carolina Department of Revenue along with the annual state tax return. Taxpayers should check for specific deadlines each tax year, as they may vary. Additionally, any changes in tax law can impact filing dates, so staying informed about updates is crucial.

Eligibility Criteria

To qualify for the solar tax credit using the SC 38 2016, taxpayers must meet specific eligibility criteria. These criteria typically include:

- The solar energy system must be installed on a property located in South Carolina.

- The system must be certified and meet the state's technical requirements.

- Taxpayers must have incurred eligible expenses related to the purchase and installation of the solar system.

Legal use of the SC 38 2016

The SC 38 2016 is legally binding when completed and submitted according to state regulations. It serves as an official request for tax credits and must be filled out truthfully to avoid issues with the South Carolina Department of Revenue. Understanding the legal implications of the information provided in this form is essential for taxpayers to ensure compliance and protect against potential audits or penalties.

Quick guide on how to complete 34301028 instructions sc schtc 38 1350

Effortlessly Prepare 34301028 INSTRUCTIONS SC SCH TC 38 1350 on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any hold-ups. Manage 34301028 INSTRUCTIONS SC SCH TC 38 1350 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign 34301028 INSTRUCTIONS SC SCH TC 38 1350 with Ease

- Find 34301028 INSTRUCTIONS SC SCH TC 38 1350 and click on Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require reprinting new document versions. airSlate SignNow satisfies all your document management needs in just a few clicks from your chosen device. Modify and eSign 34301028 INSTRUCTIONS SC SCH TC 38 1350 and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 34301028 instructions sc schtc 38 1350

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is SC 38 2016 and how does it relate to airSlate SignNow?

SC 38 2016 refers to specific compliance regulations that may impact electronic signatures. airSlate SignNow is designed to meet these regulations, ensuring that your eSignatures are legally binding and compliant. By using airSlate SignNow, you can confidently send and sign documents while adhering to SC 38 2016 standards.

-

Is airSlate SignNow a cost-effective solution for businesses working under SC 38 2016?

Yes, airSlate SignNow is a cost-effective solution catering to businesses needing to comply with SC 38 2016. The platform offers a range of pricing plans suited for every budget, allowing companies to choose an option that best fits their needs without sacrificing compliance. This ensures you get value while adhering to important regulations.

-

What features does airSlate SignNow offer for SC 38 2016 compliance?

airSlate SignNow offers features that support SC 38 2016 compliance, such as secure eSigning, audit trails, and template management. These tools help you maintain a clear record of document transactions and facilitate secure signatures for all parties involved. Utilizing these features enhances trust in your signing process while guaranteeing regulatory compliance.

-

Can airSlate SignNow integrate with other applications for SC 38 2016 documentation?

Absolutely! airSlate SignNow provides seamless integrations with various applications to ensure a smooth workflow for SC 38 2016 documentation. Whether you're using CRM software, cloud storage, or other business tools, you can integrate these with airSlate SignNow to streamline your eSigning process and maintain compliance.

-

How can airSlate SignNow benefit my workflow in relation to SC 38 2016?

Using airSlate SignNow can signNowly streamline your workflow when dealing with SC 38 2016 documentation. The platform allows for rapid document sending and signing, reducing turnaround time while ensuring compliance. This efficiency enables teams to focus on core tasks rather than getting bogged down by paperwork and regulations.

-

Is airSlate SignNow secure for handling documents under SC 38 2016?

Yes, airSlate SignNow ensures high-level security for all documents, which is crucial when handling materials under SC 38 2016. With features like encryption, user authentication, and secure storage, you can be confident that your sensitive documents are protected. This attention to security also reinforces compliance with SC 38 2016 requirements.

-

What support does airSlate SignNow offer for businesses verifying SC 38 2016 compliance?

airSlate SignNow provides excellent customer support to assist businesses in verifying SC 38 2016 compliance. Our support team is available to guide you through the eSigning process and address any questions regarding compliance-related features. This ensures you can effectively utilize airSlate SignNow while remaining compliant with necessary regulations.

Get more for 34301028 INSTRUCTIONS SC SCH TC 38 1350

- Jury instruction on or about knowingly only when willfulness or specific intent is not an element form

- Instruction of weapon form

- Jury instruction conspiracy form

- Jury instruction multiple objects for use with general conspiracy charge form

- Form rc 1

- Division of workers compensation austin representative form

- Form 480

- Potential third party liability notification dhcs 6168 form

Find out other 34301028 INSTRUCTIONS SC SCH TC 38 1350

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word