Withholding Forms SC Department of Revenue 2022-2026

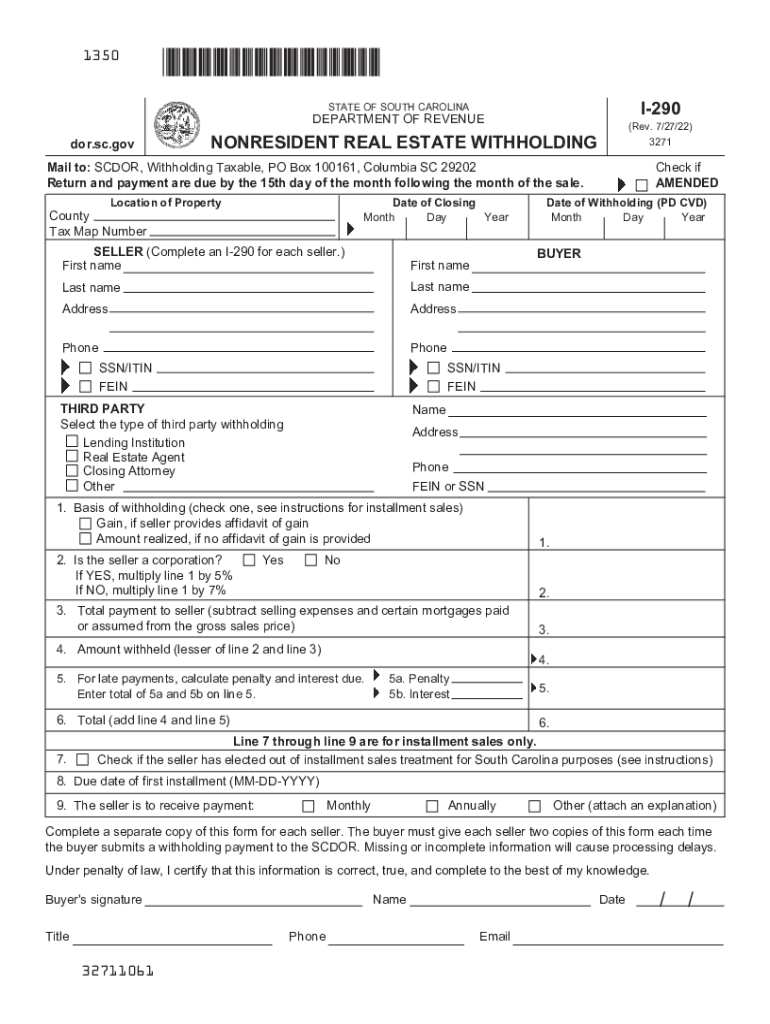

What is the South Carolina Form I-290?

The South Carolina Form I-290 is a withholding form issued by the South Carolina Department of Revenue. It is primarily used by employers to report and remit state income tax withheld from employees' wages. This form ensures compliance with state tax regulations and helps maintain accurate records for both employers and the state. Understanding the purpose and requirements of Form I-290 is essential for employers to avoid penalties and ensure proper tax reporting.

Steps to Complete the South Carolina Form I-290

Completing the South Carolina Form I-290 involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather Employee Information: Collect necessary details such as the employee's name, Social Security number, and address.

- Determine Withholding Amount: Calculate the amount of state income tax to withhold based on the employee's earnings and applicable tax rates.

- Fill Out the Form: Enter the gathered information and calculated withholding amounts into the appropriate fields on the form.

- Review for Accuracy: Double-check all entries for accuracy to prevent errors that could lead to compliance issues.

- Submit the Form: File the completed Form I-290 with the South Carolina Department of Revenue by the specified deadlines.

Legal Use of the South Carolina Form I-290

The legal use of the South Carolina Form I-290 is governed by state tax laws. Employers must ensure that the form is completed accurately and submitted on time to avoid penalties. The form serves as a legal document that verifies the withholding of state income tax from employees' wages. Compliance with the regulations surrounding this form is crucial for maintaining good standing with the South Carolina Department of Revenue and avoiding potential legal issues.

Filing Deadlines for the South Carolina Form I-290

Filing deadlines for the South Carolina Form I-290 are critical for employers to ensure timely compliance. Typically, the form must be submitted on a monthly or quarterly basis, depending on the amount of tax withheld. Employers should be aware of specific due dates to avoid late fees and penalties. Keeping a calendar of important tax filing dates can help ensure that all forms are submitted promptly.

Required Documents for the South Carolina Form I-290

When preparing to complete the South Carolina Form I-290, several documents are necessary to ensure accurate reporting:

- Employee Payroll Records: Documentation of employee wages and hours worked.

- Previous Tax Returns: Copies of prior year tax returns may be needed for reference.

- Tax Tables: Current state tax tables to determine withholding amounts accurately.

Having these documents ready will facilitate a smoother completion process for the form.

Who Issues the South Carolina Form I-290?

The South Carolina Form I-290 is issued by the South Carolina Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance with state tax regulations. Employers can obtain the form directly from the department's website or through official state publications. Understanding the role of the Department of Revenue is essential for employers to navigate the tax filing process effectively.

Quick guide on how to complete withholding forms sc department of revenue

Effortlessly Prepare Withholding Forms SC Department Of Revenue on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, enabling you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly and without interruptions. Manage Withholding Forms SC Department Of Revenue on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-driven workflow today.

The easiest way to alter and eSign Withholding Forms SC Department Of Revenue with minimal effort

- Obtain Withholding Forms SC Department Of Revenue and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Select relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you would like to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign Withholding Forms SC Department Of Revenue and guarantee outstanding communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding forms sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the withholding forms sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sc form i 290 and why is it important?

The sc form i 290 is a crucial document for individuals seeking to make adjustments to their immigration status. Understanding this form is essential as it can signNowly impact your application process and overall status in the U.S. airSlate SignNow makes it easy to complete and eSign the sc form i 290, ensuring accuracy and compliance.

-

How does airSlate SignNow simplify the sc form i 290 process?

airSlate SignNow simplifies the sc form i 290 process through its intuitive platform that allows users to fill out and electronically sign documents with ease. The step-by-step guidance ensures users do not miss critical information, which can lead to delays in processing. Additionally, users can save time and reduce paperwork errors with airSlate SignNow.

-

What are the pricing options for using airSlate SignNow to manage the sc form i 290?

airSlate SignNow offers various pricing plans tailored to meet different business needs, providing cost-effective solutions for managing documents like the sc form i 290. Plans are designed with flexibility in mind, ensuring you get the features you need without overpaying. It's advisable to visit the pricing page to explore the best option for your needs.

-

Are there any integrations available for airSlate SignNow that assist with the sc form i 290?

Yes, airSlate SignNow offers various integrations that streamline the workflow for the sc form i 290. You can connect with popular applications such as Salesforce, Google Drive, and Dropbox, enhancing productivity and ensuring easy access to your documents. These integrations facilitate a smoother experience when handling important forms.

-

What are the key features of airSlate SignNow for handling the sc form i 290?

Key features of airSlate SignNow for managing the sc form i 290 include customizable templates, real-time tracking of document status, and secure cloud storage. These features work together to enhance efficiency and ensure that your documents are processed timely and securely. With airSlate SignNow, you can manage all aspects of eSigning easily.

-

Is airSlate SignNow secure for sending and signing the sc form i 290?

Absolutely, airSlate SignNow prioritizes security for all documents, including the sc form i 290. The platform uses advanced encryption technology to protect your data during transmission and storage. This ensures that sensitive information is always secure and maintained in compliance with industry regulations.

-

Can I use airSlate SignNow on mobile devices for the sc form i 290?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to complete and eSign the sc form i 290 on-the-go. The mobile app offers all the essential features of the desktop version, providing flexibility and convenience for users who need to manage documents anytime, anywhere. This makes it ideal for busy professionals.

Get more for Withholding Forms SC Department Of Revenue

Find out other Withholding Forms SC Department Of Revenue

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed