Form I 290 2019

What is the Form I-290

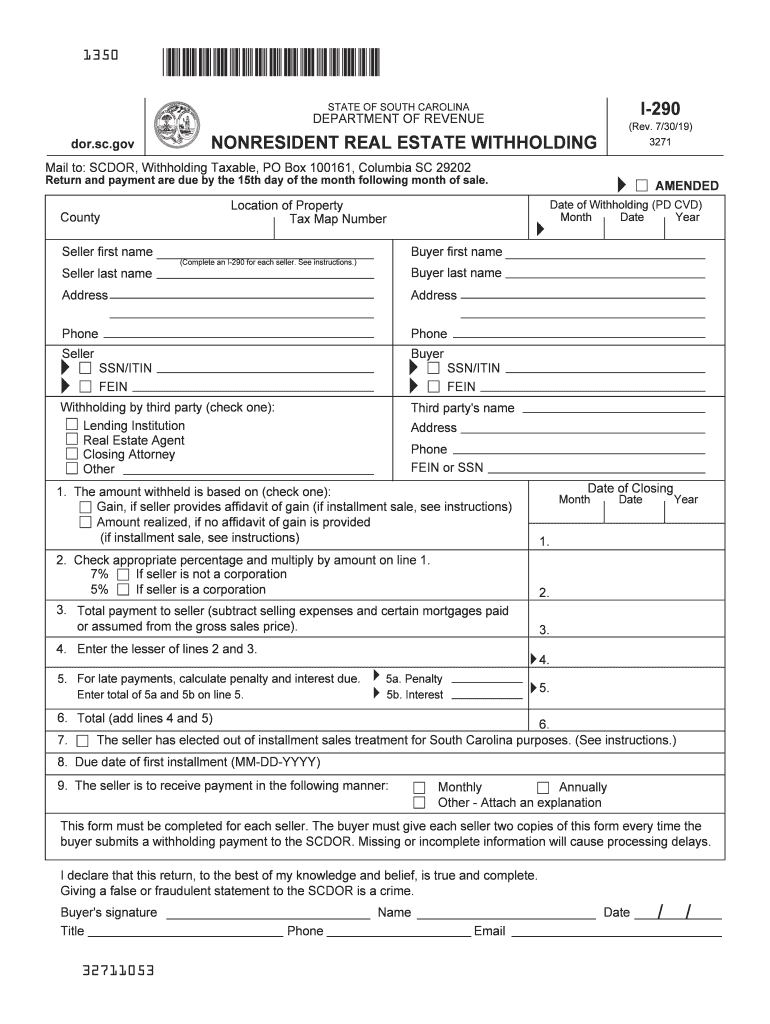

The Form I-290 is a document used in the United States for specific tax-related purposes, particularly in South Carolina. This form is often associated with the state’s revenue department and is essential for individuals and businesses to report certain tax situations. Understanding the purpose of the I-290 form is crucial for compliance with state tax regulations.

How to use the Form I-290

Using the Form I-290 involves filling it out accurately to reflect the necessary tax information. Individuals must ensure that all sections of the form are completed, including personal identification details and specific tax-related queries. After completing the form, it should be submitted according to the guidelines provided by the South Carolina Department of Revenue.

Steps to complete the Form I-290

Completing the Form I-290 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including previous tax returns and identification.

- Fill out personal information, including name, address, and Social Security number.

- Provide details regarding the specific tax situation being reported.

- Review the form for accuracy and completeness.

- Sign and date the form to validate it.

Legal use of the Form I-290

The legal use of the Form I-290 is governed by state tax laws. It is important to ensure that the form is used in compliance with these laws to avoid penalties. The form must be submitted within the designated time frame and should accurately reflect the taxpayer's situation to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the Form I-290 can vary based on individual circumstances and the type of tax situation being reported. It is essential to be aware of these deadlines to ensure timely submission. Missing a deadline can result in penalties or complications with tax filings.

Required Documents

To complete the Form I-290, certain documents are typically required. These may include:

- Previous tax returns for reference.

- W-2 forms or 1099s for income verification.

- Any relevant documentation supporting the claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

The Form I-290 can be submitted through various methods, depending on the preferences of the taxpayer and the guidelines set by the South Carolina Department of Revenue. Options typically include:

- Online submission through the state’s tax portal.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices.

Quick guide on how to complete wh 1601 south carolina department of revenue scgov

Complete Form I 290 effortlessly on any gadget

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your paperwork quickly without delays. Handle Form I 290 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and eSign Form I 290 effortlessly

- Obtain Form I 290 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent areas of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Revise and eSign Form I 290 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wh 1601 south carolina department of revenue scgov

Create this form in 5 minutes!

How to create an eSignature for the wh 1601 south carolina department of revenue scgov

How to make an eSignature for the Wh 1601 South Carolina Department Of Revenue Scgov in the online mode

How to make an electronic signature for your Wh 1601 South Carolina Department Of Revenue Scgov in Google Chrome

How to make an electronic signature for signing the Wh 1601 South Carolina Department Of Revenue Scgov in Gmail

How to generate an electronic signature for the Wh 1601 South Carolina Department Of Revenue Scgov right from your mobile device

How to make an electronic signature for the Wh 1601 South Carolina Department Of Revenue Scgov on iOS devices

How to make an electronic signature for the Wh 1601 South Carolina Department Of Revenue Scgov on Android

People also ask

-

What is the form i290 and why is it important for businesses?

The form i290 is a vital document used for various immigration-related processes. It's essential for businesses looking to sponsor foreign workers or manage immigration compliance. Properly completing and submitting the form i290 ensures adherence to legal requirements, facilitating smooth employment transitions.

-

How does airSlate SignNow help with the form i290 process?

airSlate SignNow streamlines the submission of form i290 by providing an intuitive eSignature solution. Users can easily send the form i290 for signatures and track the document's status in real-time. This efficiency minimizes delays and ensures compliance in the documentation process.

-

What are the pricing options for using airSlate SignNow for form i290?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including the management of form i290. Potential customers can choose from monthly or annual billing, and there are options for different user limits. This makes it cost-effective for companies of all sizes to streamline their documentation processes.

-

Can I integrate airSlate SignNow with other tools for managing form i290?

Yes, airSlate SignNow provides seamless integrations with various business tools and platforms. This capability allows users to automate workflows related to form i290 and connect with systems like CRMs, project management software, and more. Such integrations enhance productivity and reduce manual tasks.

-

What security measures does airSlate SignNow have for handling form i290?

airSlate SignNow prioritizes document security, especially for sensitive materials like form i290. The platform employs advanced encryption, secure data storage, and compliance with industry standards to protect customer information. This ensures that your documents are safe from unauthorized access.

-

How user-friendly is airSlate SignNow for filling out form i290?

airSlate SignNow boasts a user-friendly interface designed for ease of use. Whether you are new to form i290 or experienced, the platform simplifies the process with guided steps and intuitive navigation. This helps users quickly complete their forms without technical difficulties.

-

What benefits does airSlate SignNow offer when dealing with form i290?

Using airSlate SignNow to handle form i290 provides numerous benefits, including enhanced efficiency and reduced paperwork. The solution also improves accuracy through templates and error-checking features, ensuring the form i290 is correctly filled out. Moreover, the entire process is digital, saving time and resources.

Get more for Form I 290

- Transcript request state technical college of missouri form

- Transcript request form new mexico highlands university nmhu

- Hacc transcript request form

- Atlantic union college transcript request form

- Svcc transcript form

- Transcript request form south suburban college ssc

- Kane county il ged records form

- Iata document no 501601master shorter engine lea form

Find out other Form I 290

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast