NONRESIDENT REAL ESTATE WITHHOLDING 2020

What is the NONRESIDENT REAL ESTATE WITHHOLDING

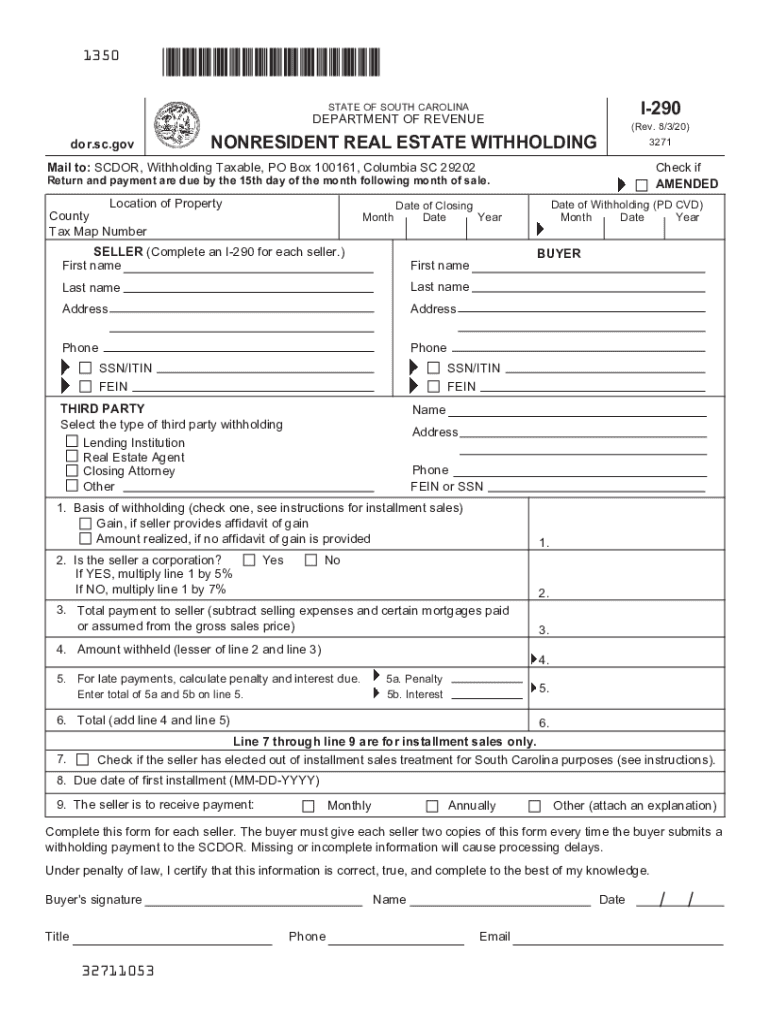

The NONRESIDENT REAL ESTATE WITHHOLDING is a tax mechanism employed by states, including South Carolina, to ensure that nonresident sellers of real estate pay taxes on any capital gains derived from the sale. This withholding is typically a percentage of the total sale price and applies to individuals or entities that are not residents of the state where the property is located. Understanding this withholding is crucial for nonresidents to comply with state tax laws and avoid penalties.

Steps to complete the NONRESIDENT REAL ESTATE WITHHOLDING

Completing the NONRESIDENT REAL ESTATE WITHHOLDING involves several key steps:

- Determine your residency status and confirm that you are a nonresident seller.

- Calculate the amount to be withheld based on the sale price of the property.

- Obtain the appropriate form, typically the SC Form I-290, to report the withholding.

- Fill out the form accurately, providing all required information, including details of the property and the seller.

- Submit the completed form to the South Carolina Department of Revenue along with the payment of the withheld amount.

Legal use of the NONRESIDENT REAL ESTATE WITHHOLDING

The legal use of the NONRESIDENT REAL ESTATE WITHHOLDING is governed by state tax laws, which require nonresidents to report and remit taxes on the sale of real estate. This withholding serves as a prepayment of the tax liability that the seller may incur. It is important for sellers to understand their obligations under the law to ensure compliance and avoid any legal repercussions.

Required Documents

To complete the NONRESIDENT REAL ESTATE WITHHOLDING process, several documents are necessary:

- The SC Form I-290, which is the official withholding form.

- Proof of the sale, such as a purchase agreement or closing statement.

- Identification documents to verify the seller's nonresident status.

- Any additional documentation required by the South Carolina Department of Revenue.

Filing Deadlines / Important Dates

It is essential to adhere to specific filing deadlines when dealing with the NONRESIDENT REAL ESTATE WITHHOLDING. Generally, the withholding must be submitted at the time of closing or within a specified period thereafter. Sellers should check with the South Carolina Department of Revenue for exact dates to ensure timely compliance and avoid penalties.

Penalties for Non-Compliance

Failing to comply with the NONRESIDENT REAL ESTATE WITHHOLDING requirements can lead to significant penalties. Noncompliance may result in fines, interest on unpaid taxes, and potential legal action by the state. It is crucial for nonresident sellers to understand their obligations and ensure that all forms and payments are submitted accurately and on time.

Quick guide on how to complete nonresident real estate withholding

Accomplish NONRESIDENT REAL ESTATE WITHHOLDING seamlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to access the appropriate document and securely maintain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage NONRESIDENT REAL ESTATE WITHHOLDING on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to alter and electronically sign NONRESIDENT REAL ESTATE WITHHOLDING effortlessly

- Locate NONRESIDENT REAL ESTATE WITHHOLDING and click Get Form to initiate.

- Leverage the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Select how you would like to deliver your form, via email, SMS, an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign NONRESIDENT REAL ESTATE WITHHOLDING and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nonresident real estate withholding

Create this form in 5 minutes!

How to create an eSignature for the nonresident real estate withholding

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the SC form IFA and how does it work?

The SC form IFA is a specific document format used for various transactions. With airSlate SignNow, you can easily create, send, and eSign SC form IFAs within minutes. Our platform streamlines the document workflow, ensuring that every step is efficient and secure.

-

What features does airSlate SignNow offer for SC form IFAs?

AirSlate SignNow offers several features tailored for SC form IFAs, including customizable templates, real-time collaboration, and robust electronic signature options. These features ensure that users can fill out and sign their documents quickly and accurately. Additionally, our platform supports document tracking and analytics to enhance workflow efficiency.

-

Is there a free trial available for SC form IFA on airSlate SignNow?

Yes, airSlate SignNow provides a free trial that allows users to explore the features available for SC form IFAs. This trial enables prospective customers to experience how easy it is to create, send, and eSign documents before committing to a subscription plan. Sign up today to take advantage of this opportunity.

-

How much does it cost to use airSlate SignNow for SC form IFAs?

The pricing for using airSlate SignNow varies based on the features you choose and the number of users in your organization. By utilizing our platform for SC form IFAs, businesses can access an affordable solution tailored to their signing and document management needs. Please check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other applications for SC form IFAs?

Absolutely! AirSlate SignNow offers numerous integrations with popular applications such as Salesforce, Google Drive, and Dropbox, making it convenient to manage SC form IFAs alongside your other tools. These integrations help create a seamless workflow by enabling users to keep all their documents and signatures in one place.

-

What are the benefits of using airSlate SignNow for SC form IFAs?

Using airSlate SignNow for SC form IFAs has several benefits, including increased efficiency, improved accuracy, and enhanced security. Our platform simplifies the signing process, reduces paperwork, and eliminates delays. Overall, businesses can save time and resources when managing their SC form IFAs.

-

Is airSlate SignNow secure for handling SC form IFAs?

Yes, airSlate SignNow prioritizes security for all documents, including SC form IFAs. We employ advanced security measures such as encryption and secure access controls to protect sensitive data. This ensures that your documents are safe and compliant with industry standards during the signing process.

Get more for NONRESIDENT REAL ESTATE WITHHOLDING

- Instructions for form rp 458 a application for alternative veterans exemption from real property taxation revised

- Michigan form 4891 cit annual return taxformfinder

- 2022 i 119 instructions for wisconsin schedule t wisconsin schedule t instructions form

- 4582 michigan business tax penalty and interest computatino for underpaid estimated tax 4582 michigan business tax penalty and form

- Electronic filing requirement for tax return preparers form

- State of georgia certificate of exemption of local form

- Pdf revenue division of department of treasury act 122 of form

- D2l2jhoszs7d12cloudfrontnetstatemichiganmichigan department of state refund request form a 226

Find out other NONRESIDENT REAL ESTATE WITHHOLDING

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed