SC DoR I 290 Fill Out Tax Template Online 2019

What is the SC DoR I 290 Fillable Form?

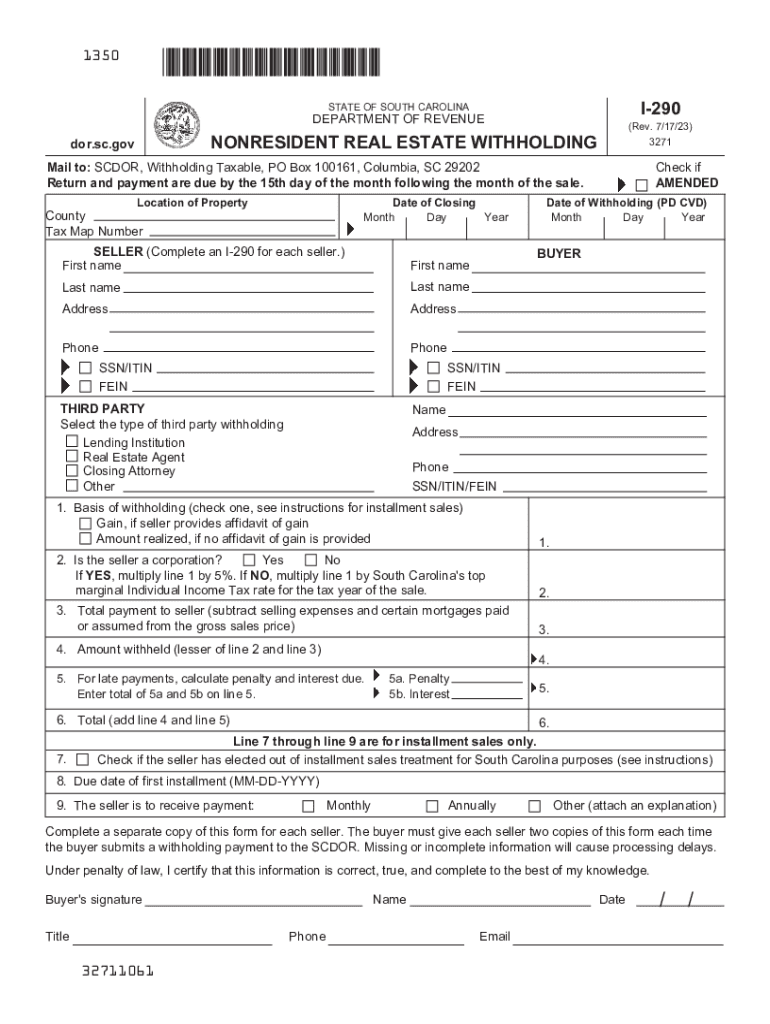

The SC DoR I 290 fillable form is a tax document utilized by residents of South Carolina to request a refund of overpaid taxes or to claim a credit. This form is issued by the South Carolina Department of Revenue (SCDOR) and is essential for individuals and businesses seeking to rectify their tax situations. Understanding the purpose of the SC I 290 is crucial for anyone looking to navigate the state's tax system effectively.

Steps to Complete the SC DoR I 290 Fillable Form

Completing the SC DoR I 290 fillable form involves several key steps:

- Gather necessary documents, including previous tax returns and any relevant financial statements.

- Access the fillable form online through the SCDOR website or a trusted digital platform.

- Input your personal information accurately, ensuring that all details match your official records.

- Detail the reasons for your refund request or credit claim, providing any supporting documentation as needed.

- Review the completed form for accuracy before submission.

Following these steps can help ensure a smooth filing process and minimize the chances of errors that could delay your refund.

Key Elements of the SC DoR I 290 Fillable Form

The SC DoR I 290 fillable form includes several critical components that must be completed accurately:

- Taxpayer Information: This section requires your name, address, and Social Security number.

- Reason for Request: Clearly state why you are filing the form, whether for a refund or credit.

- Financial Details: Provide information about the tax year in question and any amounts related to your claim.

- Signature: The form must be signed and dated to validate your request.

Understanding these elements is essential for ensuring that your form is filled out correctly and completely.

Legal Use of the SC DoR I 290 Fillable Form

The SC DoR I 290 fillable form is legally binding and must be used in accordance with South Carolina tax laws. Filing this form allows taxpayers to formally request adjustments to their tax obligations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or legal issues. Taxpayers should keep a copy of the submitted form for their records and may want to consult a tax professional if they have questions about their specific situation.

Filing Deadlines / Important Dates

Filing deadlines for the SC DoR I 290 fillable form vary depending on the nature of the request. Typically, taxpayers should submit the form within three years from the original tax return due date or the date the return was filed, whichever is later. It is essential to be aware of these deadlines to avoid missing out on potential refunds or credits. Keeping track of important dates can help ensure compliance with state tax regulations.

Form Submission Methods

The SC DoR I 290 fillable form can be submitted through various methods:

- Online: Many taxpayers prefer to submit the form electronically through the SCDOR website.

- Mail: The completed form can be printed and mailed to the appropriate SCDOR address.

- In-Person: Taxpayers may also choose to deliver the form in person at designated SCDOR offices.

Selecting the right submission method can depend on personal preference and urgency, so it's important to consider these options carefully.

Quick guide on how to complete sc dor i 290 fill out tax template online

Effortlessly Prepare SC DoR I 290 Fill Out Tax Template Online on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage SC DoR I 290 Fill Out Tax Template Online on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign SC DoR I 290 Fill Out Tax Template Online with Ease

- Locate SC DoR I 290 Fill Out Tax Template Online and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as an ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign SC DoR I 290 Fill Out Tax Template Online and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc dor i 290 fill out tax template online

Create this form in 5 minutes!

How to create an eSignature for the sc dor i 290 fill out tax template online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC I 290 fillable form used for?

The SC I 290 fillable form is utilized for filing motions to reopen or reconsider decisions made by the Immigration Courts. This form must be completed accurately to ensure proper processing of your request. Using our platform, you can easily fill out the SC I 290 fillable form with guidance on each section.

-

How can I access the SC I 290 fillable form?

You can access the SC I 290 fillable form directly through our airSlate SignNow platform. We provide a user-friendly interface that allows you to fill out the form online and save it for later use. This ensures that you have the most up-to-date version of the SC I 290 fillable form at your fingertips.

-

Is airSlate SignNow free to use for the SC I 290 fillable form?

While airSlate SignNow offers a variety of subscription plans, using the SC I 290 fillable form may require a paid plan for some features. We provide cost-effective solutions, so you can choose a plan that fits your needs and budget. Sign up today to see how affordable accessing the SC I 290 fillable form can be.

-

Can I save my progress while filling out the SC I 290 fillable form?

Yes, our platform allows you to save your progress while filling out the SC I 290 fillable form. This means you can return at any time to complete the form without losing any information. This feature enhances convenience and ensures that you can work on your form at your own pace.

-

Are there any integration options for the SC I 290 fillable form in airSlate SignNow?

airSlate SignNow integrates seamlessly with various applications, making it easy to manage the SC I 290 fillable form alongside your other essential tools. You can connect with CRMs, cloud storage services, and more to streamline your workflow. Our integrations help enhance efficiency when dealing with the SC I 290 fillable form.

-

What benefits does airSlate SignNow offer for filling out the SC I 290 fillable form?

Using airSlate SignNow for the SC I 290 fillable form provides a range of benefits, including easy navigation and prompt submission capabilities. Our platform enables electronic signatures, ensuring that your form is signed securely and efficiently. Additionally, you can track the status of your submissions in real-time.

-

How secure is my data when using the SC I 290 fillable form on airSlate SignNow?

Your data security is a top priority at airSlate SignNow. We implement advanced encryption technologies to safeguard your personal information when using the SC I 290 fillable form. Rest assured, your data is protected and managed with the utmost care on our platform.

Get more for SC DoR I 290 Fill Out Tax Template Online

- Amendment to prenuptial or premarital agreement maine form

- Financial statements only in connection with prenuptial premarital agreement maine form

- Revocation of premarital or prenuptial agreement maine form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children maine form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497310713 form

- Maine business form

- Pre incorporation agreement form

- Maine directors form

Find out other SC DoR I 290 Fill Out Tax Template Online

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors