Proposed Collection; Requesting Comments on Form 1097 BTC 2023

IRS Guidelines

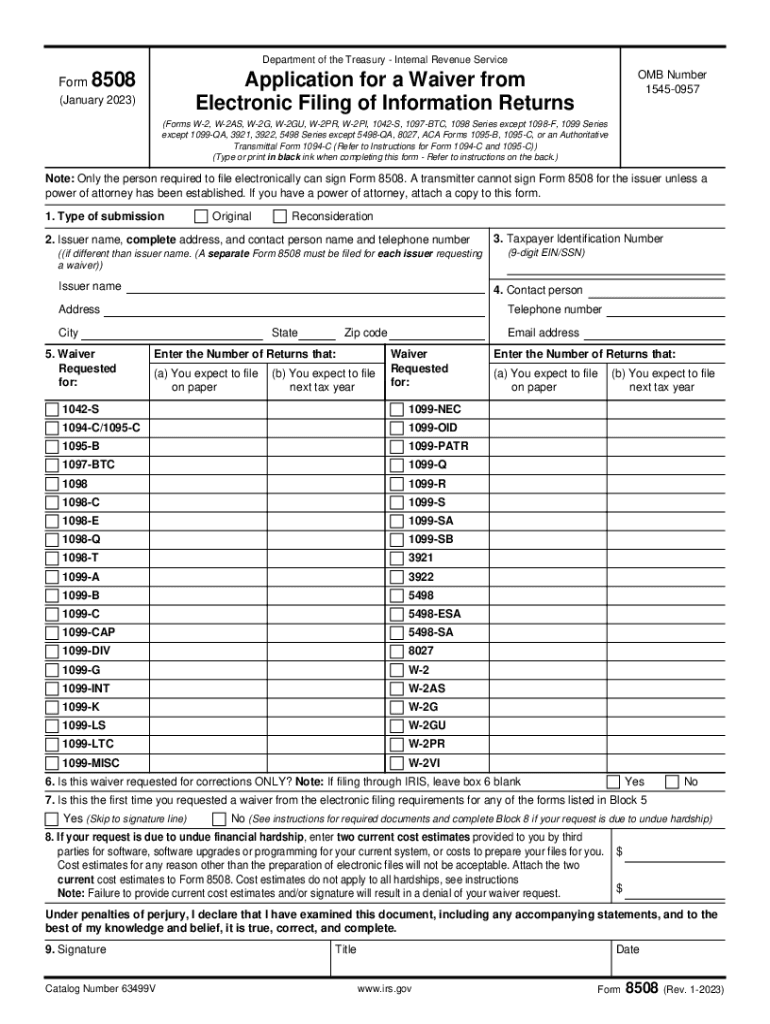

The Internal Revenue Service (IRS) provides essential guidelines for individuals and businesses regarding the submission of various forms, including the IRS 8508. Understanding these guidelines helps ensure compliance with federal regulations. The IRS outlines specific requirements for completing and submitting forms, including the necessary information and documentation needed for each type of request. Adhering to these guidelines can prevent delays and penalties associated with improper filings.

Filing Deadlines / Important Dates

Timely submission of the IRS 8508 is crucial to avoid penalties. The IRS sets specific deadlines for filing requests, which may vary based on the type of form and the taxpayer's situation. It is important to stay informed about these deadlines to ensure that all necessary forms are submitted on time. Missing a deadline can lead to complications in processing requests and potential fines.

Required Documents

When submitting an IRS 8508 request, certain documents must accompany the form to validate the request. These documents typically include identification information, prior tax filings, and any relevant supporting documentation that justifies the request. Ensuring that all required documents are included can expedite the processing time and increase the likelihood of approval.

Form Submission Methods (Online / Mail / In-Person)

The IRS offers various methods for submitting the IRS 8508 form. Taxpayers can choose to file online through the IRS website, which is often the fastest method. Alternatively, forms can be mailed to the appropriate IRS address or submitted in person at designated IRS offices. Each submission method has its own processing times and requirements, so it is essential to select the method that best suits the taxpayer's needs.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding the submission of forms, including the IRS 8508, can result in significant penalties. These penalties may include fines, interest on unpaid amounts, and additional scrutiny from the IRS. Understanding the consequences of non-compliance can motivate taxpayers to adhere to filing requirements and deadlines.

Eligibility Criteria

Not all taxpayers may qualify to submit the IRS 8508 request. The eligibility criteria depend on various factors, including the type of tax return being filed and the specific circumstances of the taxpayer. It is important to review the eligibility requirements carefully to determine if a request can be made. Meeting these criteria is essential for a successful submission.

Quick guide on how to complete proposed collection requesting comments on form 1097 btc

Effortlessly Prepare Proposed Collection; Requesting Comments On Form 1097 BTC on Any Device

Digital document management has gained traction among organizations and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, enabling you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any holdups. Manage Proposed Collection; Requesting Comments On Form 1097 BTC across any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Simplest Way to Modify and eSign Proposed Collection; Requesting Comments On Form 1097 BTC Effortlessly

- Find Proposed Collection; Requesting Comments On Form 1097 BTC and click Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or errors necessitating the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Proposed Collection; Requesting Comments On Form 1097 BTC and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct proposed collection requesting comments on form 1097 btc

Create this form in 5 minutes!

How to create an eSignature for the proposed collection requesting comments on form 1097 btc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an internal revenue service request?

An internal revenue service request refers to any formal inquiry made to the IRS regarding tax matters. Utilizing airSlate SignNow, you can efficiently prepare and eSign documents related to these requests, ensuring they're sent securely and in compliance with IRS guidelines.

-

How can airSlate SignNow assist with an internal revenue service request?

airSlate SignNow provides businesses with the tools to easily create, manage, and eSign documents related to internal revenue service requests. Our platform simplifies the process, allowing for quick submission and tracking of all submission statuses, streamlining your communication with the IRS.

-

What features does airSlate SignNow offer for handling internal revenue service requests?

Our platform includes features like document templates, real-time collaboration, and secure eSigning to help you prepare internal revenue service requests efficiently. You can also integrate with tools such as Google Drive and Dropbox for seamless document management.

-

Is there a pricing plan that suits businesses needing to submit internal revenue service requests?

Yes, airSlate SignNow offers flexible pricing plans designed to cater to different business needs, including those focused on internal revenue service requests. Whether you’re a small startup or a large enterprise, there's a plan to help you manage your documents affordably.

-

What are the benefits of using airSlate SignNow for internal revenue service requests?

By using airSlate SignNow for internal revenue service requests, you benefit from enhanced security, speed, and compliance. Our platform reduces processing times, minimizes errors, and ensures your submissions meet IRS standards, ultimately leading to better productivity.

-

Can I integrate airSlate SignNow with other tools I use for internal revenue service requests?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications to enhance your workflow for internal revenue service requests. Whether it’s CRMs or accounting software, our integrations ensure a smooth data exchange across platforms.

-

Is it easy to eSign documents for internal revenue service requests with airSlate SignNow?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it simple to eSign documents for internal revenue service requests. Our intuitive interface means any team member can quickly understand how to execute signatures and manage documents efficiently.

Get more for Proposed Collection; Requesting Comments On Form 1097 BTC

Find out other Proposed Collection; Requesting Comments On Form 1097 BTC

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online