Form 8508 Rev 10 Request for Waiver from Filing Information Returns Electronically Irs 2015

What is the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS

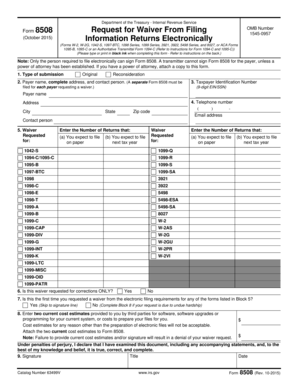

The Form 8508 Rev 10 is a request for a waiver from the requirement to file information returns electronically with the IRS. This form is particularly relevant for taxpayers who may not have the necessary technology or resources to comply with electronic filing mandates. By submitting this form, individuals or businesses can formally request permission to file their information returns in paper format instead of electronically. This form is crucial for ensuring compliance with IRS regulations while accommodating those who face challenges with electronic submissions.

How to Use the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS

Using the Form 8508 Rev 10 involves several steps to ensure that the request is processed smoothly. First, download the form from the IRS website or obtain a hard copy. Fill out the required sections, providing accurate information about your identity, the type of returns you wish to file, and the reasons for your waiver request. After completing the form, submit it to the IRS as instructed, ensuring that you keep a copy for your records. It is important to submit the form well in advance of the filing deadline to allow for processing time.

Steps to Complete the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS

Completing the Form 8508 Rev 10 requires careful attention to detail. Begin by entering your name, address, and taxpayer identification number. Next, specify the type of information returns for which you are requesting a waiver. Clearly state your reasons for the request, which may include lack of access to electronic filing tools or other valid circumstances. Review the form for accuracy before signing and dating it. Finally, submit the form to the appropriate IRS address, ensuring you follow any specific submission guidelines provided by the IRS.

Legal Use of the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS

The legal use of the Form 8508 Rev 10 is governed by IRS regulations regarding electronic filing. By submitting this form, taxpayers are formally requesting to be exempt from the electronic filing requirement, which is legally recognized by the IRS. Compliance with the submission guidelines is essential to ensure that the waiver request is valid. It is important to understand that the IRS may grant or deny the request based on the information provided, so accuracy and completeness are crucial.

Eligibility Criteria for the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS

Eligibility for submitting the Form 8508 Rev 10 primarily depends on the taxpayer's ability to comply with electronic filing requirements. Taxpayers who may qualify for a waiver include those who lack access to the necessary technology, have a limited number of returns to file, or face other legitimate barriers to electronic submission. It is important to clearly articulate these reasons in the waiver request to improve the chances of approval. Additionally, taxpayers should ensure they meet any other specific criteria outlined by the IRS.

Filing Deadlines / Important Dates for the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS

Filing deadlines for the Form 8508 Rev 10 are critical for taxpayers seeking a waiver from electronic filing. Generally, the form should be submitted at least 45 days before the due date of the information returns you intend to file. This timeline allows the IRS sufficient time to process the waiver request. It is essential to keep track of these deadlines to avoid penalties associated with late filing of information returns.

Quick guide on how to complete form 8508 rev 10 2015 request for waiver from filing information returns electronically irs

Complete Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically Irs effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically Irs on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically Irs without hassle

- Locate Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically Irs and click Get Form to initiate.

- Leverage the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically Irs and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8508 rev 10 2015 request for waiver from filing information returns electronically irs

Create this form in 5 minutes!

People also ask

-

What is Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS?

Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS is a form used by businesses to request a waiver from the IRS for the requirement to file information returns electronically. This form is essential for those who may find it challenging to comply with electronic filing mandates due to specific circumstances.

-

Who needs to submit Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS?

Any business or organization that is required to file information returns electronically yet seeks exemption due to hardship may need to submit Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS. It is important for entities that cannot meet e-filing requirements for reasons such as inadequate technology or staff resources.

-

How can airSlate SignNow assist in submitting Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS?

airSlate SignNow offers a streamlined process to create, sign, and submit the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS effectively. With its user-friendly interface and eSignature capability, businesses can quickly complete and send their waiver requests with confidence.

-

What are the benefits of using airSlate SignNow for filing information returns?

By using airSlate SignNow, businesses can enjoy a cost-effective and efficient way to eSign and submit their documentation, including the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS. This enhances productivity and streamlines processes, allowing organizations to focus on core business functions.

-

Is there a cost associated with using airSlate SignNow for filing the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS?

Yes, there is a nominal fee for using airSlate SignNow, which provides a robust platform for managing documents such as the Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS. The pricing is designed to be affordable and scalable, catering to businesses of all sizes.

-

Can airSlate SignNow integrate with other accounting or tax software for filing purposes?

Absolutely! airSlate SignNow offers integration features that allow seamless connectivity with various accounting and tax software. This simplifies the process of preparing and submitting Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS, enhancing overall efficiency.

-

What features does airSlate SignNow provide for eSigning documents like Form 8508 Rev 10?

airSlate SignNow provides features such as customizable templates, automated workflows, and audit trails for eSigning documents such as Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically IRS. These features ensure compliance and security while making the signing process swift and hassle-free.

Get more for Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically Irs

- Utah disclosure 497427525 form

- Notice of dishonored check criminal keywords bad check bounced check utah form

- Mutual wills containing last will and testaments for man and woman living together not married with no children utah form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children utah form

- Mutual wills or last will and testaments for man and woman living together not married with minor children utah form

- Non marital cohabitation living together agreement utah form

- Paternity law and procedure handbook utah form

- Bill of sale in connection with sale of business by individual or corporate seller utah form

Find out other Form 8508 Rev 10 Request For Waiver From Filing Information Returns Electronically Irs

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament