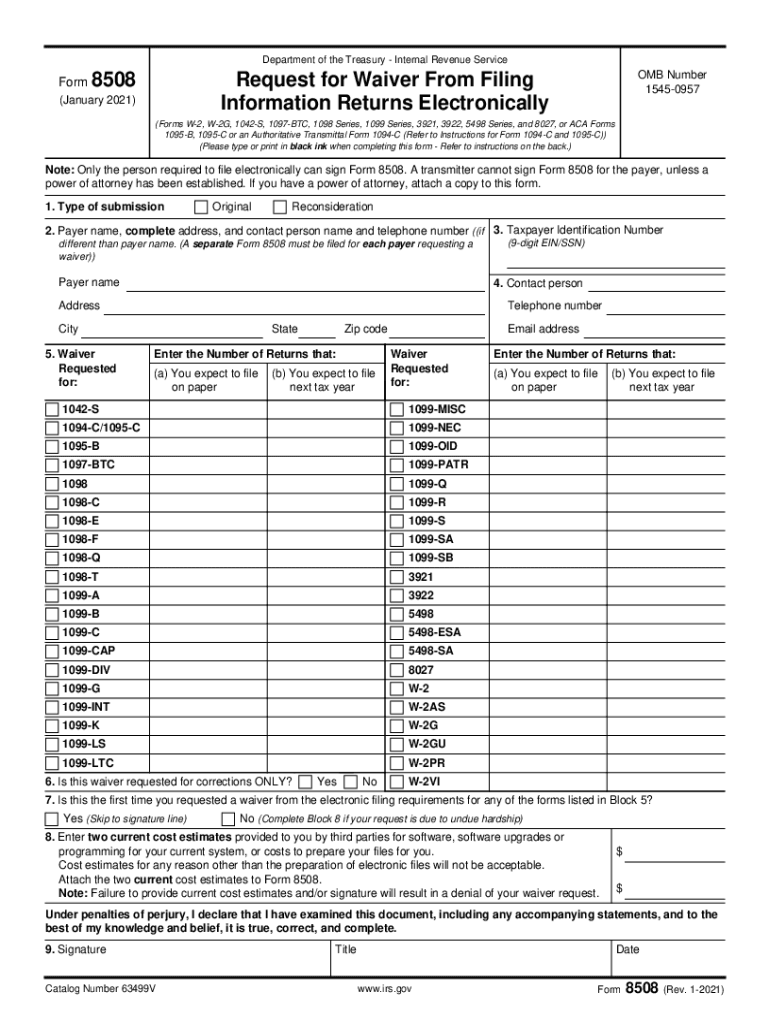

Internal Revenue Service Information 2021

What is the Internal Revenue Service Information

The Internal Revenue Service (IRS) is the U.S. government agency responsible for tax collection and tax law enforcement. It plays a crucial role in the administration of federal tax laws, ensuring compliance and facilitating the filing process for taxpayers. The IRS provides a range of information regarding tax obligations, forms, and guidelines to assist individuals and businesses in meeting their tax responsibilities. Understanding IRS information is essential for accurate filing and compliance with federal regulations.

Steps to complete the Internal Revenue Service Information

Completing IRS forms requires careful attention to detail to ensure accuracy and compliance. Here are the steps to effectively complete your IRS filing returns:

- Gather all necessary documentation, including income statements, deduction records, and previous tax returns.

- Choose the appropriate IRS form based on your filing status and type of income. Common forms include the 1040 for individual income tax returns.

- Fill out the form accurately, ensuring all required fields are completed. Double-check for any errors or omissions.

- Calculate your tax liability or refund based on the information provided.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, following the IRS guidelines for your chosen method.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for avoiding penalties and ensuring timely submissions. For the 2021 IRS filing returns, the standard deadline for individual tax returns is April 15, 2022. If you require additional time, you can file for an extension, which typically grants an extra six months. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete your IRS filing returns accurately, gather the following documents:

- W-2 forms from employers, detailing your annual earnings.

- 1099 forms for any freelance or contract work.

- Records of deductible expenses, such as receipts for business expenses or charitable contributions.

- Previous year’s tax return for reference.

- Any other relevant financial documents that may impact your tax situation.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting your IRS forms:

- Online: Many taxpayers choose to file electronically using tax software or through the IRS e-file system, which allows for faster processing and refunds.

- Mail: You can print your completed forms and mail them to the appropriate IRS address based on your location and the form type.

- In-Person: Some taxpayers may opt to file in person at designated IRS offices or authorized tax preparation sites.

Penalties for Non-Compliance

Failing to comply with IRS regulations can result in significant penalties. Common penalties include:

- Failure to file: If you do not file your tax return by the deadline, you may incur a penalty of five percent of the unpaid tax for each month the return is late.

- Failure to pay: If you do not pay the taxes owed by the due date, you may face a penalty of 0.5 percent of the unpaid tax for each month it remains unpaid.

- Accuracy-related penalties: If the IRS finds inaccuracies in your return, you may be subject to penalties based on the amount of tax underreported.

Quick guide on how to complete internal revenue service information

Complete Internal Revenue Service Information effortlessly on any device

Digital document management has become increasingly common among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can easily locate the correct form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Internal Revenue Service Information on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Internal Revenue Service Information seamlessly

- Locate Internal Revenue Service Information and then click Get Form to begin.

- Use the tools available to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether through email, SMS, or an invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Internal Revenue Service Information and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service information

Create this form in 5 minutes!

People also ask

-

What is the significance of the 2021 IRS filing returns?

The 2021 IRS filing returns are crucial as they determine your tax obligations for the year. Understanding the requirements can help you avoid delays and penalties while ensuring compliance with tax regulations. Make sure to keep all your documents organized to facilitate a smooth filing process.

-

How can airSlate SignNow assist with the 2021 IRS filing returns?

airSlate SignNow provides a seamless solution for digitally signing and sending necessary documents related to your 2021 IRS filing returns. This ensures that your filings are submitted promptly and securely. The platform simplifies collaboration, making it easier to gather necessary signatures from all parties.

-

What pricing options are available for using airSlate SignNow for my 2021 IRS filing returns?

airSlate SignNow offers various pricing plans tailored to suit different business needs, making it cost-effective for handling your 2021 IRS filing returns. Each plan provides access to essential features, ensuring you get the most out of your experience. You can choose a plan that fits your volume of transactions and document management requirements.

-

Are there any integrations available with airSlate SignNow to help with the 2021 IRS filing returns?

Yes, airSlate SignNow integrates with popular applications like CRM systems and project management tools to streamline your document workflows. This is especially useful during the 2021 IRS filing returns process as you can pull in relevant data directly from your existing software. Integrations enhance efficiency and reduce the chances of errors.

-

What benefits does airSlate SignNow offer for handling my 2021 IRS filing returns?

Using airSlate SignNow for your 2021 IRS filing returns offers numerous benefits, including improved efficiency and enhanced security. Our platform simplifies the signing process, allowing you to manage documents from anywhere at any time. This ensures you never miss a deadline when filing your taxes.

-

Is airSlate SignNow user-friendly for those unfamiliar with e-signatures when filing 2021 IRS returns?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy to navigate even for those unfamiliar with e-signatures. Our intuitive interface guides you through the process of signing and sending documents related to your 2021 IRS filing returns. Support resources are also available to assist you.

-

Can I track the status of my documents when using airSlate SignNow for 2021 IRS filing returns?

Yes, airSlate SignNow allows you to track the status of your documents in real time. This feature is particularly beneficial during the 2021 IRS filing returns process, as you can confirm when your documents are signed and sent. Keeping tabs on your submissions helps ensure that your filing process runs smoothly.

Get more for Internal Revenue Service Information

- Recording patent form

- Malicious prosecution nc form

- Agreement to provide in home personal care services form

- Contract with self employed independent contractor to sell video surveillance cameras with provisions for termination with or form

- Petition writ habeas form

- Gift form

- Sample letter for erroneous information on credit report

- Forwarding correspondence form

Find out other Internal Revenue Service Information

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free