Form it 2104 SNY Certificate of Exemption from Withholding

What is the Form IT 2104 SNY Certificate Of Exemption From Withholding

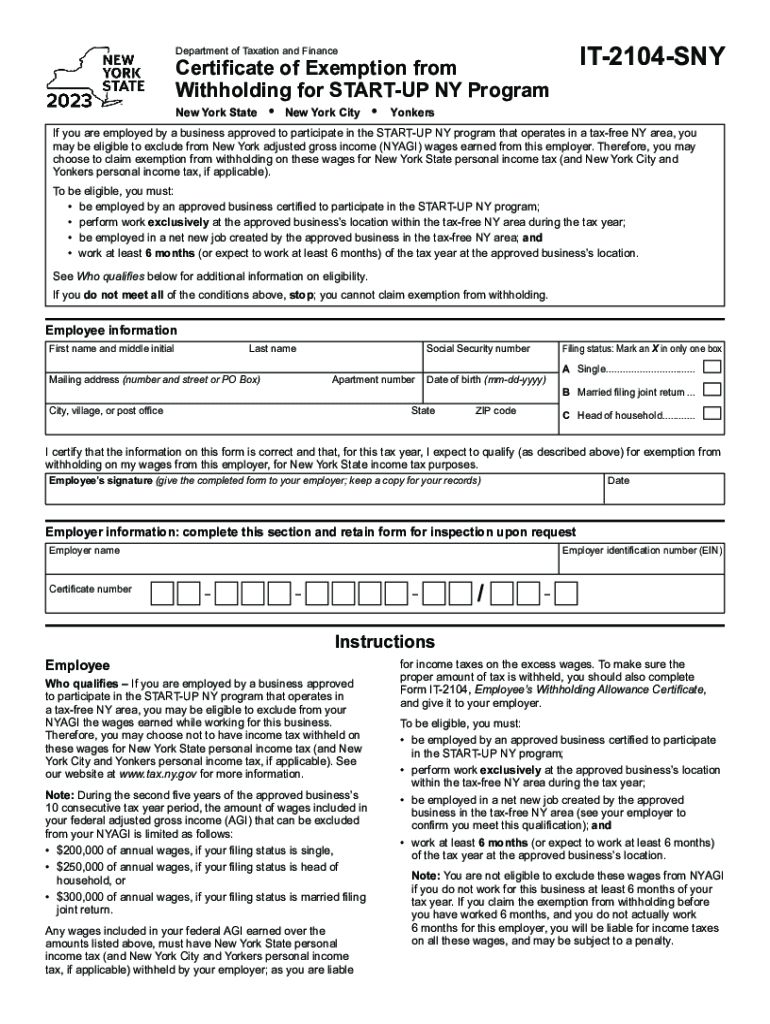

The Form IT 2104 SNY is a certificate of exemption from withholding that allows certain individuals to claim exemption from New York State income tax withholding. This form is primarily used by residents who meet specific criteria, such as having no tax liability in the previous year and expecting none in the current year. By submitting this form to their employer, individuals can ensure that no state income tax is withheld from their paychecks, which can provide immediate financial relief.

How to use the Form IT 2104 SNY Certificate Of Exemption From Withholding

To utilize the Form IT 2104 SNY, individuals must first determine their eligibility for exemption. Once confirmed, they should complete the form accurately, providing necessary personal information and confirming their exemption status. After filling out the form, it should be submitted to the employer's payroll department. It is important to keep a copy for personal records and to monitor any changes in tax liability that may affect future withholding.

Steps to complete the Form IT 2104 SNY Certificate Of Exemption From Withholding

Completing the Form IT 2104 SNY involves several straightforward steps:

- Gather personal information, including your name, address, and Social Security number.

- Review the eligibility criteria to ensure you qualify for exemption.

- Fill out the form, providing accurate details as required.

- Sign and date the form to validate your claims.

- Submit the completed form to your employer's payroll department.

Legal use of the Form IT 2104 SNY Certificate Of Exemption From Withholding

The Form IT 2104 SNY is legally recognized for claiming exemption from state income tax withholding. To ensure its legal validity, it must be filled out accurately and submitted timely to the employer. Misuse of the form or providing false information can lead to penalties, including back taxes owed and potential fines. It is essential to understand the legal implications of claiming exemption and to maintain compliance with state tax regulations.

Eligibility Criteria

To qualify for exemption using the Form IT 2104 SNY, individuals must meet specific criteria, including:

- Having no tax liability in the previous tax year.

- Expecting no tax liability in the current tax year.

- Being a resident of New York State.

It is crucial to review these criteria carefully to avoid any potential issues with tax withholding.

Form Submission Methods

The Form IT 2104 SNY can be submitted through various methods, depending on the employer's policies. Common submission methods include:

- In-person delivery to the payroll department.

- Email submission, if permitted by the employer.

- Mailing a hard copy to the employer's payroll office.

Confirming the preferred method with the employer can ensure timely processing of the form.

Quick guide on how to complete form it 2104 sny certificate of exemption from withholding

Effortlessly Prepare Form IT 2104 SNY Certificate Of Exemption From Withholding on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Manage Form IT 2104 SNY Certificate Of Exemption From Withholding on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Form IT 2104 SNY Certificate Of Exemption From Withholding with Ease

- Find Form IT 2104 SNY Certificate Of Exemption From Withholding and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for such tasks.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal weight as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form IT 2104 SNY Certificate Of Exemption From Withholding to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 2104 sny certificate of exemption from withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 2104 sny and how does it relate to airSlate SignNow?

2104 sny refers to our comprehensive eSignature solution designed to streamline document signing processes. With airSlate SignNow, businesses can easily implement 2104 sny to enhance workflow efficiency and ensure that documents are signed promptly and securely.

-

What features does airSlate SignNow offer with 2104 sny?

The 2104 sny solution includes features such as customizable templates, multi-party signing, and secure document storage. These features enable users to create a seamless signing experience that complies with legal standards, ensuring that every document is easily accessible and securely managed.

-

How much does it cost to use airSlate SignNow for 2104 sny?

Pricing for airSlate SignNow with the 2104 sny functionality is competitive and varies based on your business needs. We offer various plans that provide flexible pricing options to accommodate businesses of all sizes, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow’s 2104 sny with other software?

Yes, airSlate SignNow’s 2104 sny can be easily integrated with a wide range of applications, enhancing your existing workflows. Popular integrations include CRM systems, cloud storage services, and productivity tools, allowing for a more efficient document signing process.

-

What are the benefits of using 2104 sny for digital signatures?

Using 2104 sny for digital signatures provides numerous benefits like improved efficiency, lower operational costs, and increased compliance. Businesses can reduce turnaround times for document signing, which enhances customer satisfaction and accelerates business processes.

-

Is 2104 sny secure for signing sensitive documents?

Absolutely, airSlate SignNow’s 2104 sny is designed with security in mind. It includes advanced encryption, multi-factor authentication, and compliance with industry standards, ensuring that your sensitive documents are always protected during the signing process.

-

How can I get started with 2104 sny on airSlate SignNow?

Getting started with 2104 sny on airSlate SignNow is simple. You can sign up for a free trial to explore the platform's features and capabilities, allowing your team to test the eSignature solution before committing to a paid plan.

Get more for Form IT 2104 SNY Certificate Of Exemption From Withholding

- Hits screening tool printable form

- Utah bill of sale in consideration of example form

- Celhs form

- Boat lease agreement form

- Medication review template form

- Sole responsibility letter template form

- Trumbull county auditor property search form

- Garage sale permit application by city cityofconroe org form

Find out other Form IT 2104 SNY Certificate Of Exemption From Withholding

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe