PA DoR RCT 121C Form 2022-2026

What is the PA DoR RCT 121C Form

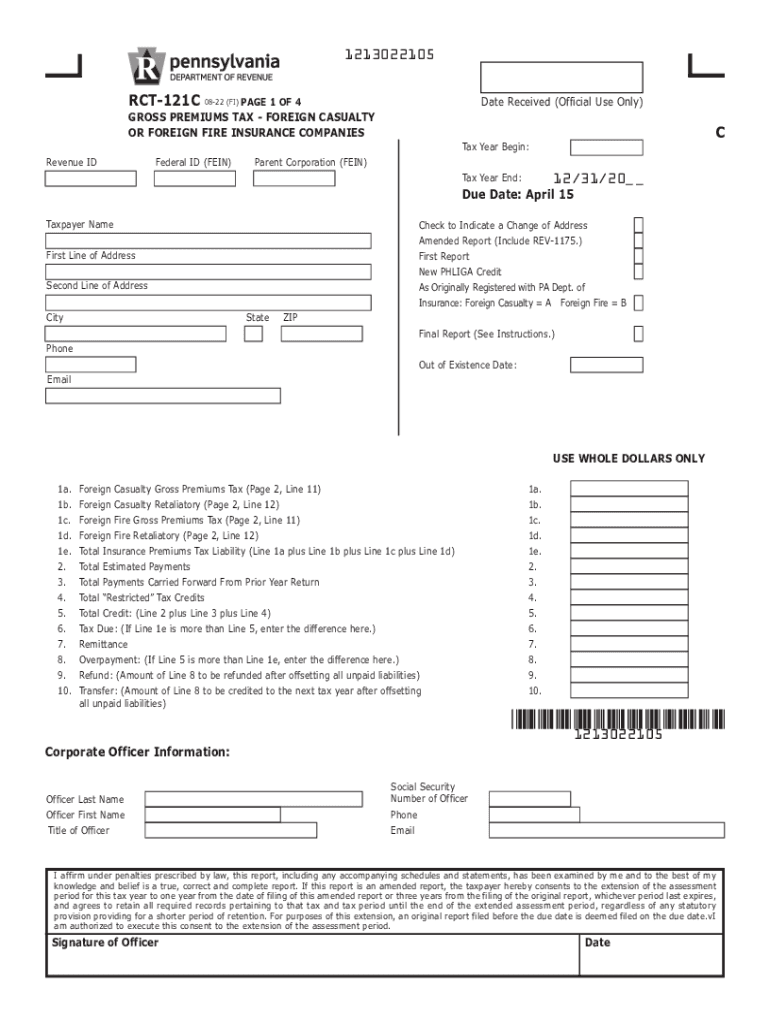

The PA DoR RCT 121C Form is a tax document used by foreign fire insurance companies operating in Pennsylvania. This form is essential for reporting the premium taxes owed to the state. It ensures that these companies comply with state regulations regarding the taxation of insurance premiums. The form captures vital information about the company's operations and the premiums collected, which is crucial for accurate tax assessment.

How to use the PA DoR RCT 121C Form

Using the PA DoR RCT 121C Form involves several steps. Initially, ensure you have the latest version of the form, which can be obtained from the Pennsylvania Department of Revenue. Fill out the required fields accurately, including details about your company and the premiums collected. Once completed, the form must be submitted to the appropriate state authority by the specified deadline to avoid penalties.

Steps to complete the PA DoR RCT 121C Form

Completing the PA DoR RCT 121C Form requires careful attention to detail. Follow these steps:

- Download the latest version of the form from the Pennsylvania Department of Revenue website.

- Provide your company’s name, address, and federal identification number.

- Report the total premiums collected during the tax year.

- Calculate the tax owed based on the reported premiums.

- Sign and date the form to certify its accuracy.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the PA DoR RCT 121C Form. Typically, the form must be submitted by March 1 of each year for the previous tax year. Keeping track of these dates helps ensure compliance and avoids potential penalties for late submissions.

Penalties for Non-Compliance

Failure to file the PA DoR RCT 121C Form on time can result in significant penalties. The Pennsylvania Department of Revenue may impose fines based on the amount of tax owed or the length of the delay in filing. Additionally, non-compliance can lead to further legal complications, making it essential for companies to adhere to the filing requirements.

Required Documents

When completing the PA DoR RCT 121C Form, certain documents may be required to support the information provided. These documents typically include:

- Financial statements detailing premium collections.

- Proof of the company's operations within Pennsylvania.

- Any prior tax returns filed with the state.

Who Issues the Form

The PA DoR RCT 121C Form is issued by the Pennsylvania Department of Revenue. This state agency is responsible for tax collection and enforcement, ensuring that all businesses operating within Pennsylvania comply with state tax laws. The department provides resources and guidance for completing the form accurately.

Quick guide on how to complete pa dor rct 121c form

Effortlessly Prepare PA DoR RCT 121C Form on Any Device

Digital document management has become increasingly favored by both companies and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, as you can locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without any holdups. Manage PA DoR RCT 121C Form on any device using airSlate SignNow’s Android or iOS applications and streamline your document-related processes today.

How to Modify and eSign PA DoR RCT 121C Form With Ease

- Find PA DoR RCT 121C Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign PA DoR RCT 121C Form to maintain exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa dor rct 121c form

Create this form in 5 minutes!

How to create an eSignature for the pa dor rct 121c form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rct 121c tax form and why is it important?

The rct 121c tax form is a crucial document for businesses in Ireland, particularly for those paying Corporation Tax. It provides details on your company's tax obligations and compliance. Submitting this form correctly can help prevent penalties and ensure that your business remains in good standing with tax authorities.

-

How can airSlate SignNow help with managing rct 121c tax documents?

airSlate SignNow offers a seamless solution for handling rct 121c tax documents by allowing you to digitally sign, store, and send your tax forms securely. With its user-friendly interface, businesses can streamline their document workflow, reducing the time spent on paperwork. This makes managing your rct 121c tax filings easier and more efficient.

-

What features does airSlate SignNow offer for rct 121c tax compliance?

airSlate SignNow includes features like electronic signatures, document templates, and secure storage, all critical for ensuring rct 121c tax compliance. These tools simplify your document management process, allowing for easy access to important tax forms and ensuring that your submissions are accurate and timely. Enhanced collaboration features also allow multiple team members to work on documents simultaneously.

-

Is there a pricing plan for using airSlate SignNow for rct 121c tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business sizes and needs, making it a cost-effective solution for managing rct 121c tax forms. Each plan includes essential features like e-signatures and document sharing. Businesses can choose a plan that fits their budget while ensuring efficient tax document management.

-

Can airSlate SignNow integrate with other accounting software for rct 121c tax management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, facilitating efficient rct 121c tax management. This integration allows for automatic updates and document sharing between platforms, streamlining the overall tax filing process. With these integrations, you can maintain accurate records and ensure compliance effortlessly.

-

How secure is airSlate SignNow for handling rct 121c tax documents?

Security is a top priority for airSlate SignNow, particularly when handling sensitive rct 121c tax documents. The platform employs industry-standard encryption, secure cloud storage, and access controls to keep your documents safe. You can confidently manage your tax filings without worrying about unauthorized access or data bsignNowes.

-

What are the benefits of choosing airSlate SignNow for rct 121c tax submissions?

Choosing airSlate SignNow offers numerous benefits for rct 121c tax submissions, including time savings, reduced paperwork, and improved accuracy. Its intuitive platform minimizes the chances of errors while enhancing collaboration among team members. Moreover, digital signatures expedite the submission process, ensuring that your forms are filed promptly.

Get more for PA DoR RCT 121C Form

- Stanford application form pdf

- Ys 1 supplemental application form

- Atomic habits contract form

- Instrument check out form

- Argosy university transcripts form

- Printable blank printable spectrum noir color chart form

- Montessori assessment checklist form

- Objection to petition to relocate with minor children form

Find out other PA DoR RCT 121C Form

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online