MT DoR MW 3 Form 2022

What is the MT DoR MW 3 Form

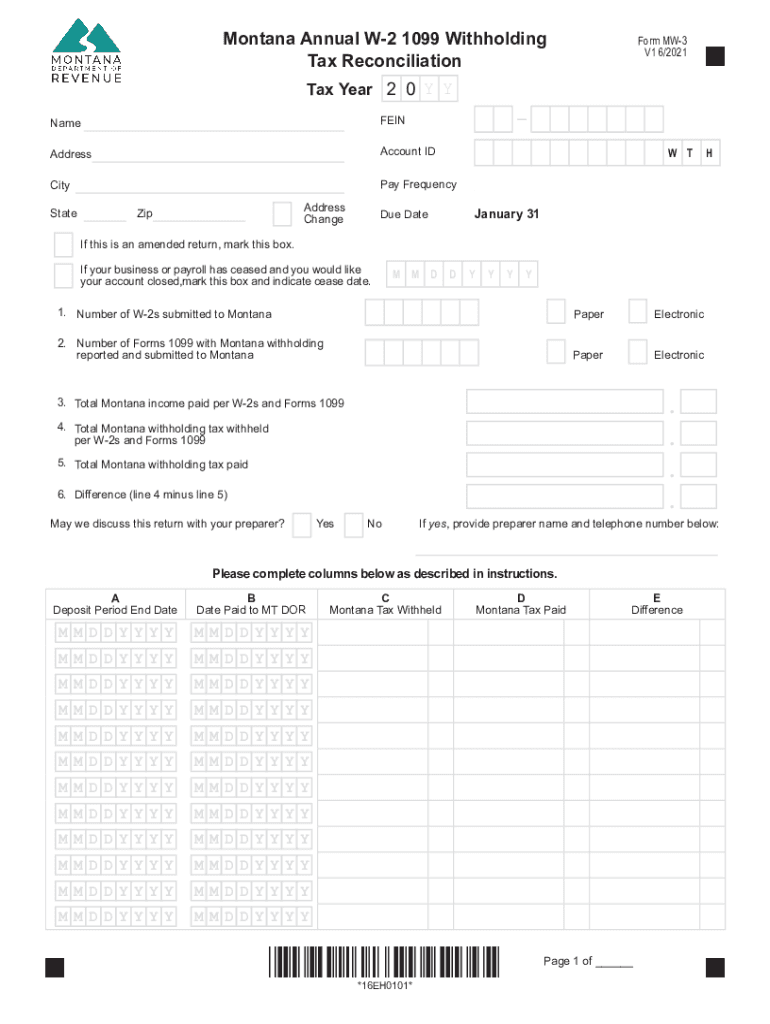

The MT DoR MW 3 Form, commonly referred to as the Montana Rev, is a crucial document used for reporting annual withholding tax information in the state of Montana. This form is primarily used by employers to report the total amount of wages paid to employees and the corresponding state income tax withheld. It serves as a summary of the withholding tax obligations for the year and is essential for both employers and the Montana Department of Revenue.

How to use the MT DoR MW 3 Form

Using the MT DoR MW 3 Form involves several steps to ensure accurate reporting. Employers must first gather all necessary payroll information, including total wages and taxes withheld for each employee. Once this data is compiled, it can be entered into the form. It is important to verify that all information is correct before submission, as inaccuracies can lead to penalties. The completed form can then be submitted electronically or via mail, depending on the employer's preference.

Steps to complete the MT DoR MW 3 Form

Completing the MT DoR MW 3 Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all payroll records for the tax year.

- Calculate the total wages paid to each employee.

- Determine the total state income tax withheld from each employee's wages.

- Fill in the required fields on the form, ensuring all information is accurate.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the Montana Department of Revenue's online portal or mail it to the appropriate address.

Legal use of the MT DoR MW 3 Form

The legal use of the MT DoR MW 3 Form is governed by Montana state tax laws. Employers are required to file this form annually to comply with state tax regulations. Failure to submit the form on time or providing inaccurate information can result in penalties, including fines and interest on unpaid taxes. It is essential for employers to understand their obligations regarding this form to avoid legal repercussions.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines for the MT DoR MW 3 Form. The form is typically due by January 31 of the year following the tax year being reported. This deadline ensures that the Montana Department of Revenue receives all necessary information in a timely manner for processing. Employers should mark this date on their calendars to ensure compliance and avoid potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The MT DoR MW 3 Form can be submitted through various methods, providing flexibility for employers. The primary submission methods include:

- Online: Employers can submit the form electronically via the Montana Department of Revenue's online portal, which is often the quickest and most efficient method.

- Mail: The completed form can also be printed and sent via postal mail to the designated address provided by the Montana Department of Revenue.

- In-Person: Some employers may choose to deliver the form in person at local Department of Revenue offices, although this method is less common.

Quick guide on how to complete mt dor mw 3 form

Complete MT DoR MW 3 Form effortlessly on any device

Web-based document management has gained traction among companies and individuals alike. It offers a sustainable alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle MT DoR MW 3 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to alter and electronically sign MT DoR MW 3 Form effortlessly

- Find MT DoR MW 3 Form and then click Get Form to commence.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to share your form—whether by email, SMS, invite link, or download it to your computer.

Eliminate the frustrations of lost or misfiled documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign MT DoR MW 3 Form to guarantee exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mt dor mw 3 form

Create this form in 5 minutes!

How to create an eSignature for the mt dor mw 3 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Montana Rev and how does it work with airSlate SignNow?

Montana Rev refers to the electronic verification processes that airSlate SignNow implements to ensure secure handling of documents. By utilizing this system, users can eSign and send documents confidently, having the assurance that their data is protected. The integration of Montana Rev makes transactions faster and streamlines the overall document management process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to fit different business needs, including options ideal for small teams as well as larger enterprises. Each plan incorporates the benefits of Montana Rev for secure digital signing and document sharing. You can explore the pricing tiers on our website to find the best fit for your organization.

-

What features does airSlate SignNow include?

airSlate SignNow includes a range of powerful features such as document templates, real-time collaboration, and customizable workflows. With the implementation of Montana Rev, users also benefit from enhanced security measures for eSigning. This ensures your sensitive documents are handled with the utmost care while being easily accessible.

-

How can airSlate SignNow improve my business's efficiency?

By using airSlate SignNow with the Montana Rev system, businesses can signNowly reduce the time spent on document management and signing processes. The streamlined interface allows for quick sending and signing, eliminating delays traditionally associated with paper documents. This enhances operational efficiency and productivity.

-

Is airSlate SignNow compatible with other software?

Yes, airSlate SignNow integrates seamlessly with various popular applications and platforms, enhancing your overall productivity. Whether you're using CRM systems, cloud storage, or project management tools, integration with Montana Rev ensures secure and efficient document handling. Explore our integrations section for a comprehensive list.

-

What are the benefits of using Montana Rev for electronic signatures?

The main benefits of using Montana Rev for electronic signatures in airSlate SignNow include enhanced security, improved compliance with legal standards, and reduced signing time. This increases the reliability of your document processes and builds trust with your clients. Montana Rev ensures that each electronic signature is verifiable and binding.

-

Can I use airSlate SignNow for remote work?

Absolutely! airSlate SignNow is designed for remote work, allowing teams to send, sign, and manage documents from anywhere. With the additional layer of security provided by Montana Rev, you can confidently handle sensitive documents online. This flexibility makes it easier to collaborate effectively, no matter where your team is located.

Get more for MT DoR MW 3 Form

Find out other MT DoR MW 3 Form

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online