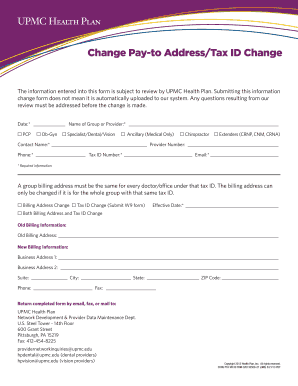

Change Pay to AddressTax ID Change Provider Information

What is the Change Pay to AddressTax ID Change Provider Information

The Change Pay to AddressTax ID Change Provider Information form is a crucial document used by businesses and organizations to update their tax identification information with the IRS. This form is essential for ensuring that all tax-related communications and payments are directed to the correct address and associated with the right Tax ID. It helps maintain accurate records and compliance with federal tax regulations.

Steps to complete the Change Pay to AddressTax ID Change Provider Information

Completing the Change Pay to AddressTax ID Change Provider Information form involves several key steps:

- Gather necessary information, including your current Tax ID, new address, and any relevant business details.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Required Documents

When submitting the Change Pay to AddressTax ID Change Provider Information form, you may need to include supporting documentation. Commonly required documents include:

- Proof of the new address, such as a utility bill or lease agreement.

- Identification documents for the business owner or authorized representative.

- Any previous correspondence with the IRS regarding the Tax ID.

Legal use of the Change Pay to AddressTax ID Change Provider Information

This form is legally recognized and is a necessary step for businesses to ensure compliance with federal tax laws. Failure to update your Tax ID information can lead to misdirected tax notices and potential penalties. It is advisable to keep your information current to avoid complications during audits or tax assessments.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines when submitting the Change Pay to AddressTax ID Change Provider Information form. Generally, updates should be made as soon as a change occurs. However, specific deadlines may apply based on your business's tax filing schedule. Keeping track of these dates can help ensure compliance and avoid penalties.

Examples of using the Change Pay to AddressTax ID Change Provider Information

Businesses may need to use the Change Pay to AddressTax ID Change Provider Information form in various scenarios, such as:

- When relocating to a new office or facility.

- After a merger or acquisition that changes the business structure.

- When changing the business name that requires a new Tax ID.

Quick guide on how to complete change pay to addresstax id change provider information

Complete [SKS] effortlessly on any device

Online document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Change Pay to AddressTax ID Change Provider Information

Create this form in 5 minutes!

How to create an eSignature for the change pay to addresstax id change provider information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Change Pay to AddressTax ID Change Provider Information?

To Change Pay to AddressTax ID Change Provider Information, simply log into your airSlate SignNow account, navigate to the settings, and select the option to update your provider information. Follow the prompts to enter your new Tax ID and address details. This ensures that your documents reflect the most accurate information.

-

Are there any fees associated with changing my Tax ID or provider information?

No, there are no additional fees to Change Pay to AddressTax ID Change Provider Information within your airSlate SignNow account. This feature is included in your subscription, allowing you to keep your information up-to-date without incurring extra costs.

-

How does changing my Tax ID affect my existing documents?

Changing your Tax ID to AddressTax ID Change Provider Information will not affect your existing documents. All previously signed documents will remain valid, and only new documents will reflect the updated Tax ID. This ensures compliance while maintaining the integrity of your past agreements.

-

Can I integrate airSlate SignNow with other software for managing provider information?

Yes, airSlate SignNow offers various integrations with popular software solutions that can help you manage your provider information more effectively. By integrating with accounting or CRM systems, you can streamline the process of updating and maintaining your Tax ID and address details.

-

What benefits does airSlate SignNow offer when changing provider information?

Changing your provider information with airSlate SignNow is quick and easy, ensuring that your documents are always accurate. This feature enhances your business's professionalism and compliance, allowing you to focus on your core operations without worrying about outdated information.

-

Is there customer support available for assistance with changing my Tax ID?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions or issues related to changing your Tax ID or provider information. You can signNow out via chat, email, or phone for prompt assistance.

-

How often should I update my Tax ID and provider information?

It's advisable to update your Tax ID and provider information whenever there are changes in your business structure or tax status. Regularly reviewing and updating this information ensures compliance and helps maintain accurate records for your clients and partners.

Get more for Change Pay to AddressTax ID Change Provider Information

- July 6 trs oneonta form

- Independent study form suny oneonta

- Angel 7 4 html editor reference manual outreach oneonta form

- College at oneonta uup professional request for salary increase or form

- Leave donation form oneonta

- Oneonta speakers bureau hosting institution request form oneonta

- Student statement of hours worked form oneonta

- Concentra patient information form

Find out other Change Pay to AddressTax ID Change Provider Information

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template