Www Google Com ChromeGoogle Chrome Download the Fast, Secure Browser from Google 2021

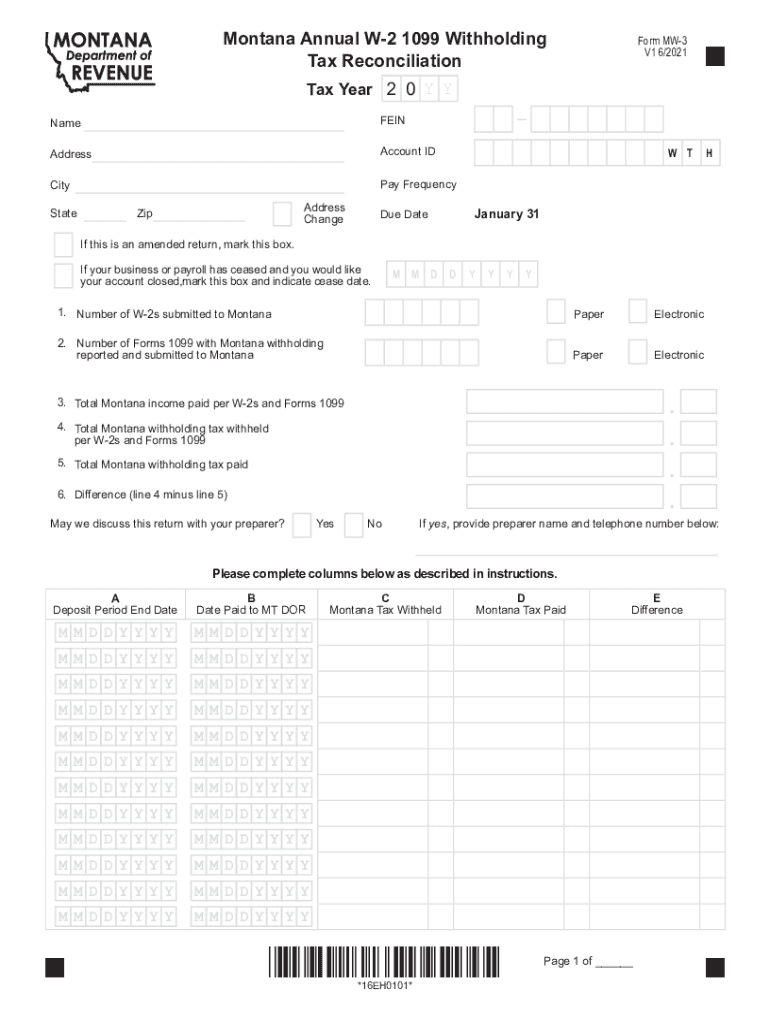

Understanding the Montana Form Withholding Tax

The Montana form withholding tax is a crucial document for employers in the state of Montana. It is used to report and remit the state income tax withheld from employees' wages. This form ensures that the correct amount of state income tax is collected and submitted to the Montana Department of Revenue. Employers must be aware of their responsibilities regarding this form to maintain compliance with state tax laws.

Filing Deadlines and Important Dates

Employers must adhere to specific deadlines when submitting the Montana form withholding tax. Typically, the form is due on the last day of the month following the end of each quarter. For example, the first quarter's filing deadline is April 30. It is essential for employers to mark these dates on their calendars to avoid penalties and interest for late submissions.

Required Documents for Submission

To complete the Montana form withholding tax accurately, employers need several key documents. These include:

- Employee W-4 forms to determine the correct withholding amount.

- Payroll records that detail the wages paid to employees.

- Previous tax filings to ensure consistency in reporting.

Having these documents ready will streamline the process and help avoid errors that could lead to compliance issues.

Form Submission Methods

Employers can submit the Montana form withholding tax through various methods. The options include:

- Online submission via the Montana Department of Revenue website.

- Mailing a paper copy of the form to the appropriate tax office.

- In-person delivery at designated tax offices.

Choosing the right method depends on the employer's preference and the resources available to them.

Penalties for Non-Compliance

Failure to file the Montana form withholding tax on time can result in significant penalties. The state may impose fines based on the amount of tax due and the length of the delay. Additionally, interest may accrue on any unpaid taxes. Employers should prioritize timely filing to avoid these financial repercussions.

Eligibility Criteria for Withholding Tax

Not all businesses in Montana are required to withhold state income tax. Employers must meet specific eligibility criteria, including:

- Having employees who earn wages subject to Montana state income tax.

- Registering with the Montana Department of Revenue as an employer.

Understanding these criteria is vital for businesses to determine their obligations regarding withholding tax.

Quick guide on how to complete wwwgooglecom chromegoogle chrome download the fast secure browser from google

Prepare Www google com ChromeGoogle Chrome Download The Fast, Secure Browser From Google effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Www google com ChromeGoogle Chrome Download The Fast, Secure Browser From Google on any device using airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign Www google com ChromeGoogle Chrome Download The Fast, Secure Browser From Google seamlessly

- Find Www google com ChromeGoogle Chrome Download The Fast, Secure Browser From Google and click Get Form to begin.

- Take advantage of the tools we provide to fill out your document.

- Emphasize signNow sections of your documents or obscure sensitive information with functionalities that airSlate SignNow has specifically designed for that purpose.

- Generate your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Www google com ChromeGoogle Chrome Download The Fast, Secure Browser From Google and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwgooglecom chromegoogle chrome download the fast secure browser from google

Create this form in 5 minutes!

How to create an eSignature for the wwwgooglecom chromegoogle chrome download the fast secure browser from google

The best way to make an e-signature for your PDF document online

The best way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the montana form withholding tax and who needs to use it?

The Montana form withholding tax is a document that employers must complete to report and remit state income tax withheld from employee wages. Any business operating in Montana that employs residents or pays wages subject to state tax must use this form. It ensures compliance with state tax regulations.

-

How can airSlate SignNow help with montana form withholding tax documents?

airSlate SignNow streamlines the process of sending and signing the Montana form withholding tax documents electronically. Our platform allows for secure eSignatures, ensuring that your forms are legally binding and easily accessible. This reduces paperwork and speeds up the filing process for your business.

-

Is airSlate SignNow cost-effective for managing montana form withholding tax?

Yes, airSlate SignNow is a cost-effective solution for managing montana form withholding tax documents. With flexible pricing plans tailored to your needs, you can efficiently handle all your document signing without breaking the bank. This investment helps streamline your compliance processes.

-

What features does airSlate SignNow offer for montana form withholding tax?

airSlate SignNow offers various features like customizable templates, secure eSigning, and automated reminders to help you manage your montana form withholding tax documents seamlessly. Our intuitive interface and tracking tools make it easy to monitor the status of your forms at any time. These features facilitate efficient document management.

-

Can airSlate SignNow integrate with other accounting software for montana form withholding tax?

Absolutely! airSlate SignNow integrates with popular accounting software, allowing for smooth data transfer related to montana form withholding tax. This integration simplifies the tax filing process as it centralizes your business operations, making it easier to track deductions and withholdings.

-

What are the benefits of using airSlate SignNow for montana form withholding tax?

Using airSlate SignNow for montana form withholding tax provides numerous benefits including enhanced efficiency, reduced errors, and improved compliance. Our digital solution cuts down on paperwork and helps ensure timely submissions, keeping your business compliant with Montana tax laws. Plus, you can access your documents anytime, anywhere.

-

How secure is airSlate SignNow for managing sensitive montana form withholding tax data?

Security is a top priority for airSlate SignNow when it comes to managing sensitive montana form withholding tax data. Our platform uses advanced encryption methods and complies with industry standards to safeguard your information. You can trust that your data is protected and handled with the utmost care.

Get more for Www google com ChromeGoogle Chrome Download The Fast, Secure Browser From Google

- Complaint of committal mississippi form

- Complaint regarding faulty printer mississippi form

- Ms petition 497314020 form

- Temporary order injunction form

- Judicial review form

- Complaint for alienation of affections mississippi form

- Mississippi probate will form

- Petition for forfeiture of auto 41 29 101 mississippi form

Find out other Www google com ChromeGoogle Chrome Download The Fast, Secure Browser From Google

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation