MW 3 Montana Annual W 2 1099 Withholding Tax Online Services 2019

What is the MW-3 Montana Annual W-2 1099 Withholding Tax?

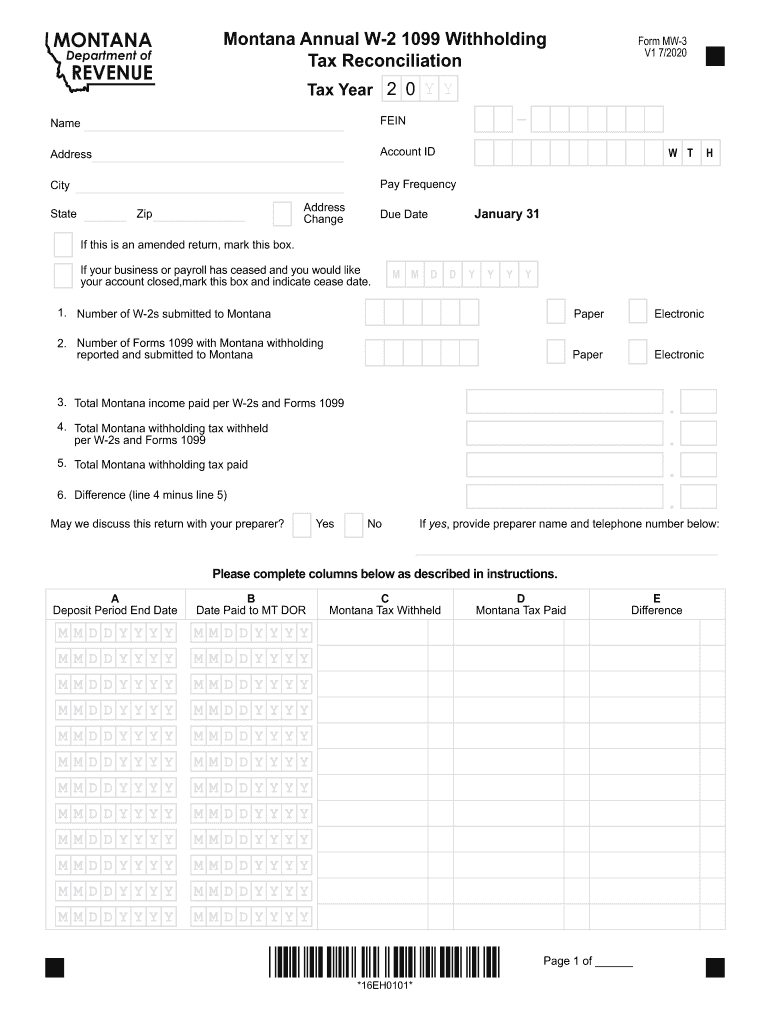

The MW-3 form is a crucial document for employers in Montana, used to report annual withholding tax information for W-2 and 1099 employees. This form consolidates wage and tax data for all employees, allowing the state to ensure proper tax collection. It is essential for businesses to accurately complete this form to comply with state tax regulations and avoid potential penalties.

Steps to Complete the MW-3 Montana Annual W-2 1099 Withholding Tax

Completing the MW-3 form involves several key steps:

- Gather all W-2 and 1099 forms issued to employees for the tax year.

- Ensure that all employee information, including names, Social Security numbers, and wages, is accurate.

- Calculate the total amount of state income tax withheld from all employees.

- Fill out the MW-3 form, ensuring all required fields are completed.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the MW-3 form to avoid late fees. Typically, the MW-3 must be filed by January 31 of the year following the tax year. Employers should also ensure that all W-2 and 1099 forms are distributed to employees by this date. Staying on schedule helps maintain compliance with state tax laws.

Required Documents

To complete the MW-3 form, employers need the following documents:

- All W-2 forms issued to employees.

- All 1099 forms issued to contractors.

- Records of state income tax withheld from employee wages.

- Employer identification information, including the Employer Identification Number (EIN).

Penalties for Non-Compliance

Failure to file the MW-3 form on time or inaccuracies in the submitted information can result in penalties. The state of Montana may impose fines or interest on unpaid taxes. It is crucial for employers to ensure timely and accurate submissions to avoid these consequences.

Legal Use of the MW-3 Montana Annual W-2 1099 Withholding Tax

The MW-3 form serves a legal purpose by providing the state with necessary information regarding employee wages and tax withholdings. This form must be completed in accordance with Montana tax laws to ensure compliance and protect against legal issues. Employers should keep copies of submitted forms for their records.

Quick guide on how to complete mw 3 montana annual w 2 1099 withholding tax online services

Complete MW 3 Montana Annual W 2 1099 Withholding Tax Online Services seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, revise, and eSign your documents quickly without lag. Handle MW 3 Montana Annual W 2 1099 Withholding Tax Online Services on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign MW 3 Montana Annual W 2 1099 Withholding Tax Online Services with ease

- Find MW 3 Montana Annual W 2 1099 Withholding Tax Online Services and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using tools available through airSlate SignNow specifically for that purpose.

- Create your signature using the Sign function, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it directly to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign MW 3 Montana Annual W 2 1099 Withholding Tax Online Services to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mw 3 montana annual w 2 1099 withholding tax online services

Create this form in 5 minutes!

How to create an eSignature for the mw 3 montana annual w 2 1099 withholding tax online services

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the montana form annual used for?

The montana form annual is essential for businesses in Montana to report their annual activities and submit necessary documentation. It helps ensure compliance with state regulations and simplifies the filing process for organizations operating within the state.

-

How does airSlate SignNow facilitate the completion of the montana form annual?

airSlate SignNow streamlines the process of filling out the montana form annual by offering an intuitive eSigning platform that allows users to complete and sign documents electronically. This not only saves time but also ensures that documents are filed accurately and promptly.

-

What pricing options does airSlate SignNow offer for montana form annual processing?

airSlate SignNow offers flexible pricing plans that cater to different business needs, allowing you to choose a plan that fits your budget while efficiently managing the montana form annual. Whether you are a small business or a large organization, there’s a cost-effective solution available.

-

Are there any features specific to handling the montana form annual in airSlate SignNow?

Yes, airSlate SignNow includes features like document templates and cloud storage that are particularly useful for managing the montana form annual. Additionally, its mobile compatibility allows users to access and sign documents from anywhere, making it a convenient choice.

-

What benefits does using airSlate SignNow provide for the montana form annual?

Using airSlate SignNow for the montana form annual provides numerous benefits, including increased efficiency and reduced paperwork. The eSigning process accelerates approval times and enhances collaboration among team members, making it easier to meet filing deadlines.

-

Can I integrate airSlate SignNow with other tools for managing the montana form annual?

Absolutely, airSlate SignNow offers seamless integrations with various productivity tools and software, helping to streamline the management of the montana form annual. This connectivity enhances your workflow and allows for better data management across platforms.

-

Is airSlate SignNow secure for submitting the montana form annual?

Yes, airSlate SignNow prioritizes security and implements robust encryption methods, ensuring that your montana form annual and other sensitive documents are protected. This gives users peace of mind knowing their data is safe during the signing process.

Get more for MW 3 Montana Annual W 2 1099 Withholding Tax Online Services

- West virginia property management package west virginia form

- New resident guide west virginia form

- Release satisfaction cancellation deed of trust by corporate lender west virginia form

- Release satisfaction cancellation deed of trust individual lender or holder west virginia form

- Partial release of property from deed of trust for corporation west virginia form

- Partial release of deed of trust 497432006 form

- Writ execution form

- West virginia form 497432009

Find out other MW 3 Montana Annual W 2 1099 Withholding Tax Online Services

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe