IRS 941 V Form 2022-2026

What is the IRS 941 V Form

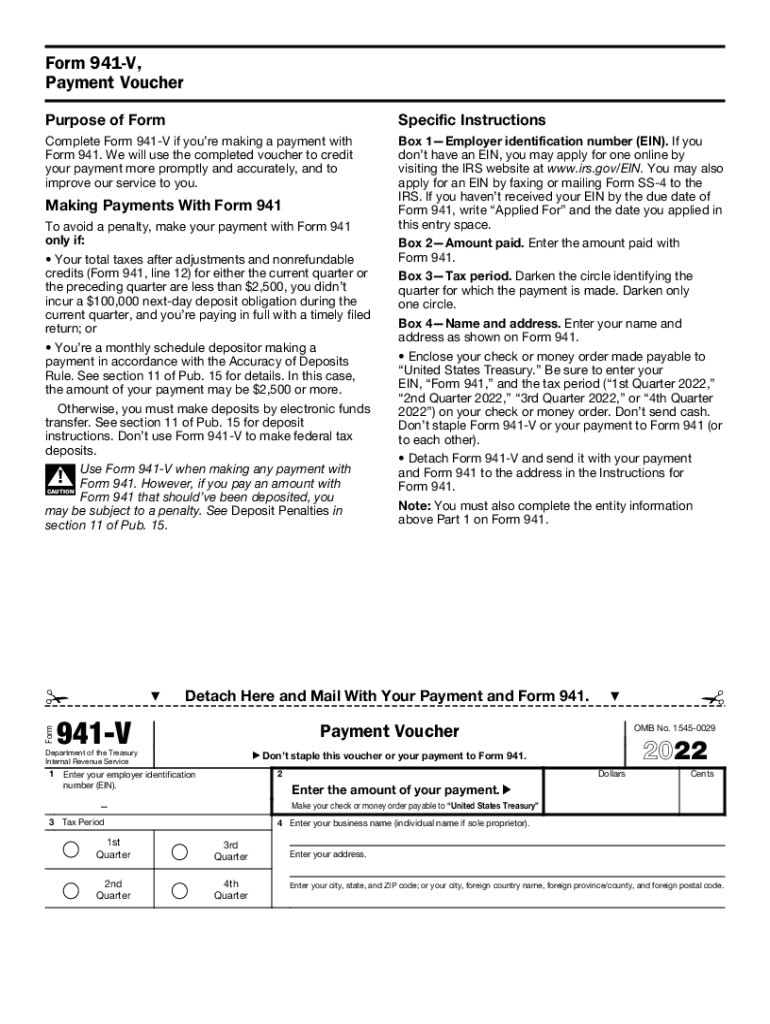

The IRS 941 V Form is a payment voucher used by employers to submit their federal payroll taxes. This form is specifically designed for use with Form 941, which reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. The 941 V serves as a convenient way for employers to ensure their payments are properly credited to their accounts when filing electronically or by mail. Understanding the purpose of this form is crucial for maintaining compliance with federal tax obligations.

How to use the IRS 941 V Form

To use the IRS 941 V Form effectively, employers should first complete Form 941, which details the total amount of taxes owed. After determining the payment amount, the employer fills out the 941 V Form, including their name, address, and Employer Identification Number (EIN). This voucher should accompany any payment made to the IRS, whether submitted electronically or via check. Using the 941 V ensures that the payment is applied correctly to the employer's tax account, helping to avoid any potential issues with the IRS.

Steps to complete the IRS 941 V Form

Completing the IRS 941 V Form involves several straightforward steps:

- Gather necessary information, including your EIN, business name, and address.

- Determine the payment amount based on your completed Form 941.

- Fill out the 941 V Form, ensuring all details are accurate.

- Submit the form along with your payment to the designated IRS address or electronically.

Following these steps will help ensure that your payment is processed efficiently and accurately.

Legal use of the IRS 941 V Form

The IRS 941 V Form is legally recognized as a valid method for submitting payroll tax payments. To ensure compliance, employers must adhere to the guidelines set forth by the IRS regarding the use of this form. This includes timely submissions and accurate reporting of tax amounts. Utilizing the 941 V Form appropriately helps businesses avoid penalties and maintain good standing with the IRS.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines associated with the IRS 941 V Form. Generally, Form 941 must be filed quarterly, with payments due on the last day of the month following the end of each quarter. For example, the deadline for the first quarter (January to March) is April 30. It is essential to stay informed about these deadlines to avoid late fees and ensure compliance with federal tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The IRS 941 V Form can be submitted through various methods, providing flexibility for employers. Payments can be made electronically through the IRS's Electronic Federal Tax Payment System (EFTPS), which is a secure and efficient way to manage tax payments. Alternatively, employers can mail the completed 941 V Form along with their payment to the appropriate IRS address. In-person submissions are also possible at designated IRS offices, although this method is less common. Each submission method has its advantages, so employers should choose the one that best fits their needs.

Quick guide on how to complete irs 941 v form

Easily Prepare IRS 941 V Form on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Handle IRS 941 V Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign IRS 941 V Form Effortlessly

- Obtain IRS 941 V Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal value as a traditional ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign IRS 941 V Form to ensure efficient communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 941 v form

Create this form in 5 minutes!

How to create an eSignature for the irs 941 v form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 941 voucher tax printable?

A 941 voucher tax printable is a form used by businesses to report their quarterly payroll taxes to the IRS. It simplifies the reporting process, allowing businesses to easily calculate and submit their tax liabilities. With airSlate SignNow's features, you can efficiently complete and manage these forms.

-

How can I obtain a 941 voucher tax printable using airSlate SignNow?

To obtain a 941 voucher tax printable, simply log in to your airSlate SignNow account and select the appropriate form from our library of templates. You can fill out the form digitally, ensuring accuracy while saving considerable time in the process.

-

Is the 941 voucher tax printable feature included in the basic plan?

Yes, the ability to access and create a 941 voucher tax printable is included in the basic plan of airSlate SignNow. This plan empowers users to efficiently manage tax forms, saving both time and effort while ensuring compliance with IRS regulations.

-

What are the benefits of using airSlate SignNow for 941 voucher tax printable?

Using airSlate SignNow for your 941 voucher tax printable offers numerous benefits, including secure eSignature capabilities and easy document sharing. It enhances productivity by streamlining the workflow, making tax filing straightforward and efficient.

-

Can I integrate airSlate SignNow with other accounting software for my 941 voucher tax printable?

Absolutely! airSlate SignNow allows seamless integration with popular accounting software to facilitate the filing of your 941 voucher tax printable. This integration helps ensure that your payroll data is accurately reflected in the forms, making tax preparation less cumbersome.

-

How secure is my information when using airSlate SignNow for 941 voucher tax printable?

Your information is highly secure when using airSlate SignNow for your 941 voucher tax printable. We utilize advanced encryption protocols and comply with industry standards to protect sensitive tax data throughout the eSigning process.

-

Can I track the status of my 941 voucher tax printable once it is sent?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 941 voucher tax printable after it is sent. This ensures you are always updated on its processing and submission, enhancing transparency and organization.

Get more for IRS 941 V Form

Find out other IRS 941 V Form

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application