941 V 2014

What is the 941 V?

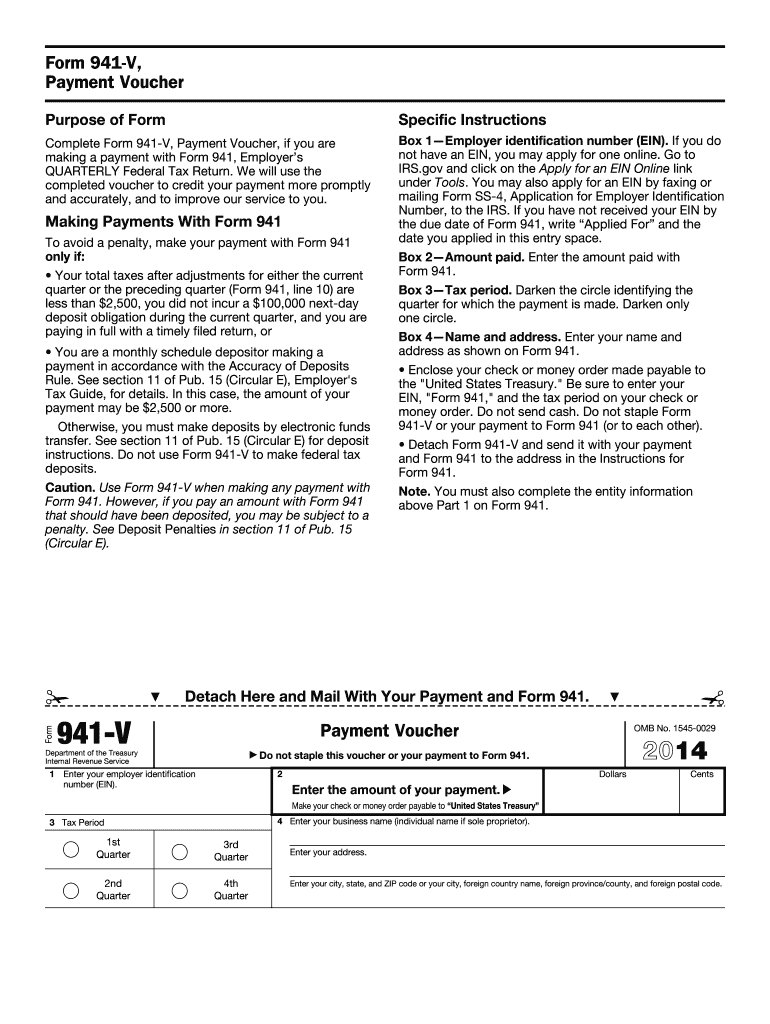

The 941 V, also known as the Form 941 payment voucher, is a crucial document used by employers in the United States to report and pay federal payroll taxes. This form is specifically designed for making payments associated with the quarterly Form 941, which reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. The 941 V serves as a voucher to accompany payments made to the IRS, ensuring that the payments are properly credited to the employer's account.

How to use the 941 V

Using the 941 V is straightforward. Employers should complete the form by entering their business information, including the employer identification number (EIN), the quarter for which the payment is being made, and the payment amount. The completed voucher should be submitted along with the payment to the appropriate IRS address. It is important to ensure that the payment is made by the due date to avoid penalties and interest. Employers can use the 941 V for both electronic and paper payments.

Steps to complete the 941 V

To complete the 941 V, follow these steps:

- Download the 941 V form from the IRS website or obtain a physical copy.

- Fill in your business name, address, and employer identification number (EIN).

- Indicate the quarter for which you are making the payment.

- Enter the total amount of payment being submitted.

- Review the information for accuracy before submitting.

Legal use of the 941 V

The 941 V is legally recognized as a valid method for employers to report and pay payroll taxes. Compliance with IRS regulations is essential to ensure that the form is accepted. Employers must adhere to the guidelines set forth by the IRS regarding the completion and submission of the 941 V. This includes ensuring that payments are made on time and that the information provided is accurate to avoid any legal repercussions.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the 941 V to avoid penalties. The payment voucher is typically due on the same day as the quarterly Form 941, which is due one month after the end of each quarter. For example, the due dates for the 941 V are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The 941 V can be submitted through various methods. Employers have the option to make payments electronically via the IRS Electronic Federal Tax Payment System (EFTPS) or by mailing a check along with the completed voucher. When submitting by mail, it is important to send the voucher to the correct IRS address based on the state of the business. In-person submissions are generally not available for the 941 V, as payments are typically processed through electronic or mail methods.

Quick guide on how to complete 941 v

Complete 941 V effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage 941 V on any platform with airSlate SignNow’s Android or iOS applications and streamline your document-related processes today.

How to modify and electronically sign 941 V with ease

- Obtain 941 V and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize essential sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes just moments and carries the same legal significance as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 941 V and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941 v

Create this form in 5 minutes!

How to create an eSignature for the 941 v

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is form 941 v?

Form 941 v is a payment voucher used by employers to submit their payroll taxes to the IRS. This form is essential for businesses to report income taxes withheld from employee wages and additional taxes related to Social Security and Medicare. Using airSlate SignNow, you can easily fill out and eSign form 941 v to streamline your tax reporting process.

-

How does airSlate SignNow help with form 941 v?

airSlate SignNow provides businesses with a simple and efficient way to complete and electronically sign form 941 v. The platform's user-friendly interface and customizable templates facilitate quick data entry and signature collection, ensuring that you meet essential filing deadlines and compliance requirements.

-

What are the pricing options for using airSlate SignNow for form 941 v?

airSlate SignNow offers a range of pricing plans to cater to different business needs when handling form 941 v. Whether you're a small business or a large organization, there are affordable options available, including monthly and annual subscriptions that grant access to various features, including templates and analytics.

-

Can I integrate other software with airSlate SignNow for form 941 v?

Yes, airSlate SignNow allows for seamless integration with numerous applications, making it easy to connect your existing software when managing form 941 v. This integration enables you to automate data transfer and enhance your workflow, ensuring a more efficient tax filing process.

-

What features does airSlate SignNow offer for completing form 941 v?

airSlate SignNow provides various features to enhance the process of completing form 941 v, including customizable document templates, electronic signing capabilities, and secure cloud storage. These features not only save time but also help maintain the integrity and security of your important tax documents.

-

Is airSlate SignNow secure for submitting form 941 v?

Absolutely, airSlate SignNow prioritizes data security and compliance, ensuring that your form 941 v submissions are protected. With advanced encryption and secure servers, you can confidently eSign and share documents, knowing that sensitive information is safeguarded from unauthorized access.

-

How does eSigning form 941 v with airSlate SignNow save time?

eSigning form 941 v with airSlate SignNow signNowly reduces the time spent on manual processes. The platform allows multiple parties to sign documents electronically from anywhere, eliminating the hassle of printing, signing, and scanning paper documents. This efficiency speeds up your tax filing process.

Get more for 941 V

- Deed individual trust 497307397 form

- Kansas subcontractor form

- Ks intestate form

- Warning to residential owner individual kansas form

- Quitclaim deed by two individuals to llc kansas form

- Warranty deed from two individuals to llc kansas form

- Kansas llc 497307404 form

- Owners statement of receipt of warning individual kansas form

Find out other 941 V

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement