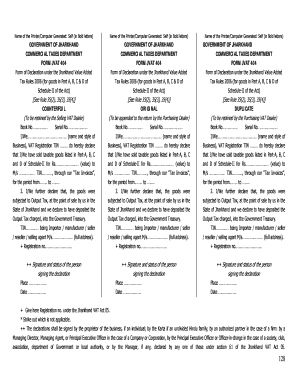

Form 404

What is the Form 404

The Form 404, also known as the VAT 404 form, is a crucial document used for reporting value-added tax (VAT) in specific jurisdictions. This form is primarily utilized by businesses to report their VAT obligations and claim refunds. It serves as an official record of transactions that involve VAT, ensuring compliance with tax regulations. Understanding the purpose and requirements of the Form 404 is essential for businesses operating within the VAT framework.

How to use the Form 404

Using the Form 404 involves several key steps to ensure accurate reporting and compliance. First, businesses need to gather all relevant financial records, including sales invoices and purchase receipts that include VAT. Next, the form should be filled out with precise details regarding the VAT collected and paid. This includes entering totals for sales, purchases, and any applicable exemptions. After completing the form, it must be submitted to the appropriate tax authority by the specified deadline.

Steps to complete the Form 404

Completing the Form 404 can be broken down into a series of straightforward steps:

- Collect all necessary documentation, such as invoices and receipts.

- Fill in the business details, including name, address, and tax identification number.

- Report the total sales and purchases, ensuring to separate VAT amounts.

- Include any adjustments or corrections from previous filings.

- Review the completed form for accuracy before submission.

Legal use of the Form 404

The legal use of the Form 404 is governed by tax regulations that require accurate reporting of VAT. To be considered valid, the form must be completed truthfully and submitted within the designated time frame. Non-compliance can result in penalties, including fines or audits. Therefore, businesses should ensure that they understand the legal implications of their submissions and maintain proper records to support their filings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 404 vary by jurisdiction and can be critical for compliance. Generally, businesses must submit the form quarterly or annually, depending on their VAT registration status. It is essential to keep track of these deadlines to avoid late submissions, which can incur penalties. Marking important dates on a calendar can help ensure timely filing and adherence to tax obligations.

Required Documents

To complete the Form 404, several documents are typically required. These include:

- Sales invoices that detail the VAT charged.

- Purchase invoices that show the VAT paid.

- Previous VAT returns, if applicable, for reference.

- Any correspondence with tax authorities regarding VAT matters.

Having these documents organized and readily available can streamline the completion process and enhance accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Form 404 can often be submitted through various methods, depending on the regulations of the jurisdiction. Common submission methods include:

- Online submission through the tax authority's official website, which may offer a more efficient processing time.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, where assistance may be available.

Choosing the right submission method can help ensure that the form is processed promptly and correctly.

Quick guide on how to complete form 404

Effortlessly Prepare Form 404 on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle Form 404 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Form 404 with Ease

- Obtain Form 404 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to secure your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors requiring new copies to be printed out. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form 404 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 404

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT 404 form?

The VAT 404 form is a document used to reclaim VAT paid on goods and services in specific jurisdictions. Businesses utilize this form to ensure compliance with tax regulations while effectively managing their VAT refunds. Understanding how to correctly fill out and submit the VAT 404 form can signNowly enhance your financial efficiency.

-

How can airSlate SignNow assist with VAT 404 forms?

airSlate SignNow facilitates the eSigning and sharing of your VAT 404 form, streamlining the submission process. With its intuitive interface, you can quickly prepare your document for digital signatures, ensuring that all parties involved can efficiently review and approve the VAT 404 form. This simplifies your workflow and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for VAT 404 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the handling of VAT 404 forms. Depending on your chosen plan, you can access a range of features designed to simplify document management and increase productivity at a competitive price. Explore our pricing options to find the best fit for your organization.

-

What features does airSlate SignNow offer for managing VAT 404 forms?

airSlate SignNow offers features such as document templates, automated workflows, and secure eSigning for VAT 404 forms. These tools help speed up the process, minimize errors, and enhance overall compliance. With our platform, tracking and managing your VAT 404 form submissions becomes seamless and efficient.

-

Can I integrate airSlate SignNow with my existing accounting software for VAT 404 forms?

Absolutely! airSlate SignNow supports integration with various accounting software solutions which makes managing your VAT 404 form submissions seamless. This allows you to synchronize your financial data effortlessly, ensuring that your VAT documents are always accurate and up-to-date. Explore our integrations to see how we can enhance your workflow.

-

How does eSigning a VAT 404 form work?

eSigning a VAT 404 form with airSlate SignNow is quick and straightforward. Users can upload their document, add signature fields, and send it out for individual signatures. Once all parties have signed the VAT 404 form, you will receive a finalized version that is legally binding and easily accessible.

-

What are the benefits of using airSlate SignNow for VAT 404 forms?

Using airSlate SignNow for VAT 404 forms offers enhanced efficiency, better compliance, and reduced turnaround times. Its cloud-based solution allows easy access anywhere, anytime, ensuring your team remains productive. Additionally, the ability to track document status ensures nothing falls through the cracks.

Get more for Form 404

- Plumbing form

- Medical certificate format pdf rajasthan

- Hifu consent form

- T tess evidence examples form

- 16 team consolation bracket form

- Court of common pleas form 10 200 the philadelphia courts courts phila

- Notice of appearance florida sample form

- Just fax it seton medical center harker heights form

Find out other Form 404

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word